US Government Shutdown Ends + Cash Handouts, Will Crypto See a Liquidity Boom?

According to Polymarket data, the market estimates a 55% probability that the U.S. government shutdown will end between November 12 and 15.

According to Polymarket data, the probability that the U.S. government shutdown will end between November 12 and 15 is 55%.

Written by: 1912212.eth, Foresight News

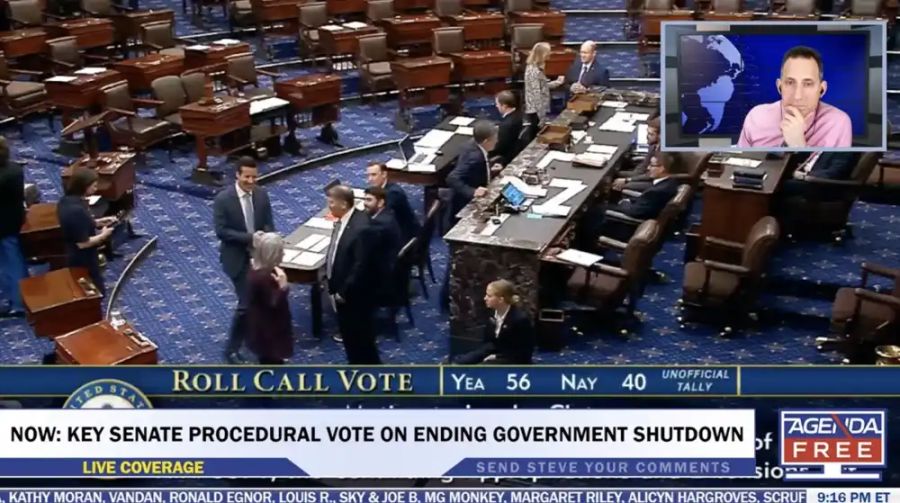

Recently, the crypto market has welcomed two major positive developments. On November 9, Trump announced that he would distribute at least $2,000 in bonuses to everyone. The next day, Trump told the media that the shutdown seemed to be coming to an end. Currently, the U.S. Senate is conducting a test vote on a plan to end the government shutdown, which requires 60 votes to pass. The latest data shows that only one more vote is needed for approval.

Boosted by positive news, the crypto market responded accordingly. On the evening of November 9, BTC surged from $102,000 to oscillate near a recent high of $106,600, while ETH climbed from around $3,400 to nearly $3,600, with a 24-hour increase of over 7%. Altcoins saw a slight overall rise.

The Longest U.S. Government Shutdown in History Is About to End

The potential end of the U.S. government shutdown is the biggest recent macro positive for the crypto market. The shutdown began in October this year, triggered by congressional budget disagreements, resulting in a freeze of federal funds and affecting everything from social security payments to defense spending. According to the U.S. Congressional Budget Office, the shutdown has caused an estimated daily economic loss of about $1 billion, totaling tens of billions of dollars. This has directly hit investor confidence, increased uncertainty, and led institutional funds to shift to safe assets like Treasury bonds, causing crypto liquidity to dry up.

White House National Economic Council Director Hassett stated: If the U.S. government shutdown continues, fourth-quarter GDP may turn negative. U.S. Treasury Secretary Bessent also said the economic impact of the shutdown is getting worse.

Around 9 a.m. on November 10, as the U.S. federal government shutdown reached its 40th day, President Trump told the media: It looks like we are getting closer to ending the "shutdown." That evening, the U.S. Senate was expected to advance a vote on a bill already passed by the House, but the bill would be amended to bundle a short-term funding measure (which could fund the federal government until January 2026) with three full-year appropriations bills.

According to a Fox News reporter, the U.S. Senate is conducting a test vote on a plan to end the government shutdown, which requires 60 votes to pass.

The Senate is holding a procedural vote on the plan to end the government shutdown, and currently only one more vote is needed for passage. According to related information, after the procedural vote passes, the Senate must amend three appropriations bills (legislative, military construction, and agriculture, including the SNAP program) and then send them back to the House. Each amendment will trigger a 30-hour debate period, which could delay the process. If Democrats choose to extend these debates, the government may not reopen until Wednesday or Thursday, but if they waive the time, the "end of shutdown" process could be completed tonight, and the U.S. government could reopen tomorrow night. The current filibuster rules could significantly affect the timeline.

Data from Polymarket shows that the probability of the U.S. government shutdown ending before November 11 has risen to 39%, while the probability for November 12 to 15 is 55%. The total trading volume on this prediction market has exceeded $18.1 million.

BitMEX co-founder Arthur Hayes wrote that the U.S. government is back to doing what it does best—printing money and distributing welfare. BTC and ZEC are about to take off. Previously, Arthur analyzed that since the U.S. debt ceiling was raised in July, BTC has fallen by 5% and dollar liquidity has dropped by 8%. The U.S. Treasury General Account (TGA) has drained liquid dollars from the market. When the U.S. government shutdown ends, the TGA will decrease, which is favorable for dollar liquidity and will push BTC higher.

