Whale Investors Acquire 534,894 HYPE Tokens with $21.06 Million USDC

- Main event impacts Hyperliquid’s trading volume and community sentiment.

- Whale addresses not linked to public individuals.

- No broad effects on major cryptocurrencies observed.

Two whale addresses purchased 534,894 HYPE tokens for $21.06 million USDC over two days, using Hyperliquid’s spot market. Address “0x5AE” spent $11.21 million, and “0x152” spent $9.85 million, reflecting strategic trading activities.

Two whale addresses spent a total of $21.06 million USDC to acquire 534,894 HYPE tokens through Hyperliquid’s spot market over the past two days.

The substantial HYPE purchase signifies notable investment trends towards decentralized finance, stimulating discourse on token liquidity and market dynamics.

On-chain data verified that notable whale addresses “0x5AE” and “0x152” invested heavily in HYPE. Whale “0x5AE” obtained 285,821 HYPE for $11.21 million USDC, while “0x152” acquired 249,073 HYPE at a cost of $9.85 million USDC. Both have track records of profiting from high-value trades on the Hyperliquid platform.

“The whale activity we’re seeing demonstrates the increasing confidence in HYPE’s potential within the DeFi landscape.” — Richard Hart, CEO, Hex.

The acquisitions have led to boosted trading volumes for HYPE, although there are minor unrealized losses from intraday price shifts. Community discussions have intensified with these purchases. Despite the heightened activity, no immediate ripple effects have been detected on other major cryptocurrencies or DeFi protocols.

Whale “0x152,” known for previous significant profits on Hyperliquid, continues to shape market behavior through large transactions. No direct comments or guidance from Hyperliquid executives or regulators have emerged. Industry observers speculate on future strategic decisions by these whale entities within decentralized markets.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

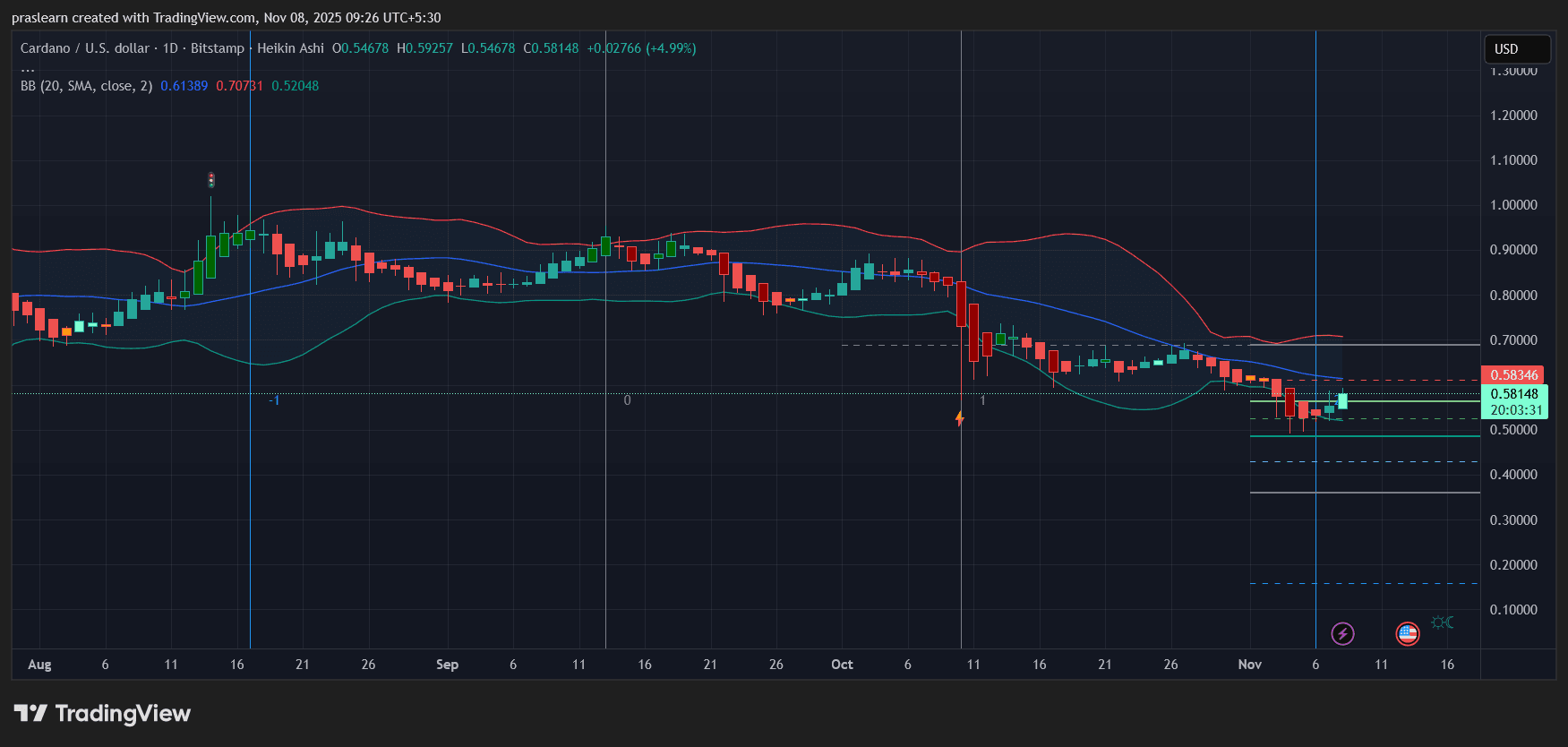

Cardano (ADA) Price Prediction: Can ADA Hold Its Recovery Amid Fed Uncertainty?

Hyperliquid's Rapid Rise: Emerging as a Major Player in Decentralized Trading?

- Hyperliquid captures 73% of decentralized perpetual trading volume with $12.9B daily trading and $9.76B open positions in October 2025. - Platform executes $645M HYPE token buybacks (46% of crypto buybacks) while 62.26% of Arbitrum's USDC liquidity flows to Hyperliquid. - Institutional adoption grows with 21Shares proposing SEC-approved HYPE ETF, while HIP-3 protocol enables permissionless market creation via HYPE staking. - Faces competition from new rivals (Aster, Lighter) and leadership risks, but exp

Bitcoin News Today: Is Bitcoin’s Recent Sell-Off Driven by Corporate Debt Reduction or Market Manipulation?

- Bitcoin fell below $100,000 on Nov. 4, 2025, with $1.3B in liquidations as whales and firms like Sequans sold BTC to reduce debt. - Analysts argue sellers may amplify bearish narratives via social media to profit from lower prices, while corporate treasury strategies face risks amid falling prices. - On-chain data shows moderate unrealized losses (3.1% stress level), suggesting potential stabilization, though some warn a $56,000 cascade could follow a $100,000 break. - Diverging strategies emerge: Americ

"Study Reveals 25% of Polymarket's Trading Volume is Artificial Due to Ghost Trades"

- Columbia University study reveals 25% of Polymarket's trading volume may involve wash trading, where users self-trade to inflate activity. - Sports and election markets showed highest manipulation rates (45% and 17% fake volume), peaking at 95% in election markets in March 2025. - Platform's lack of transaction fees and pseudonymous wallets enabled manipulation, despite CFTC regulatory actions since 2022. - Researchers urge Polymarket to adopt their detection methods to exclude fraudulent wallets and res