Ethereum: Transaction fees drop to 0.067 Gwei

Making a transaction on Ethereum now costs only a few cents. This Sunday, gas fees plunged to 0.067 gwei, a level never seen in years. While traders praise this spectacular drop, it raises questions about the economic viability of Ethereum’s model.

In brief

- Gas fees on Ethereum dropped to 0.067 gwei on Sunday, in a context of widespread crypto market slowdown.

- An exchange transaction now costs only 0.11 dollars, compared to over 150 dollars during congestion periods in 2021.

- This drop is notably explained by the March 2024 Dencun update, which reduced fees for layer 2 solutions.

- Ethereum base layer revenues have dropped by 99% since 2024, raising concerns about the model’s sustainability.

Ethereum records historically low transaction fees

Yesterday, Ethereum users were able to make transactions for a fraction of a cent. The gas fees hit the floor at 0.067 gwei, a level rarely seen in the network’s history.

For active traders, it is an unexpected boon. Exchanging tokens costs 0.11 dollars, buying an NFT costs 0.19 dollars, and transferring assets to another blockchain requires only 0.04 dollars.

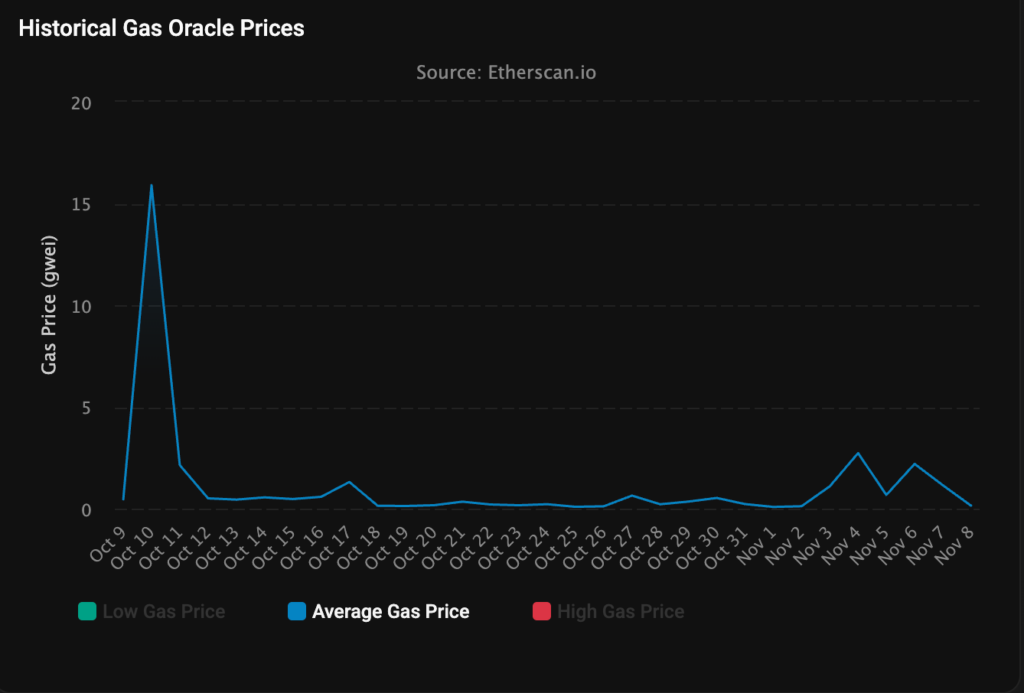

This phenomenon fits into a downward trend started after the October “flash crash.” On October 10, during a flash crash where some cryptos lost up to 90% of their value in 24 hours, fees momentarily surged to 15.9 gwei. But two days later, they had already fallen back to 0.5 gwei. Since then, they have remained below the symbolic 1 gwei mark.

This situation sharply contrasts with the golden era of 2021. At the height of the bull market, making a simple transaction on Ethereum could cost 150 dollars, or even more during congestion peaks.

Users then had to choose between paying exorbitant fees or waiting hours, sometimes days, for the network to clear. Today, that problem belongs to the past.

The Dencun update , deployed in March 2024, played a key role in this transformation. By optimizing data management for layer 2 solutions, it significantly reduced pressure on the main network.

Platforms like Arbitrum, Optimism, and Base can now process massive volumes of transactions at lower costs, freeing up space on layer 1.

Gas price evolution on Ethereum layer 1 over the last 30 days. Source: Etherscan

Gas price evolution on Ethereum layer 1 over the last 30 days. Source: Etherscan

The dangers of a weakened economic model

However, this medal has its flip side. Since the beginning of 2024, Ethereum’s base layer has been recording net revenue losses. The fees generated are no longer sufficient to cover the network’s operational costs.

The 99% drop in revenues alarms seasoned observers. How can a network remain viable with such an erosion of its financial income?

Validators, who secure the network by processing transactions, depend on these fees to monetize their investments. With revenues plummeting, their motivation could wane.

Certainly, staking rewards still exist, but they do not fully offset the disappearance of transaction fees. In fact, nearly 2.45 million ETH are currently waiting in the validator withdrawal queue, indicating some nervousness among participants.

Critics point to Ethereum’s scaling strategy, which heavily relies on a layer 2 ecosystem. This architecture presents an apparent contradiction.

On one hand, it allows the network to compete with recent blockchains like Solana or Aptos, capable of processing thousands of transactions per second. On the other, it channels economic activity towards external protocols, thus depriving layer 1 of its traditional revenue sources.

According to a Binance analysis, Ethereum faces a “double-edged sword.” Layer 2 solutions strengthen its technical competitiveness but simultaneously create internal competition.

Users naturally favor networks where fees are lowest. As a result, activity massively shifts toward Base, Arbitrum, or Optimism, leaving the main layer underutilized. This dynamic could ultimately weaken Ethereum’s fundamental value proposition.

A necessary strategic reconsideration

Facing this paradoxical situation , the Ethereum community stands at a crossroads. Low fees undeniably constitute a competitive advantage to attract users.

However, they also signal a drop in demand for the base layer, casting doubt on the model’s long-term sustainability. Upcoming updates, notably Fusaka scheduled for December 2025 , will introduce mechanisms like PeerDAS to further optimize the network.

But will they solve the structural revenue problem? The community must quickly find a viable model: one that balances accessibility for users and sufficient remuneration for validators, otherwise the leader of smart contracts could lose its throne to competitors less scrupulous about decentralization.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

‘Most hated bull run ever?’ 5 things to know in Bitcoin this week

Bitcoin price eyes $112K liquidity grab as US government shutdown nears end

This year's hottest cryptocurrency trade suddenly collapses—should investors cut their losses or buy the dip?

The cryptocurrency boom has cooled rapidly, and the leveraged nature of treasury stocks has amplified losses, causing the market value of the giant whale Strategy to nearly halve. Well-known short sellers have closed out their positions and exited, while some investors are buying the dip.

Showcasing portfolios, following top influencers, one-click copy trading: When investment communities become the new financial infrastructure

The platforms building this layer of infrastructure are creating a permanent market architecture tailored to the way retail investors operate.