Stellar Tests $0.40 & Hedera ETF Draws Inflows, While BlockDAG’s 1,000x Projection Turns Viral with $0.005-to-$5 Target

The crypto market is shifting toward networks that prove long-term scalability and consistent delivery. Stellar (XLM) has drawn interest as its chart mirrors the 2017 breakout, with analysts monitoring the $0.40 resistance for signs of a sustained rally. Hedera (HBAR) also maintains strong traction after its first spot ETF launch, which brought institutional participation and renewed liquidity across exchanges.

Points Cover In This Article:

ToggleStill, the project commanding the most attention is BlockDAG (BDAG). Priced at $0.005 in Batch 32, it has raised $435 million, and built a global base of 3.5 million X1 app miners. Supported by its BWT Alpine Formula 1® Team partnership and hybrid DAG-based Proof-of-Work system, BlockDAG pairs measurable scalability with institutional trust, positioning itself as a fast-growing crypto heading into 2025.

Stellar Mirrors Its 2017 Wyckoff Setup Near $0.33

Stellar is showing a market pattern almost identical to its 2017 Wyckoff setup, when the coin surged from $0.005 to $0.75 within months. Analysts note that the current accumulation zone near $0.33 resembles that historical phase, with resistance at $0.40 emerging as the key breakout point.

This technical formation suggests XLM could be entering the final stage before a large upward move if buying pressure continues. Increasing trading volume and higher lows hint that bulls are preparing for momentum expansion.

For buyers, the similarity to the 2017 setup matters; these structures often precede strong rallies when confirmed. However, the pattern remains unproven until price clears resistance. A breakout above $0.40 could turn Stellar into one of November’s most-watched altcoins for those seeking risk-adjusted upside potential.

New ETF Launch Draws Major Inflows Into HBAR Hashgraph

The crypto market is taking notice of HBAR as institutional demand increases following the launch of a new spot ETF tied to Hedera Hashgraph. Reports indicate meaningful inflows and a spike in trading volume, signaling that regulated access is generating fresh momentum for the token.

This shift matters because it places HBAR in the spotlight, not just as an alt-coin, but as an asset now visible to institutional investors and regulated funds. With more capital able to flow in, HBAR could benefit from stronger liquidity and improved market depth.

For those considering entering the crypto space, HBAR offers a case to assess: it’s gaining structural access, institutional interest, and a price push.

BlockDAG’s Growth and Market Potential

BlockDAG has become one of the most discussed names in crypto, and the excitement is understandable. Now priced at $0.005 in Batch 32, the project has raised $435 million, built a community of 312,000+ holders, and attracted 3.5 million+ X1 app miners worldwide. Analysts across major crypto forums are debating BlockDAG’s long-term potential and growth prospects. Some predict significant growth, putting its potential market value near major industry leaders during previous peak cycles.

Such projections highlight the strength behind BlockDAG’s fundamentals. Its hybrid Directed Acyclic Graph and Proof-of-Work architecture allows parallel processing and rapid confirmations, setting new standards for scalability and efficiency. In addition, the partnership with the BWT Alpine Formula 1® Team strengthens brand visibility while signaling entry into mainstream culture.

Institutional backing exceeding $86 million further confirms market confidence, establishing BlockDAG as a credible, utility-driven network. With scarcity rising as the Value Era unfolds, early participation at $0.005 may represent a rare entry before valuation expands further.

Whether BDAG ultimately reaches higher valuations or not, its structural transparency, technology depth, and accelerating adoption make it one of the most compelling blockchain stories emerging in 2025.

Final Verdict

This week in crypto can be summed up by one theme: momentum. Stellar (XLM) continues to test upper resistance near $0.40, drawing comparisons to its 2017 rally, while Hedera (HBAR) gains consistent traction from ETF inflows that enhance its liquidity and institutional presence. Both projects reflect steady progress, moving with caution as markets await stronger signals.

BlockDAG (BDAG), however, is defining the pace. With $435 million raised, 4.3 billion coins remaining, and 3.5 million X1 app miners active, it has shifted from promise to proof. Supported by its BWT Alpine Formula 1® Team partnership and confirmed $0.05 listing price, BlockDAG is executing at scale. As others build anticipation, BlockDAG is already delivering results, setting a new benchmark for growth in 2025.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

