Kazakhstan to create $500 million to $1 billion national crypto reserve fund

Key Takeaways

- Kazakhstan plans to create a national crypto reserve fund valued between $500 million and $1 billion.

- The fund will invest in crypto ETFs and crypto-related companies for exposure to digital assets, such as Bitcoin.

Kazakhstan plans to establish a national crypto reserve fund valued between $500 million and $1 billion, Bloomberg reported today. The Central Asian nation aims to diversify its economy beyond oil dependence through strategic digital asset investments.

The reserve fund will target ETFs and crypto-related companies to gain exposure to digital assets including Bitcoin. Kazakhstan’s deputy central bank governor publicly confirmed the initiative as part of broader economic diversification efforts.

The central bank is considering channeling portions of its gold and foreign exchange reserves into crypto assets. This strategy represents Kazakhstan’s effort to reduce its traditional reliance on oil revenues through alternative financial instruments.

The move positions Kazakhstan among nations integrating digital assets into sovereign reserves for strategic financial positioning. The fund structure would provide indirect crypto exposure through established investment vehicles rather than direct digital asset holdings.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

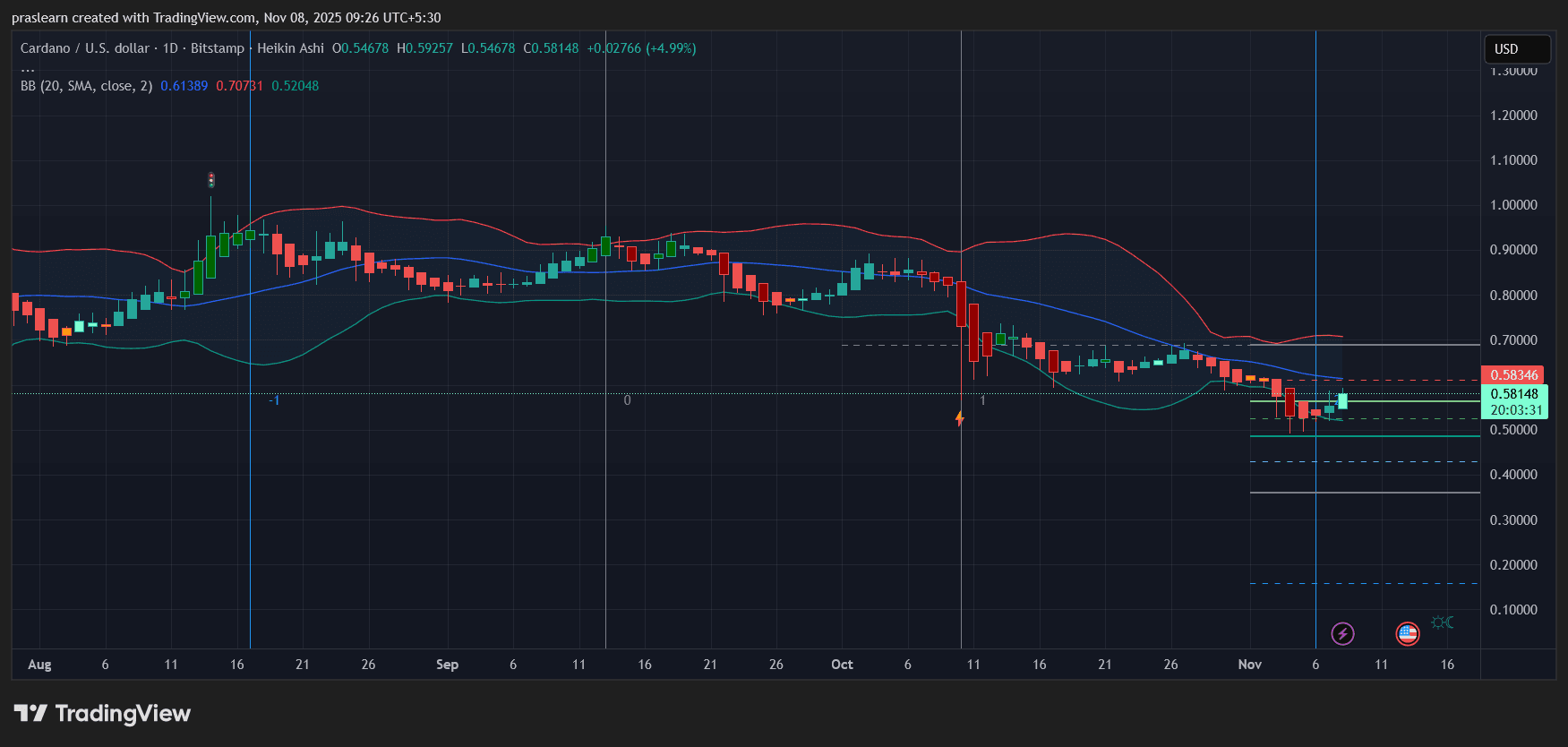

Cardano (ADA) Price Prediction: Can ADA Hold Its Recovery Amid Fed Uncertainty?

Hyperliquid's Rapid Rise: Emerging as a Major Player in Decentralized Trading?

- Hyperliquid captures 73% of decentralized perpetual trading volume with $12.9B daily trading and $9.76B open positions in October 2025. - Platform executes $645M HYPE token buybacks (46% of crypto buybacks) while 62.26% of Arbitrum's USDC liquidity flows to Hyperliquid. - Institutional adoption grows with 21Shares proposing SEC-approved HYPE ETF, while HIP-3 protocol enables permissionless market creation via HYPE staking. - Faces competition from new rivals (Aster, Lighter) and leadership risks, but exp

Bitcoin News Today: Is Bitcoin’s Recent Sell-Off Driven by Corporate Debt Reduction or Market Manipulation?

- Bitcoin fell below $100,000 on Nov. 4, 2025, with $1.3B in liquidations as whales and firms like Sequans sold BTC to reduce debt. - Analysts argue sellers may amplify bearish narratives via social media to profit from lower prices, while corporate treasury strategies face risks amid falling prices. - On-chain data shows moderate unrealized losses (3.1% stress level), suggesting potential stabilization, though some warn a $56,000 cascade could follow a $100,000 break. - Diverging strategies emerge: Americ

"Study Reveals 25% of Polymarket's Trading Volume is Artificial Due to Ghost Trades"

- Columbia University study reveals 25% of Polymarket's trading volume may involve wash trading, where users self-trade to inflate activity. - Sports and election markets showed highest manipulation rates (45% and 17% fake volume), peaking at 95% in election markets in March 2025. - Platform's lack of transaction fees and pseudonymous wallets enabled manipulation, despite CFTC regulatory actions since 2022. - Researchers urge Polymarket to adopt their detection methods to exclude fraudulent wallets and res