Bitcoin Updates: Fed Divided Over Rate Reduction Amid Conflicting Inflation and Employment Concerns

- Fed officials debate December rate cuts amid conflicting inflation data and labor market risks, with no consensus on policy path. - Short-term inflation expectations rose to 4.7% in Nov 2025, while long-term forecasts stabilized at 3.6%, reflecting cautious public confidence. - Government shutdown delays critical economic data, forcing policymakers to rely on limited information as officials warn against both high rates and rapid cuts. - Tech/industrial firms showed resilience with strong Q3 earnings, co

Federal Reserve policymakers are split over the direction of monetary policy, as mixed economic signals and shifting market expectations make the central bank’s next move uncertain, according to

The discussion has grown more urgent as a government shutdown has postponed key economic reports, leaving Fed officials to make decisions with incomplete data. Fed Governor Lisa Cook, who is currently involved in a legal dispute with President Donald Trump regarding her dismissal, highlighted the delicate balance between inflation and employment risks. She cautioned that keeping rates high could sharply weaken the labor market, while cutting rates too quickly might destabilize inflation expectations. San Francisco Fed President Mary Daly shared this perspective, describing the recent rate cut as a safeguard against job losses and urging a prudent approach for December.

At the same time, broader economic data remains mixed. Technology and industrial companies have shown strength, with

The possibility of the Fed moving toward a looser monetary stance has caught the eye of both investors and analysts. Billionaire

While short-term volatility persists, expectations for inflation over the long run remain steady. The University of Michigan’s five-year inflation projection dropped to 3.6% in October, the lowest in four months, reflecting trust in the Fed’s ability to restore price stability. This confidence is crucial as officials consider their December decision, with markets currently assigning about a 50% probability to a rate cut.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Updates Today: Regulatory Changes and Unprecedented Staking Returns Drive Institutional Growth for Ethereum

- Ethereum's institutional adoption accelerates due to SEC's in-kind ETF approval, boosting market efficiency and participation. - SharpLink and Bit Digital report record staking yields (up to 2.93%), highlighting Ethereum's "productive" treasury asset advantage over Bitcoin . - Justin Sun's $154M ETH staking via Lido signals growing confidence in Ethereum's infrastructure despite liquid staking centralization concerns. - Regulatory tailwinds and $12.5M ETH ETF inflows counterbalance price declines, with t

Vitalik Buterin Introduces New ZK Technology: What It Means for Ethereum's Development

- Vitalik Buterin leads Ethereum’s shift to ZK proofs, targeting modexp removal and GKR protocol integration to boost scalability and privacy. - Modexp precompile’s 50x computational burden on ZK-EVM proofs will be replaced by standard EVM code, prioritizing long-term efficiency over short-term gas costs. - GKR protocol enables 2M Poseidon2 hashes/sec on consumer hardware, accelerating verification and enhancing quantum resistance for Ethereum’s "Lean Ethereum" vision. - ZKsync’s 150% token surge and Citib

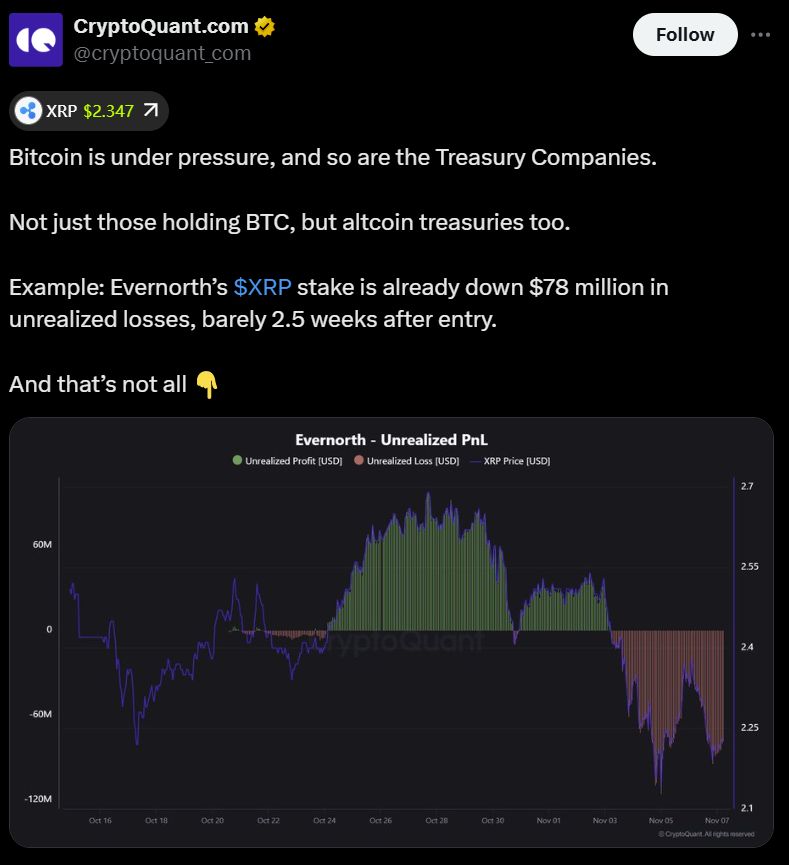

Evernorth’s unrealized XRP losses expose mounting pressure on DATs: CryptoQuant

Marina Protocol and Audiera Ally to Bring AI-Powered Music and Dance to Web3