Bitcoin price crash calls are coming from self-serving sellers: Analyst

Some traders who are warning about an upcoming Bitcoin correction might be driven more by self-interest than by an unbiased view of the market, according to a Bitcoin analyst.

“If you sold, you really want lower prices,” Bitcoin analyst PlanC said on the Mr. M Podcast published to YouTube on Friday, reiterating that those who’ve recently sold Bitcoin (BTC) may become more vocal on social media, promoting the idea of Bitcoin’s price falling in hopes of seeing the market move in their favor.

“The whole point of you selling is to think that the bear market is coming,” he said. “So you’re going to get on social media,” he added.

Bitcoin social media sentiment is still leaning positive overall

Many market participants turn to social media to gauge overall sentiment about Bitcoin, paying close attention to community interactions and prediction posts.

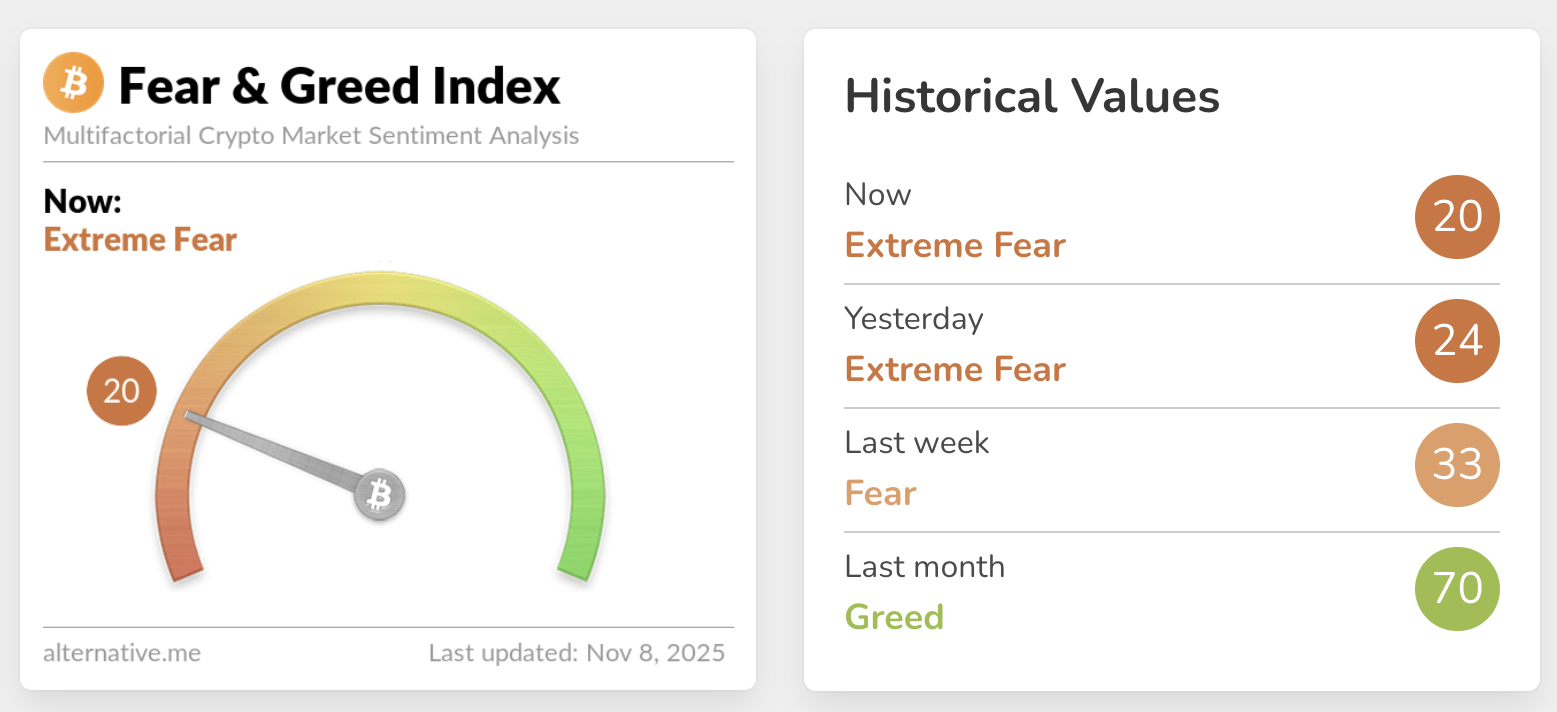

It comes as sentiment among the broader crypto market has plunged, with the Crypto Fear & Greed Index, which gauges overall market sentiment, posting an “Extreme Fear” reading of 20 in its Saturday update.

However, data from sentiment platform Santiment shows overall social media sentiment for Bitcoin (BTC) is 57.78% positive, 15.80% neutral, and 26.42% negative.

