Crypto ETF Weekly Report | Last week, US spot bitcoin ETFs saw a net outflow of $1.208 billion; US spot ethereum ETFs saw a net outflow of $507 million

Franklin Templeton's XRP ETF has been listed on the DTCC website with the ticker XRPZ.

Compiled by: Jerry, ChainCatcher

Performance of Crypto Spot ETFs Last Week

US Bitcoin Spot ETFs See Net Outflow of $1.208 Billion

Last week, US Bitcoin spot ETFs experienced four consecutive days of net outflows, totaling $1.208 billion dollars.

Last week, six ETFs were in a net outflow state, with the main outflows coming from IBIT, FBTC, and ARKB, with outflows of $581 million, $438 million, and $129 million, respectively.

Data source: Farside Investors

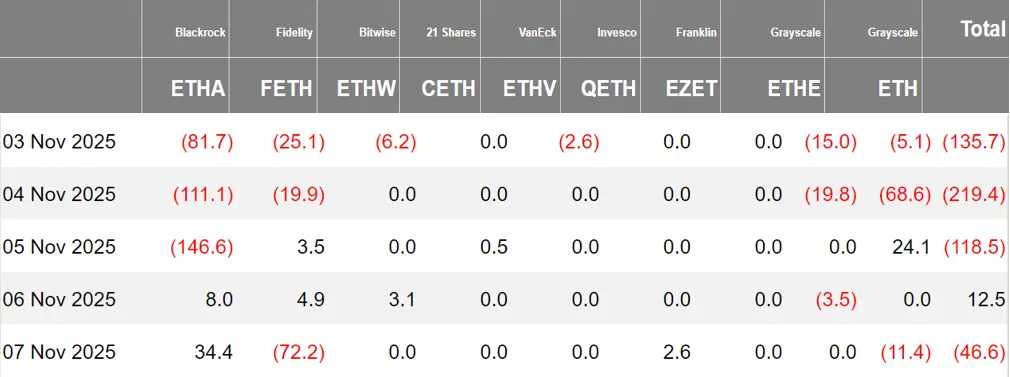

US Ethereum Spot ETFs See Net Outflow of $507 Million

Last week, US Ethereum spot ETFs experienced four consecutive days of net outflows, totaling $507 million dollars.

The main outflow last week came from BlackRock's ETHA, with a net outflow of $2.97 trillion. All six Ethereum spot ETFs were in a net outflow state.

Data source: Farside Investors

Overview of Crypto ETF Developments Last Week

21Shares Submits 8(A) Form to US SEC for Proposed XRP Spot ETF

Bloomberg ETF analyst Eric Balchunas posted on social media that 21Shares has submitted a new 8(a) form to the US SEC, proposing to launch its XRP spot ETF. The application is subject to a 20-day review period.

JPMorgan Significantly Increases Bitcoin ETF Holdings, Bullish on BTC Reaching $170,000

According to The Block, JPMorgan significantly increased its Bitcoin ETF holdings in the third quarter, with BlackRock's iShares BTC Trust (IBIT) holdings rising by 64% to 5.28 million shares, valued at approximately $333 million. Meanwhile, the bank almost completely liquidated its Ethereum ETF holdings, retaining only 66 shares worth about $1,700.

JPMorgan analysts predict that the price of Bitcoin could reach $170,000 in the next 6-12 months.

Franklin Templeton XRP ETF Listed on DTCC Website, Ticker: XRPZ

According to Cryptopolitan, Franklin Templeton's XRP exchange-traded fund (ETF) has appeared on the website of the US Depository Trust & Clearing Corporation (DTCC), with the trading code XRPZ. This listing is only a preparatory step and does not indicate approval or the start of trading.

It is reported that Franklin Templeton submitted a revised S-1 registration statement on Tuesday, including a shortened "8(a)" clause. This legal "loophole" allows the registration to automatically take effect after 20 days without direct signature from the US Securities and Exchange Commission (SEC), unless the agency intervenes.

