Insiders: Visa and Mastercard to end 20-year fee dispute with U.S. merchants

Foresight News reported, citing The Wall Street Journal and informed sources, that Visa and Mastercard are about to reach a settlement with U.S. merchants, ending a legal dispute that has lasted for two decades. The settlement aims to reduce credit card payment fees charged to merchants and give them greater autonomy in choosing which credit cards to accept.

The proposed agreement shows that Visa and Mastercard will reduce fees by an average of 0.1% over several years and allow merchants to independently choose which credit cards to accept. Previously, both companies required merchants to accept all credit card payments within the network if they accepted any one type of credit card from the network.

The legal dispute between the two parties began in 2005, when U.S. merchants accused Visa, Mastercard, and major banks of monopolistic practices regarding fees and credit card acceptance rules. In March 2024, the two sides reached a settlement agreement proposing to reduce fees by 0.07% over five years and give merchants greater flexibility, allowing them to charge surcharges for credit card payments, but the agreement was rejected by the presiding judge.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Federal Reserve Governor Milan once again calls for a significant rate cut in December

International Business Settlement: Acquired approximately 247 bitcoins between October 17 and November 7

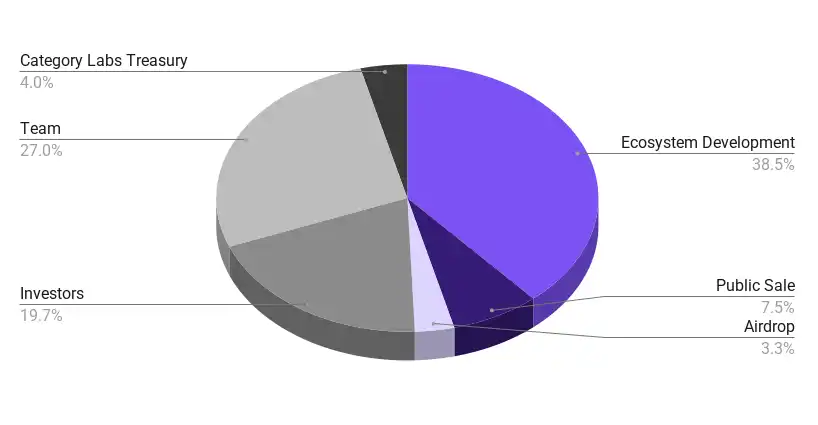

Monad announces tokenomics: total supply of 100 billions tokens, 3% to be distributed via airdrop

Trending news

MoreOverview of Monad Tokenomics: 49.4% of the total supply will be unlocked on the first day of mainnet launch, with 10.8% entering circulation through public sale and airdrop, and 38.5% managed by the Monad Foundation.

Federal Reserve Governor Milan once again calls for a significant rate cut in December