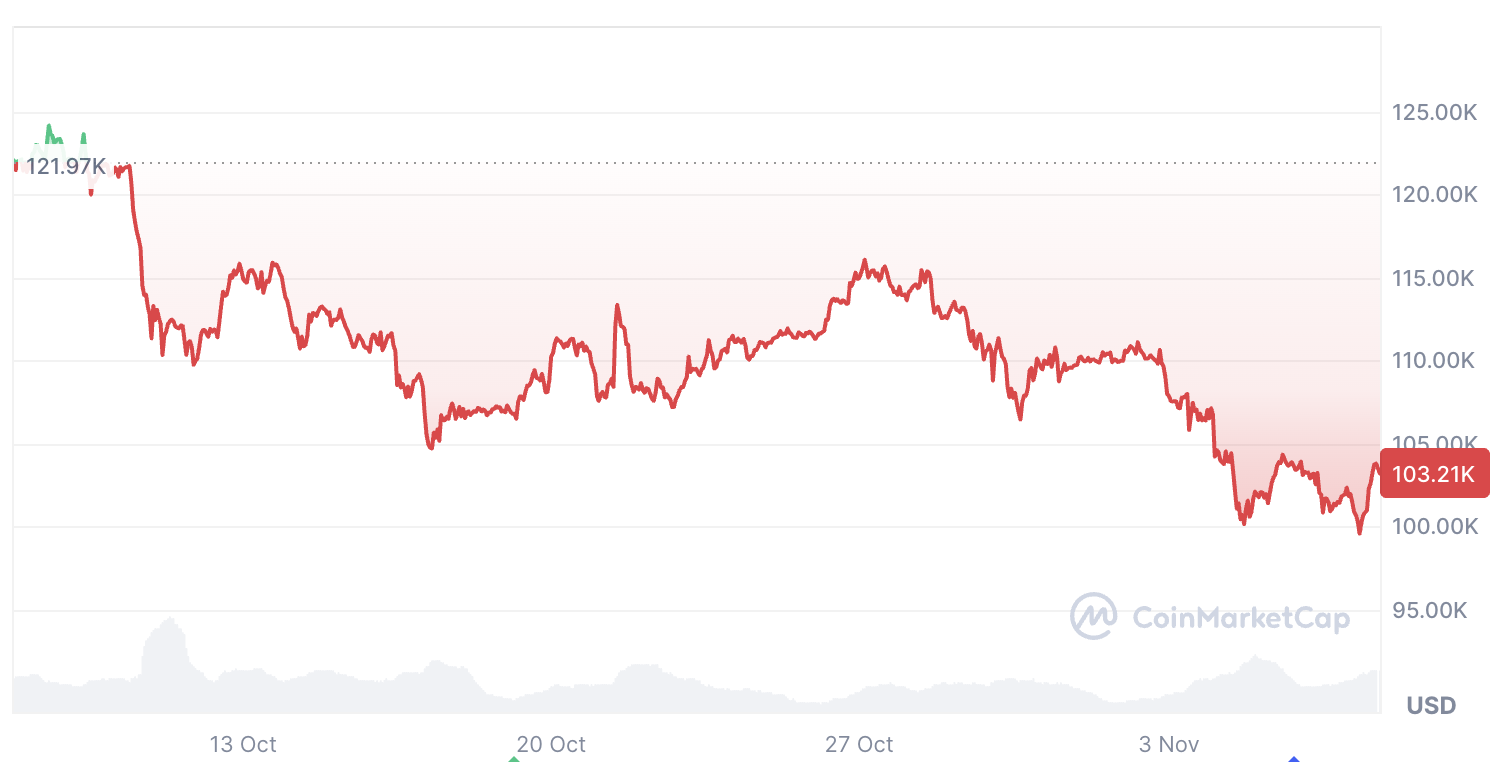

PlanC said that Bitcoin’s recent price decline below the psychological $100,000 price level to $98,000 may have been the local bottom for now.

PlanC forecasts a “decent chance” that Bitcoin just reached a bottom

“I think there is a good chance, again, it is hard to quantify exact probabilities, but from my perspective, there is a decent chance that was the major bottom,” PlanC said.

“If it wasn’t, I don’t see us going down much lower,” he added. Bitcoin has since rebounded to $103,562, according to CoinMarketCap, but PlanC cautioned that another brief pullback could still occur.

“Maybe we go for one more scare over the coming week or so lower,” he explained. “Maybe we go down to like 95 or something, right?” he added.

It comes on the back of more bearish forecasts from analysts over the past week.

Bloomberg analyst Mike McGlone said in an X post on Thursday that Bitcoin hitting $100,000 could be “a speed bump toward $56,000.”

Meanwhile, ARK Invest CEO Cathie Wood cut her long-term Bitcoin price projection by $300,000.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto Funds See $1.17B Weekly Outflows, CoinShares Reports

Quick Take Summary is AI generated, newsroom reviewed. Crypto funds saw $1.17 billion in outflows, marking the second straight week of withdrawals. Bitcoin and Ethereum funds recorded the largest losses at $932 million and $438 million, respectively. Solana continued its positive streak with $118 million in inflows, totaling $2.1 billion over nine weeks. U.S. investors led the selling ($1.22B outflows), while Europe (Germany, Switzerland) saw modest net inflows.References According to CoinShares, digital a

Uniswap News Today: Uniswap Activates Fee Switch, Burning Tokens to Boost Holder Value

- Uniswap activates a fee switch to redirect trading fees to UNI tokenholders, boosting UNI's price by 38% to $9.70. - The proposal burns 1 billion UNI (16% of supply) and creates a "token jar" mechanism to reduce circulating supply and incentivize burns. - This deflationary strategy, combined with a merged governance structure, aims to generate $2B+ annual revenue while solidifying DeFi dominance.

Bitcoin OGs Turn to ETFs for Smarter Tax and Investment Gains

Bitcoin Surges Past $106K as US Shutdown Fears Fade