Bitcoin News Update: JPMorgan Sets $170K Bitcoin Goal Despite Market Volatility and Competitor Doubts

- JPMorgan raises Bitcoin price target to $170K, citing undervaluation vs. gold in risk-adjusted analysis. - Market turmoil sees Bitcoin fall below $100K amid $1.3B liquidations and institutional selling. - Galaxy Digital cuts 2025 target to $120K, citing macro risks and $50B in October Bitcoin outflows. - JPMorgan notes ETF outflows and stabilized leverage as potential market bottom indicators. - Banks like JPMorgan/Goldman Sachs expand crypto adoption by enabling digital asset collateral.

JPMorgan Chase & Co. has increased its

This outlook comes during a period of market instability. On November 4, 2025, Bitcoin dipped below $100,000 for the first time in half a year, wiping out 20% of its value since peaking near $125,835 in October,

Technical analysis also points to increased price swings. Bitcoin is trading close to $101,290, with the lower band of the Keltner Channel offering temporary support at $103,321, as reported by Yahoo Finance. The MACD indicator remains negative, highlighting bearish

Institutional interest continues to grow, with JPMorgan now permitting clients to use Bitcoin and

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Zcash News Today: Balancing Privacy and Regulation: Zcash's Rise Challenges Compliance Boundaries

- Zcash (ZEC) surges over 1,270% YTD, hitting $600 and $10B market cap amid record Puell Multiple miner profitability. - Privacy upgrades like Project Tachyon and Zashi wallet adoption drive institutional interest, outpacing Monero in market cap. - $51M short liquidations and 83.38 RSI signal extreme overbought conditions, while 2025 halving fuels scarcity narratives. - Regulatory scrutiny of privacy tools and compliance challenges persist despite Zcash's flexible shielded transaction model.

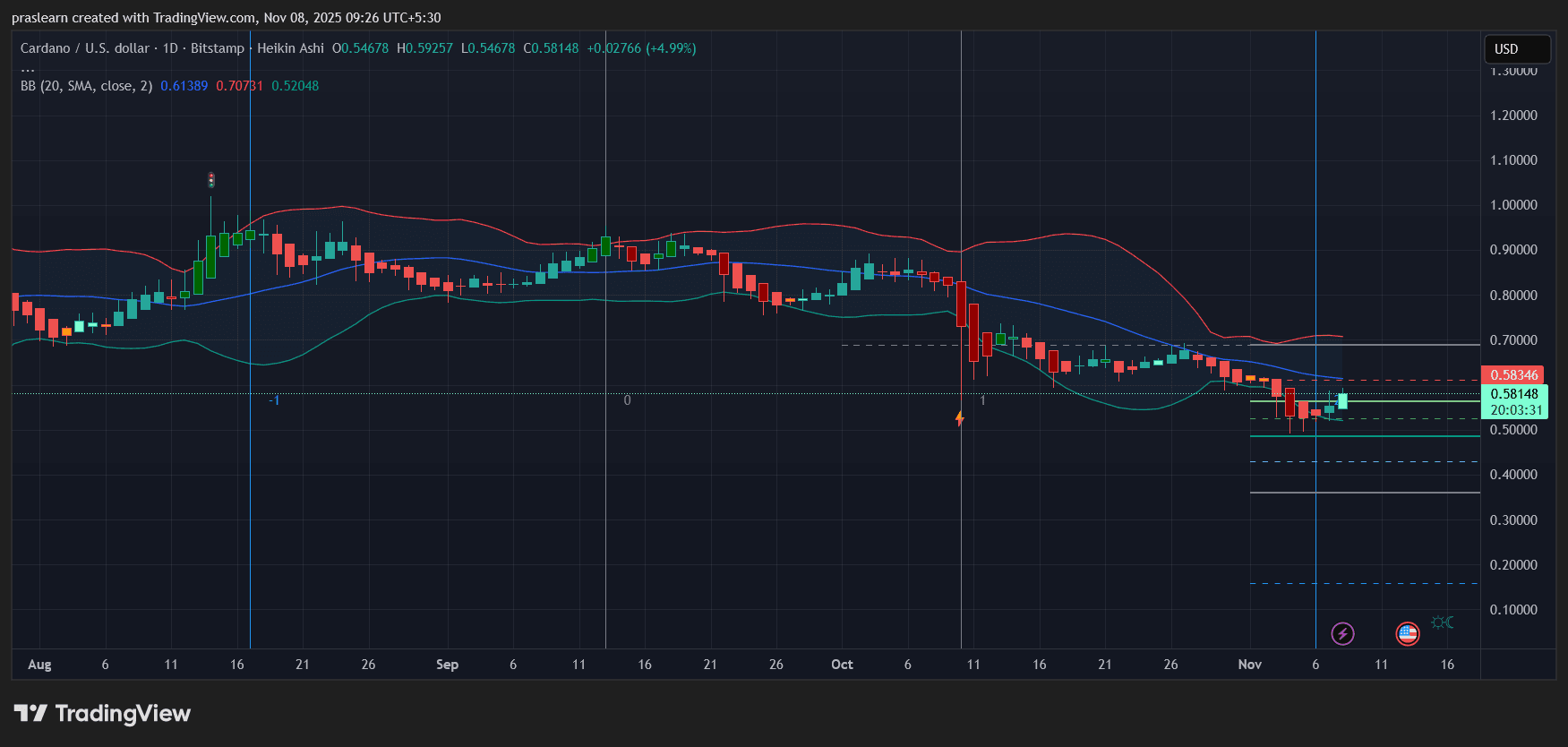

Cardano (ADA) Price Prediction: Can ADA Hold Its Recovery Amid Fed Uncertainty?

Hyperliquid's Rapid Rise: Emerging as a Major Player in Decentralized Trading?

- Hyperliquid captures 73% of decentralized perpetual trading volume with $12.9B daily trading and $9.76B open positions in October 2025. - Platform executes $645M HYPE token buybacks (46% of crypto buybacks) while 62.26% of Arbitrum's USDC liquidity flows to Hyperliquid. - Institutional adoption grows with 21Shares proposing SEC-approved HYPE ETF, while HIP-3 protocol enables permissionless market creation via HYPE staking. - Faces competition from new rivals (Aster, Lighter) and leadership risks, but exp

Bitcoin News Today: Is Bitcoin’s Recent Sell-Off Driven by Corporate Debt Reduction or Market Manipulation?

- Bitcoin fell below $100,000 on Nov. 4, 2025, with $1.3B in liquidations as whales and firms like Sequans sold BTC to reduce debt. - Analysts argue sellers may amplify bearish narratives via social media to profit from lower prices, while corporate treasury strategies face risks amid falling prices. - On-chain data shows moderate unrealized losses (3.1% stress level), suggesting potential stabilization, though some warn a $56,000 cascade could follow a $100,000 break. - Diverging strategies emerge: Americ