Key Notes

- Eric Trump-backed firm expands Bitcoin treasury to 4,004 BTC through mining operations and market purchases.

- Bitcoin ETFs recorded $3.5 billion in outflows over six sessions as government shutdown impacts markets.

- Institutional investors like Strategy and Strive raise capital offerings despite correction, signaling long-term conviction.

Eric Trump-backed American Bitcoin Corp. (Nasdaq: ABTC) has announced a purchase of approximately 139 Bitcoin BTC $101 198 24h volatility: 0.2% Market cap: $2.02 T Vol. 24h: $86.63 B , bringing its total holding above the 4,000 BTC mark. The purchase confirmation comes amid intense market sell-off as the US government reports worse-than-expected impact of shutdown.

In addition to strategic purchases, a significant portion of American Bitcoin’s 4,004 BTC haul Bitcoin mining revenue, which includes Bitcoin held in custody or pledged for miner purchases under an agreement with BITMAIN.

“We continue to expand our Bitcoin holdings rapidly and cost-effectively through a dual strategy that integrates scaled Bitcoin mining operations with disciplined at-market purchases,” E ric Trump stated .

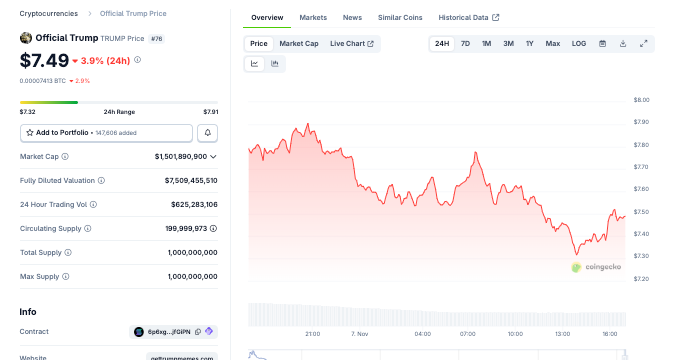

Official Trump memecoin price declines 3% to $7.5 on Nov 7, 2025 | Source: Coingecko

The Official Trump memecoin, which is often driven by major announcements from Trump-linked entities, also plunged with the market on Nov. 7, 2025. The Trump token is trading at $7.5, down 3% intraday, with a market capitalization of $1.5 billion, according to Coingecko data .

Institutional Investors Remain Resilient Amid ETF Profit-Taking

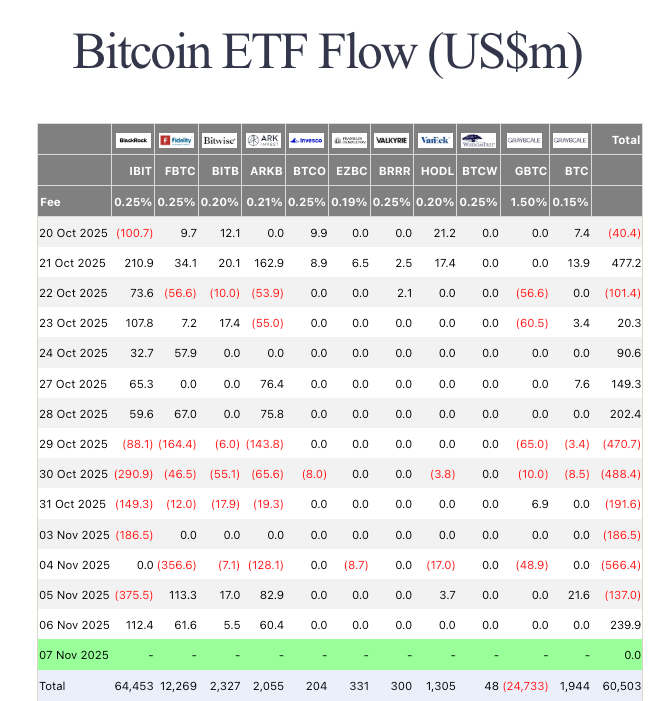

Bitcoin ETFs have faced significant withdrawals this month, with $3.5 billion in outflows across six consecutive trading sessions in early November, according to Farside data. The selloff coincides with rising short-term bond yields as the US government shutdown delays spending resolutions, prompting capital rotation away from equities and risk assets.

Bitcoin ETF Flows | Source: FarsideInvestors

However, institutional investors with a longer-term horizon are capitalizing on the wobbling Bitcoin prices to increase their holdings.

Amid the market-wide corrections on Nov. 7, Bitcoin investment firm Strategy raised its Stream Perpetual Preferred Stock (STRE) offering to €620 million ($715 million).

Strategy upsized offering follows Strive’s $80 IPO which nearly doubled its Perpetual Preferred Stock (SATA) from 1.25 million to 2 million shares.

After Charles Schwab’s Bitcoin ETF announcement on Nov. 6, net inflows resumed across the ETF sector, with $239.9 million re-entering the market as Bitcoin stabilized near $100,000.