Grayscale Announces Waiver of Solana ETF Management Fees Until AUM Reaches $1 Billion

According to official sources, digital asset investment platform Grayscale Investments announced on X that it will waive sponsor fees for the Grayscale Solana Trust ETF (ticker: GSOL) and reduce related fees during the staking period, for up to three months or until the fund's assets under management (AUM) reach $1 billion, whichever comes first.

The fund has now staked up to 100% of its SOL, offering a staking yield of 7.23%. The fee waiver policy applies to both new and existing GSOL investors.

Franklin Templeton Submits Updated XRP ETF S-1, Aiming for Launch This Month

Bloomberg analyst James Seyffart posted that Franklin Templeton has submitted an updated XRP ETF S-1, shortening the 8(a) clause, with the goal of launching within this month.

BlackRock to Launch Its Bitcoin ETF in Australia in Mid-November

BlackRock has confirmed it will launch the iShares Bitcoin ETF (ASX:IBIT), providing Australian investors with a more convenient way to access cryptocurrencies in the local market. BlackRock stated that the ETF is expected to be listed on the Australian Securities Exchange in mid-November 2025. BlackRock said IBIT will charge a 0.39% management fee and, by bundling the US-listed iShares Bitcoin Trust (Nasdaq: IBIT), will provide investors with a low-cost, regulated channel to access Bitcoin without the technical and operational complexities of direct ownership.

Previously, the Australian Securities and Investments Commission (ASIC) updated its guidance last week, reclassifying most digital assets—including stablecoins, wrapped tokens, security tokens, and digital asset wallets—as financial products. Although Bitcoin itself does not constitute a financial product, under the updated guidance of Information Sheet 225, services and products containing this cryptocurrency may be considered financial products.

Grayscale Lists Shiba as One of the Assets Eligible for Spot ETF Listing

Grayscale Investments has listed Shiba Inu as one of the cryptocurrencies eligible for listing on US spot exchange-traded funds (ETFs). Grayscale mentioned this in a recent blog post titled "Market Byte: Here Come the Altcoins." After the launch of Bitcoin and Ethereum ETFs, Grayscale acknowledged that the process for launching similar ETF products for altcoins like Shiba Inu has now been simplified.

The report shows that the launch of the first Bitcoin spot exchange-traded product (ETP) took more than ten years—from the initial proposal in 2013 to final approval in January 2024. However, the "Generic Listing Standards" (GLS) framework approved by the US Securities and Exchange Commission (SEC) has now accelerated the launch of crypto exchange-traded products (ETPs).

Bitwise and Grayscale Disclose XRP and Dogecoin Spot ETF Fees, May Go Live Without SEC Approval

According to The Block, Bitwise plans to charge a 0.34% fee for the Bitwise XRP ETF, while Grayscale will charge 0.35% for its XRP and Dogecoin ETFs. Both companies have previously launched SOL spot ETFs, with Bitwise attracting about $56 million on the first day.

In the context of a US government shutdown and limited SEC manpower, institutions can submit S-1 filings without a "delaying amendment" and meet listing standards, allowing products to automatically take effect after 20 days, meaning some crypto ETFs may be listed without prior SEC approval. NovaDius says the first XRP spot ETF may be seen within two weeks.

Opinions and Analysis on Crypto ETFs

Bloomberg ETF Analyst: Bitwise Dogecoin Spot ETF Will Be Listed Within 20 Days

Bloomberg ETF analyst Eric Balchunas posted on social media that Bitwise is conducting 8(a) operations for its Dogecoin spot ETF, which essentially means that unless there is intervention, they plan to go live within 20 days.

Citi: Crypto Weakness Stems from Slowing ETF Inflows and Reduced Risk Appetite

According to CoinDesk, Wall Street bank Citi said that although the stock market is performing strongly, the crypto market has weakened again recently, with a large liquidation in October hurting investor confidence.

The sell-off has reduced risk appetite among leveraged traders and new spot ETF investors, with the latter withdrawing their investments. Recently, inflows into US spot Bitcoin ETFs have dropped sharply, weakening a key factor supporting the market's optimistic outlook.

Citi originally predicted that ETF inflows would continue as financial advisors and others increased their Bitcoin exposure, but now the momentum has stalled and market sentiment may remain subdued.