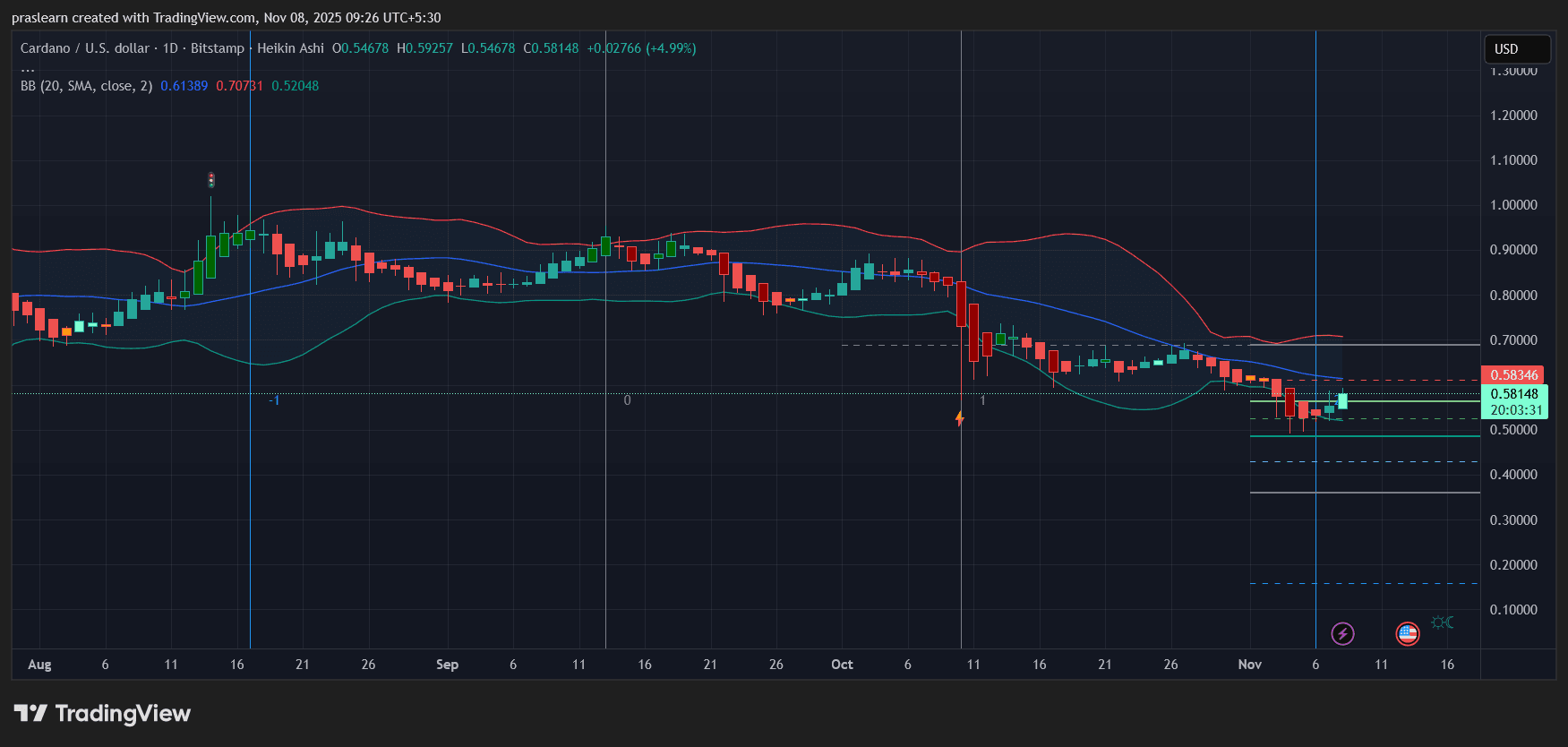

Cardano (ADA) Price Prediction: Can ADA Hold Its Recovery Amid Fed Uncertainty?

Hyperliquid's Rapid Rise: Emerging as a Major Player in Decentralized Trading?

- Hyperliquid captures 73% of decentralized perpetual trading volume with $12.9B daily trading and $9.76B open positions in October 2025. - Platform executes $645M HYPE token buybacks (46% of crypto buybacks) while 62.26% of Arbitrum's USDC liquidity flows to Hyperliquid. - Institutional adoption grows with 21Shares proposing SEC-approved HYPE ETF, while HIP-3 protocol enables permissionless market creation via HYPE staking. - Faces competition from new rivals (Aster, Lighter) and leadership risks, but exp

Bitcoin News Today: Is Bitcoin’s Recent Sell-Off Driven by Corporate Debt Reduction or Market Manipulation?

- Bitcoin fell below $100,000 on Nov. 4, 2025, with $1.3B in liquidations as whales and firms like Sequans sold BTC to reduce debt. - Analysts argue sellers may amplify bearish narratives via social media to profit from lower prices, while corporate treasury strategies face risks amid falling prices. - On-chain data shows moderate unrealized losses (3.1% stress level), suggesting potential stabilization, though some warn a $56,000 cascade could follow a $100,000 break. - Diverging strategies emerge: Americ

"Study Reveals 25% of Polymarket's Trading Volume is Artificial Due to Ghost Trades"

- Columbia University study reveals 25% of Polymarket's trading volume may involve wash trading, where users self-trade to inflate activity. - Sports and election markets showed highest manipulation rates (45% and 17% fake volume), peaking at 95% in election markets in March 2025. - Platform's lack of transaction fees and pseudonymous wallets enabled manipulation, despite CFTC regulatory actions since 2022. - Researchers urge Polymarket to adopt their detection methods to exclude fraudulent wallets and res