The crypto market suffers consecutive crashes, and the "digital asset treasury company" that "leveraged cryptocurrencies" has collapsed.

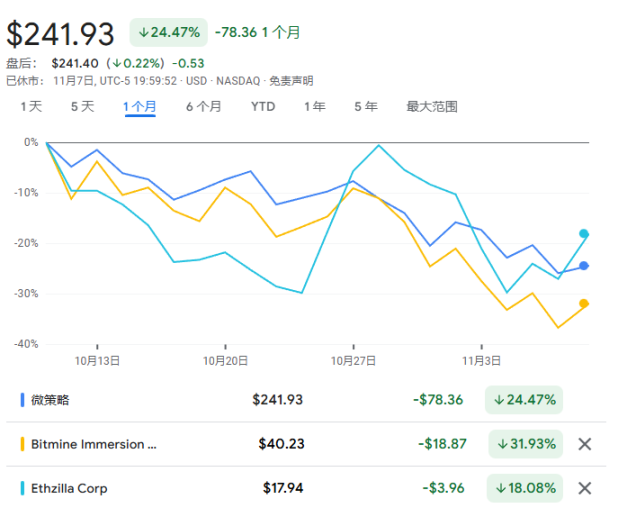

Over the past month, MicroStrategy's stock price dropped by 25%, BitMine Immersion fell by more than 30%, while bitcoin declined by 15% during the same period.

Over the past month, MicroStrategy's stock price has fallen by 25%, BitMine Immersion has dropped more than 30%, while bitcoin's decline over the same period was 15%.

Written by: Zhao Ying

Source: Wallstreetcn

A cryptocurrency sell-off that began last October is now engulfing Wall Street’s hottest investment strategy of the year. “Digital asset treasury companies” that buy bitcoin, ethereum, and other cryptocurrencies by borrowing or raising funds were once seen by investors as an excellent way to leverage crypto exposure. Now, their stock prices have fallen far more than the tokens they hold.

This model was pioneered by Michael Saylor in 2020, transforming a small software company called MicroStrategy into a bitcoin whale. The company’s market capitalization peaked at about $128 billion last July, but has since shrunk to around $70 billion. Over the past month, MicroStrategy's stock price has dropped 25%, while bitcoin's decline over the same period was 15%.

This round of sharp declines has affected several heavyweight investors, including well-known venture capitalist Peter Thiel. BitMine Immersion Technologies, an ethereum treasury company backed by Thiel, has fallen more than 30% in the past month, while another Thiel-backed company, ETHZilla, which pivoted from biotech, dropped 23% over the same period.

The total market capitalization of cryptocurrencies has plunged about 20% from the all-time high of nearly $4.4 trillion reached on October 6, almost erasing all gains from the first ten months of this year. Year-to-date gains now stand at just 2.5%, down about 18% from the record high of $120,000 set on October 6.

The Logic Behind Treasury Company Premiums Is Being Questioned

The core issue with digital asset treasury companies is that investors are effectively paying a premium far above the net asset value for companies holding cryptocurrencies. Brent Donnelly, president of Spectra Markets, bluntly stated: “The whole concept makes no sense to me. You’re just paying $2 for a $1 bill. Eventually, these premiums will be compressed.”

This skepticism is not unfounded. Well-known Wall Street short seller Jim Chanos has previously shorted MicroStrategy while buying bitcoin, believing there is no reason for investors to pay a premium for Saylor’s company.

Last Friday, he told clients it was time to close out this trade. In an interview on Sunday, he said that although treasury company stocks are still overvalued, the premium is no longer extreme, and “the logic of this trade has basically played out.”

When digital asset treasury companies first emerged, they provided a channel for institutional investors who previously found it difficult to invest directly in cryptocurrencies. However, cryptocurrency exchange-traded funds launched over the past two years now offer the same solution, weakening the unique value proposition of treasury companies.

Leverage Effect Amplifies Downside Risk

“Digital asset treasury companies are essentially leveraged crypto assets, so when cryptocurrencies fall, they fall even more,” said Matthew Tuttle. The MSTU ETF he manages aims to provide twice the return of MicroStrategy, but has plunged 50% in the past month.

This leverage effect is vividly reflected in many treasury companies. Tuttle also emphasized, “Bitcoin has proven it’s not going away, and buying the dip will be rewarded.”

Matt Cole, CEO of bitcoin treasury company Strive, said that earlier this year, the company’s average purchase price for bitcoin was more than 10% higher than current levels. Strive’s stock price has fallen 28% in the past month. Cole noted that many treasury companies are “in trouble” because companies facing losses find it difficult to issue new shares to buy more crypto, which could put pressure on cryptocurrency prices and raise questions about these companies’ business models.

However, Cole said that Strive, having recently raised funds through preferred stock rather than debt, is well-positioned to “weather the volatility.”

Believers Are Still Holding On

Despite the setbacks, some investors are still increasing their positions. Cole Grinde, a 29-year-old investor from Seattle, bought about $100,000 worth of BitMine shares at around $45 each earlier this year when the company began accumulating ethereum. He is currently down about $10,000. But the beverage industry salesman says he is adding to his position and is selling BitMine options to help offset his losses.

Grinde attributes his confidence in the company to the growing popularity of the ethereum blockchain and the influence of Tom Lee. Lee, who worked at JPMorgan for 15 years, is now a managing partner at Fundstrat Global Advisors and a frequent guest on business TV shows. “I think his network and charisma helped the stock price soar after he took over,” Grinde said.

Saylor himself has maintained his usual optimism, declaring on social media that bitcoin is currently “on sale.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum News Update: Crypto Shares Rally Even as Ethereum Falls 12% with Whales Purchasing $1.37 Billion

- U.S. major stock indexes rose 0.23-1.5% on Nov 10, 2025, driven by crypto stocks like Coinbase (+4%) and Circle (+4.94%) amid renewed sector confidence. - Mercurity Fintech was added to MSCI Global Small Cap Indexes, enhancing institutional visibility and liquidity for its blockchain-powered fintech services. - Ethereum fell 12% to $3,000 but saw $1.37B in whale purchases, signaling long-term institutional confidence despite short-term price declines. - European indexes rebounded 0.47-1.22% as U.S. shutd

Bitcoin Updates: U.S. 10-Year Treasury Yield Ignores Downward Trends, Poised for Potential 6% Surge

- U.S. 10-year Treasury yields near 4% show bullish technical patterns mirroring Bitcoin's 2024 rally setup. - Divergence between bearish momentum indicators and price action suggests potential breakout to 6.25%. - Stacked SMAs and Ichimoku cloud confirm long-term uptrend, last seen in the 1950s. - Parallel to Bitcoin's $100k surge highlights market strength building beneath surface indicators. - Yield rise could pressure equities/cryptos but recent political stability may push Bitcoin toward $112k.

ZEC rises 50.53% over the past month as large investors and favorable market trends support upward movement

- ZEC surged 50.53% in 1 month as a whale on Hyperliquid built a $2.21M long position with 5x leverage, selling 5,000–15,000 ZEC during a recent correction. - ZEC traded near $610 with a 1.006 long/short ratio, showing bullish momentum via MACD (101.55) and MFI (71.17) despite weakening price momentum. - A new 10x leveraged ZEC long on Hyperliquid and Arthur Hayes’ bullish BTC/ZEC outlook highlight growing institutional interest in privacy-focused crypto. - A proposed MFI-based ZEC trading strategy (buy at