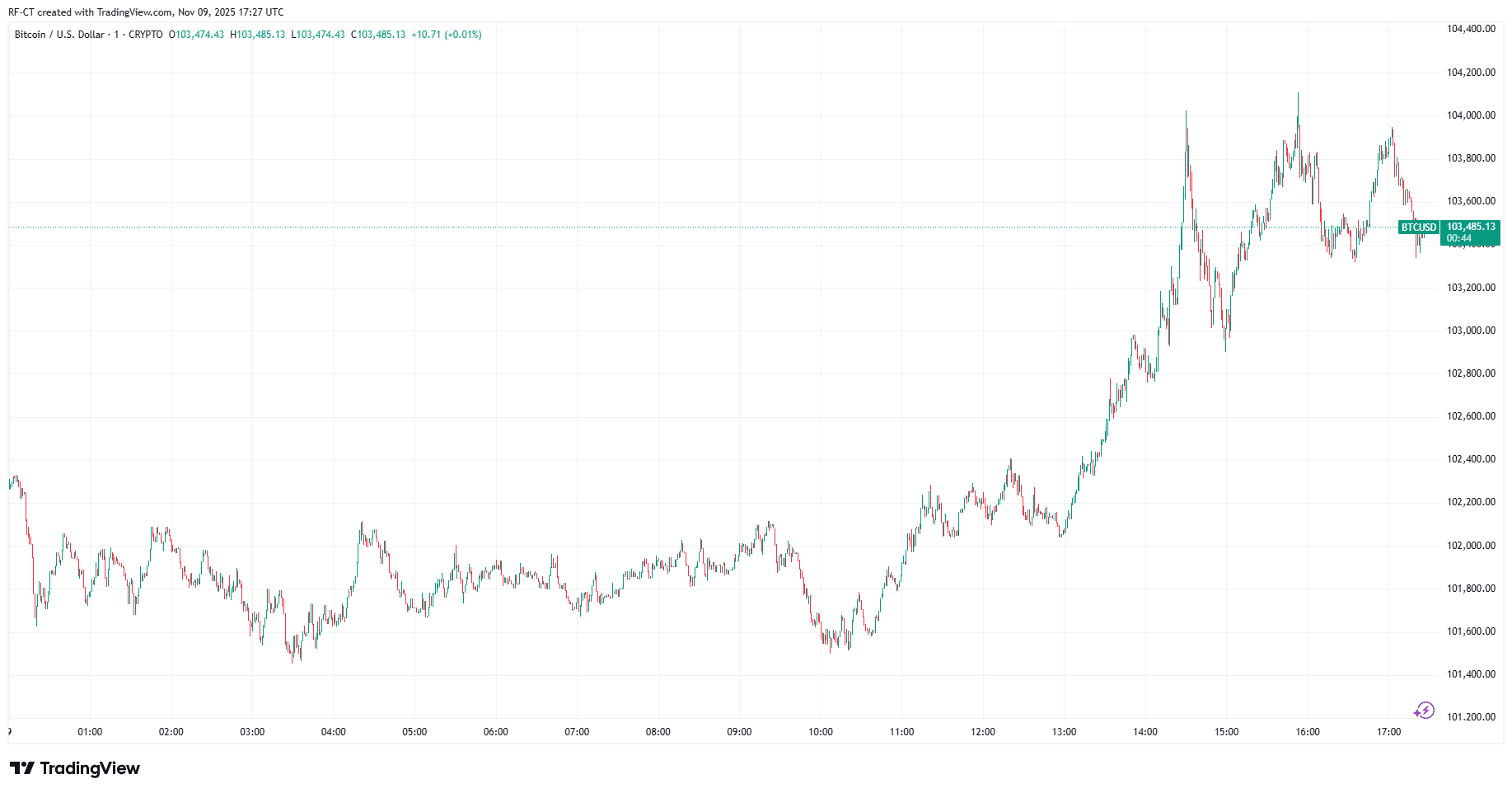

- Bitcoin is transforming the global financial system.

- It challenges traditional banking and monetary policies.

- The impact of Bitcoin rivals major historical innovations.

Bitcoin has often been labeled a “disruptive force”—but calling it one of the most disruptive technologies since 1000 AD? That’s a bold claim, and increasingly, a valid one. While the past millennium has seen innovations like the printing press, electricity, and the internet, Bitcoin stands apart for its ability to challenge global financial structures at their core.

At its heart, Bitcoin is more than digital currency. It’s a decentralized, censorship-resistant system that bypasses the need for traditional banks and intermediaries. In an era where central banks dictate monetary policy and inflation erodes purchasing power, Bitcoin offers an alternative: a fixed-supply, borderless store of value.

Challenging Centuries of Financial Norms

Since 1000 AD, financial systems have evolved—but always with a central authority in control. Bitcoin breaks that mold. It empowers individuals with full ownership of their assets through cryptographic keys, effectively removing the need to trust governments or financial institutions.

This innovation is particularly impactful in countries facing hyperinflation or financial censorship. Bitcoin provides a secure, transparent alternative for people seeking to protect their wealth and engage in global commerce.

The Long-Term Impact of Bitcoin

Bitcoin’s underlying technology— blockchain —has paved the way for broader decentralized finance ( DeFi ), smart contracts, and even NFT ecosystems. But it’s Bitcoin’s simplicity and resilience that make it such a powerful force.

From Wall Street to developing nations, its reach is undeniable. It has sparked institutional adoption, legislative debates, and even national-level interest, as seen in El Salvador’s adoption of Bitcoin as legal tender.

In hindsight, Bitcoin may very well be remembered alongside the most transformative breakthroughs in human history—not just in finance, but in how we understand and use value itself.

Read Also :

- Bitcoin Short Squeeze May Be on the Horizon

- Deutsche Bank Predicts Fed QE Return in Q1 2026

- Whale Moves 3,600 BTC to Exchange, Sparks Speculation

- Binance BTC Reserves Drop by 8,181 Since October 1

- Arthur Hayes Reveals ZEC as His Holding After BTC