Polkadot Break Above $2.85 Ahead? Reversal Setup Forms Beneath Heavy Resistance

Polkadot’s price action is beginning to hint at a possible shift in momentum, with a reversal setup forming just below the critical $2.85 level. The bulls are gradually building pressure, eyeing a breakout that could confirm a change in trend. Still, the presence of strong resistance overhead means the coming sessions will be crucial in determining whether DOT can break free or face another rejection.

DOT’s Downtrend Shows Signs Of Exhaustion As Buyers Eye A Short-Term Recovery

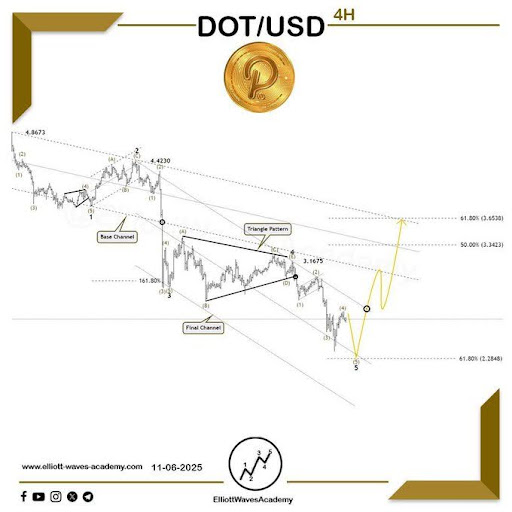

Giving a follow-up on the expected path of DOT in the 4-hour timeframe, Elliott Waves Academy revealed that the series of declines through the sub-waves of the recent impulsive move may be nearing its end. This suggests that the current downward trend is exhausting itself, at least in the short term, with a potential recovery ahead.

Related Reading: Polkadot Recovery Stalls As Bearish Pressure Returns With $3.5 In Sight

Elliott Waves Academy observes that a diagonal pattern appears to be forming, which is outlining the intricate details of wave (1)/(A). This diagonal formation is key to the analysis, as it typically signals the termination of a prior trend and precedes a reversal.

The analyst points to a confirmed break above the upper boundary of this diagonal pattern. Such a break would officially open the path for an upward recovery toward the zone between $3.3423 and $3.36538.

On the other hand, the $2.2848 level is deemed crucial for maintaining the immediate recovery outlook. Elliott Waves Academy warned that if this critical $2.2848 level is broken, further significant downside is expected through an extension of the existing bearish waves.

Polkadot Remains Trapped Beneath Major HTF Resistance Levels

Crypto_Jobs shared on X that the long-term chart for Polkadot remains largely stagnant and constrained beneath major high-timeframe (HTF) resistance zones at $3.200 and $3.780. The analyst cautioned traders to remain conservative with any swing (long) setups while the price trades below these critical resistance barriers.

Examining the current price action, Crypto_Jobs described market conditions as neutral, with Polkadot fluctuating within a tight range between $2.500 and $2.700. The sideways movement reflects a lack of clear direction, as both bulls and bears struggle for dominance. Despite this period of indecision, the chart showcases an emerging pattern that could soon dictate the next significant move.

The crypto analyst noted the possible formation of an inverse head and shoulders pattern, with a neckline around the $2.700–$2.850 to $3.00 zone. A confirmed breakout above this neckline could signal renewed bullish momentum, potentially leading to a 5–10% price surge.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ALGO Falls 1.74% as 1-Month Results Remain Subdued

- Algorand (ALGO) dropped 1.74% on Nov 24, 2025, extending its 1-month decline to 20.35% amid sustained bearish sentiment. - The token’s annual price has fallen 57.76% from its peak, driven by macroeconomic volatility and uncertainty over potential interest rate cuts. - No ALGO-specific news or on-chain developments were reported, with price movements linked to broader economic factors and risk appetite shifts. - Analysts warn the bearish trend may persist unless major upgrades emerge, urging investors to

DOGE drops 53.85% over the past year after early dissolution of federal agency

- Trump's DOGE department, aimed at cutting federal spending, was disbanded early, with functions absorbed by OPM. - DOGE's aggressive cost-cutting, including $1.9B in canceled contracts, faced scrutiny over lack of transparency and legal concerns. - The DOGE cryptocurrency token fell 53.85% in a year, while Grayscale launched spot ETFs as the department dissolved. - Former DOGE staff now hold federal roles, but its legacy raises ongoing questions about executive authority in reform efforts.

YFI Value Increases by 1.18% During Market Fluctuations

- YFI rose 1.18% in 24 hours to $4,036 but fell 49.49% annually, highlighting extreme volatility. - Short-term gains lack clear catalysts, with analysts noting broader market dynamics drive fluctuations. - Long-term bearish trends persist despite temporary rebounds, urging caution amid macroeconomic pressures.

Aave News Today: The Two Sides of DeFi: Aave's Expansion Increases Volatility Concerns

- Aave's AAVE token faces volatility risks near 0.57 support level, with whale accumulation and leveraged positions amplifying short-term instability. - A major Aave whale added 24,000 AAVE tokens (total 276,000) at $165 average cost, but remains vulnerable to repeat October 11 liquidation risks. - A $80M WBTC long position on Aave approaches $65,436 liquidation threshold, threatening forced selling and downward price pressure. - Tangem's Aave-integrated stablecoin yield feature highlights protocol's DeFi