On-chain data also adds to the cautious atmosphere: the number of large Bitcoin holders has declined, the number of small retail wallets has increased, and funding rates have dropped, indicating that long-term investors may be selling and demand for leverage is weakening. Technically, Bitcoin has fallen below its 200-day moving average, which may further suppress demand. Citi also links Bitcoin's weakness to tightening bank liquidity. The report concludes that spot ETF fund flows are a key signal for observing shifts in crypto market sentiment.

Bloomberg Analyst: Even with Bitcoin Price Pullback, BlackRock IBIT Annualized Return Still Near 80%

Bloomberg senior ETF analyst Eric Balchunas posted on X: Even with the price pullback, since BlackRock submitted its Bitcoin ETF (IBIT) application 30 months ago, Bitcoin's price has risen by 300%, equivalent to an annualized return of nearly 80%, so the market need not worry.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

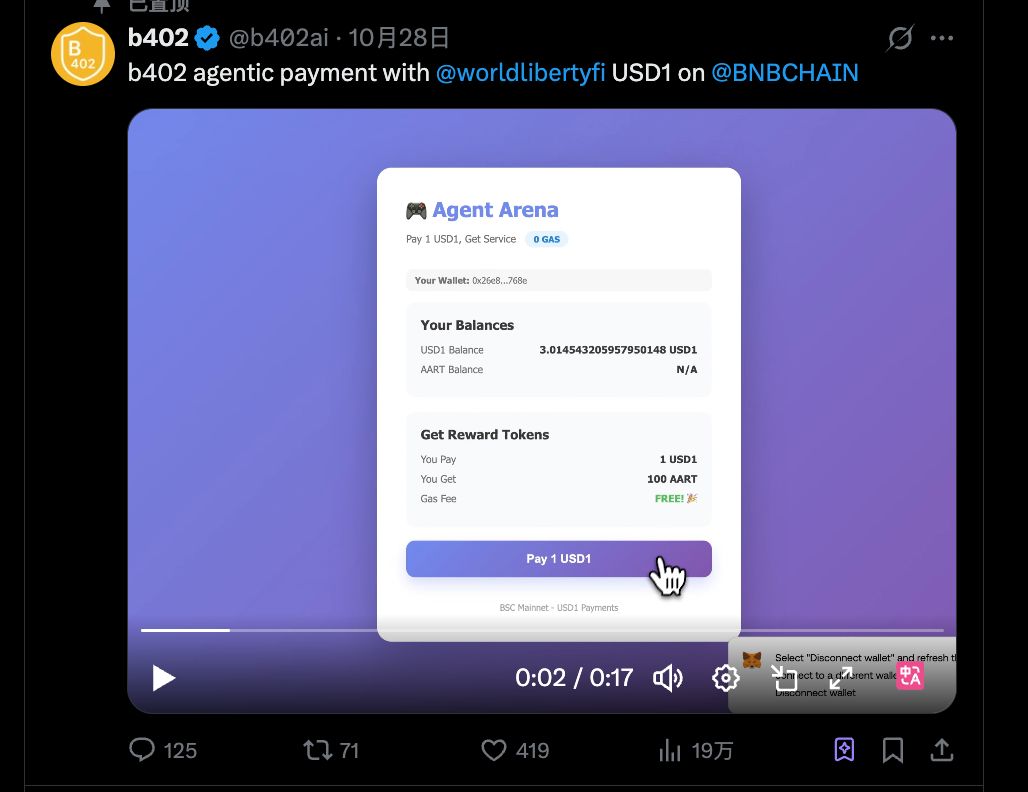

Interpretation of b402: From AI Payment Protocol to Service Marketplace, BNBChain's Infrastructure Ambitions

b402 is not just an alternative to x402 on BSC; it could be the starting point for a much bigger opportunity.

Shutdown Leaves Fed Without Key Data as Job Weakness Deepens

Institutional Investors Turn Their Backs on Bitcoin and Ethereum

Litecoin LTC Price Prediction 2025, 2026 – 2030: Can Litecoin Reach $1000 Dollars?