Zcash Overtakes Stellar: What's Next for XLM?

The price of the privacy-focused token Zcash (ZEC) has risen in several weeks. This price growth has caused its market capitalization to increase, currently at $9.41 billion.

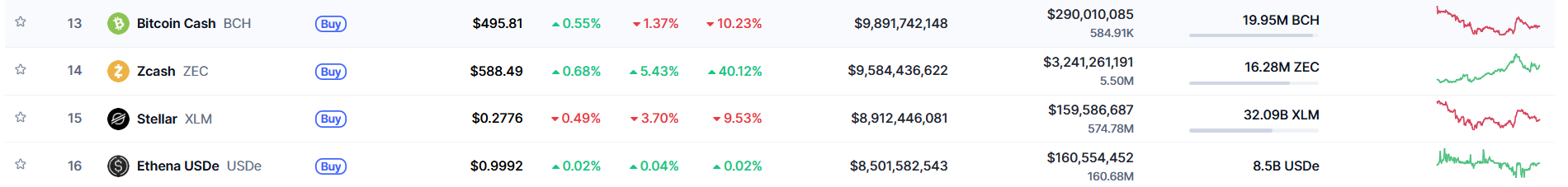

At its current market valuation, Zcash has surpassed Stellar (XLM), ranking the 14th largest cryptocurrency ahead of XLM, which has a market cap of $8.88 billion.

Zcash, created in 2016 via a fork of Bitcoin’s codebase, supports anonymous transactions with zero-knowledge proofs.

Zcash has surged 1,172% yearly, surpassing Monero to become the largest privacy token. Unlike past rallies, the current rise seems driven by real usage, increasing shielded adoption and shifting perceptions of privacy in crypto.

Zcash, until recently a fairly obscure cryptocurrency, started rising in late September, and has risen over tenfold since then.

From under $54 in late September, Zcash rose unrelentingly to reach a high of $748 on Friday, last seen in January 2018.

At the time of writing, Zcash was up 5.59% in the last 24 hours to $589 as the larger crypto market traded down, and up 41% weekly.

What's next for XLM?

Stellar network saw 37% growth in full-time developers in the last quarter, about eight times faster than the industry growth rate. The network added 1,450 new developers in Q3, a 70% quarterly increase. Daily smart contract invocations on the network rose nearly 100%, surpassing 1 million per day. By the end of Q3, total invocations hit 157 million.

The Stellar Ambassador program also continued to scale in Q3, with 400 new signups, 160 community events and double-digit regional growth across Latin America and Asia Pacific.

The figures suggest increased developer activity, which demonstrates growing momentum on the network. However, this is yet to translate into price growth for XLM, which is just up 175% yearly.

In the coming days, attention will be paid to XLM's price, with a break above $0.5 sparking a fresh uptrend for the token.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The ChainOpera AI Token Collapse: A Warning Story for DeFi Platforms Powered by AI

- ChainOpera AI's COAI token collapsed 96% in late 2025 due to algorithmic stablecoin failures, exposing systemic risks in AI-driven DeFi. - Technical flaws and opaque governance in COAI's AI systems worsened liquidity crises, despite $50M in funding. - Regulatory pressures and centralized token distribution exacerbated vulnerabilities, contradicting DeFi's decentralization principles. - Market resilience emerged as Uniswap's UNI token rose 15%, highlighting potential for innovation in token economics. - T

Modern Monetary Theory and the Transformation of Asset Valuation in 2025: Policy Changes, Risk Adjustments, and Actual Market Conditions

- Modern Monetary Theory (MMT) has transitioned from academic concept to central framework for central banks addressing post-stablecoin crisis market instability in 2025. - Central banks are embedding MMT principles into policy tools, shifting from asset purchases to targeted liquidity facilities while prioritizing digital asset system resilience. - Academic research introduces "growth risk premium" to explain how MMT-driven fiscal expansion and low interest rates reshape traditional asset valuations and r

Fed Governor Stephen Miran sees stabilizing influence from stablecoins

Shiba Inu Holds Steady at $0.00001006 as Market Activity Remains Balanced