Historical data shows that after a similar shutdown ended in 2019, the crypto market rebounded by 10%-15% within two weeks. If history repeats itself, the end of the shutdown could once again drive market prices to continue rebounding.

The U.S. Government Will Pay a $2,000 Bonus to Everyone

The tariff war initiated by Trump once kept global investors on edge. The tariff war even became the trigger for the crypto market's "10.11 crash."

Recently, Trump defended his tariff war by saying: Anyone who opposes tariffs is a fool! We are now the richest and most respected country in the world, inflation is almost zero, and the stock market has hit record highs. 401k retirement account balances have also reached historic highs. We earn trillions of dollars every year and will soon begin to pay off the massive $37 trillion debt. U.S. investment has reached record highs, and factories and businesses are springing up everywhere. At least $2,000 in bonuses will be paid to everyone (excluding high-income groups!).

Trump's tariff bonus plan injects potential funds from the consumption side, amplifying the leverage effect in the crypto market. This is based on his trade policy: imposing tariffs of 10%-60% on imported goods, expected to generate $1 trillion in revenue by 2026. Preliminary estimates from the Treasury Department indicate this will cover hundreds of millions of people, with total expenditures exceeding $6 trillion, some of which will be distributed via direct transfers.

The positive impact of this plan on crypto liquidity lies in the spillover effect of funds. U.S. consumer spending accounts for 70% of GDP, and bonus payments will stimulate retail and investment. According to Federal Reserve data, after the 2021 pandemic stimulus checks, retail funds flowing into crypto reached 15%, pushing bitcoin from $40,000 to $60,000. This bonus is even larger, and it is expected that 10%-20% (about $600 billion to $1.2 trillion) will flow into high-risk assets.

With these two major events intertwined, short-term sentiment in the crypto market has been significantly boosted. The resolution of the shutdown has released previously frozen institutional funds, while the bonus plan injects fresh capital from the retail side.

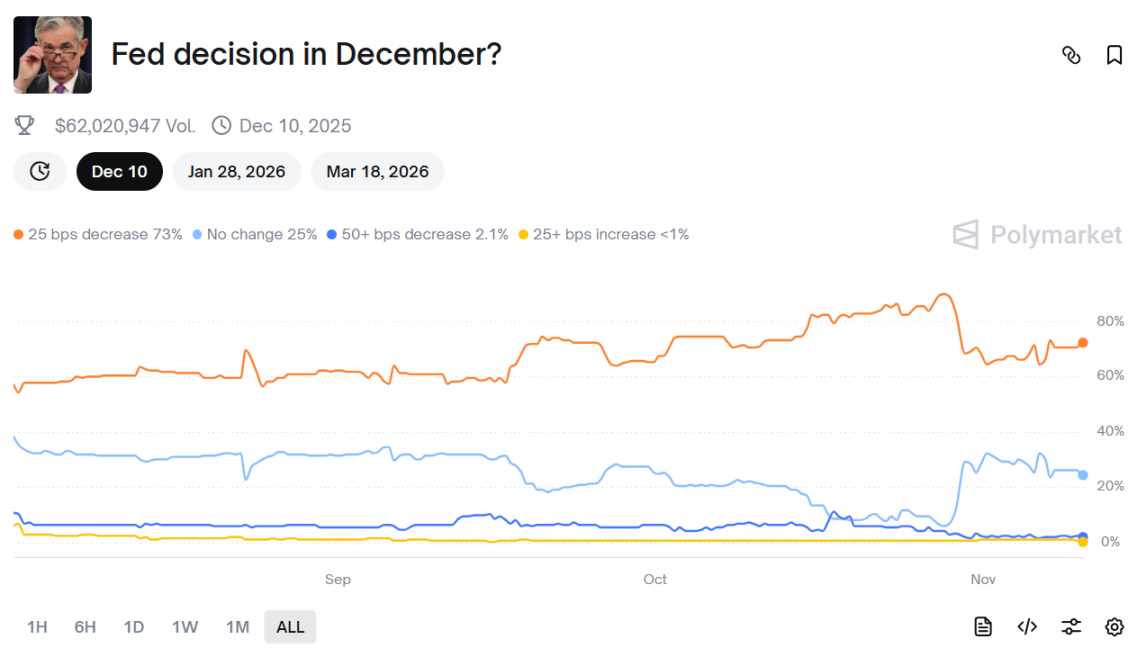

In addition, the probability of a 25 basis point rate cut by the Federal Reserve in December this year, as bet on Polymarket, has risen to 73%, which will continue to inject liquidity into risk assets.

Currently, after the crypto market fell into extreme fear at the beginning of November, the fear index remains at 29. Perhaps when market liquidity returns, market sentiment will improve significantly.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Showcasing portfolios, following top influencers, one-click copy trading: When investment communities become the new financial infrastructure

The platforms building this layer of infrastructure are creating a permanent market architecture tailored to the way retail investors operate.

Ripple raised another $500 million—are investors buying $XRP at a discount?

The company raised funds at a valuation of $40 billions, but it already holds $80 billions worth of $XRP.

CoinShares: Net outflow of $1.17 billion from digital asset investment products last week.

Crypto Jumps On Trump’s $2,000 Dividend Announcement