ASTER Becomes #1 DEX with $12B Volume – Still 53% Below Peak!

ASTER’s strong rally, fueled by its Phase 4 “Aster Harvest” launch and Coinbase roadmap inclusion, has sparked renewed bullish momentum. With rising trading volume and bullish chart setups, the token could be preparing for a push toward new highs.

The ASTER token is having a breakout week, surging over 12% in the past 24 hours and becoming the top-ranked decentralized perpetuals exchange (perps DEX) globally, with $12 billion in trading volume.

The launch of Phase 4 – Aster Harvest and Coinbase’s decision to add ASTER to its Listing Roadmap have ignited fresh optimism that the project could reclaim its previous all-time high (ATH), despite its price remaining 53% below peak levels.

Phase 4: A Major Milestone in Aster’s Expansion Journey

According to the project’s official announcement, Phase 4, titled Aster Harvest, has officially begun. This phase will allocate an additional 1.5% of the total ASTER supply, distributed evenly across six weekly epochs (0.25% per epoch).

At the same time, Aster DEX has increased its buyback rate to $7,500 per minute, signaling a strong commitment to supply control and long-term price stability.

ASTER’s buyback rate. Source:

ASTER’s buyback rate. Source:

Another key catalyst comes from Coinbase, which has added ASTER to its official listing roadmap. This move is not only a strong publicity boost but also a potential gateway for institutional capital inflows once ASTER secures a complete listing on the US exchange.

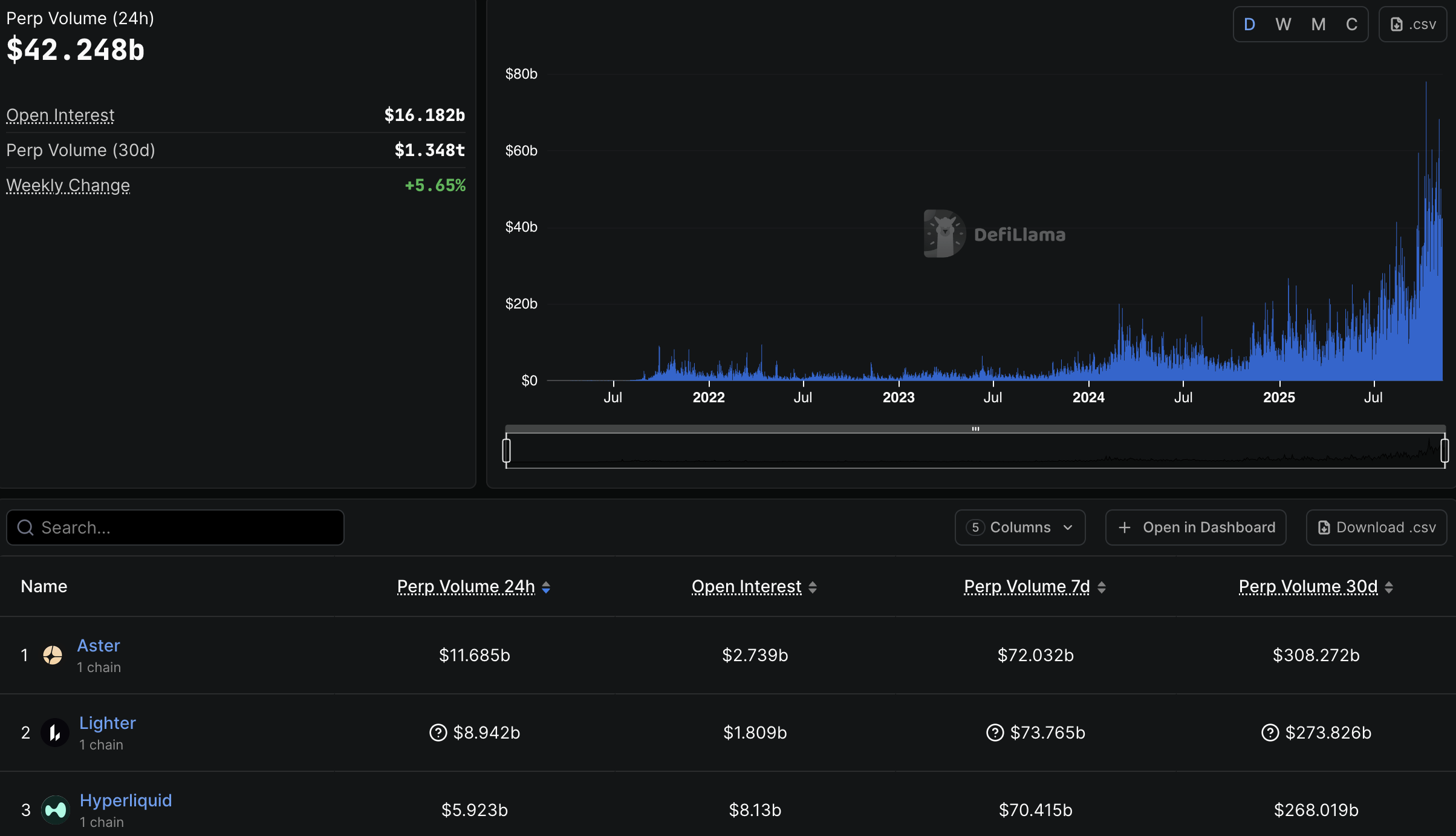

Currently, Aster DEX leads all decentralized perpetual exchanges (perp DEXs) in daily trading volume, with over $12 billion in volume, according to DeFiLlama data. This growth demonstrates Aster’s growing dominance in the perpetual futures segment, a sector increasingly regarded as the “backbone” of next-generation DeFi.

Aster’s trading volume. Source:

Aster’s trading volume. Source:

The combination of an aggressive buyback program and a possible Coinbase listing may act as dual catalysts, propelling ASTER out of its prolonged consolidation phase and into a new growth cycle. However, market liquidity and broader sentiment still pose near-term risks.

Technical Analysis: Signs of a Breakout From an Ascending Triangle

From a technical standpoint, several analysts have noted bullish momentum forming in the ASTER/USDT chart. According to one market observer, a symmetrical triangle pattern is emerging, with a strong rebound from the Point of Control (PoC) support zone. A successful breakout above the triangle resistance could trigger a strong bullish rally.

ASTER/USDT 2H chart. Source:

ASTER/USDT 2H chart. Source:

Another analyst on X highlighted price consolidation within an ascending triangle, with resistance near $1.16 and support around $1.09. A clear move above $1.29 could invalidate the prior bearish structure and open the door to higher targets.

“The most probable scenario now is a clean break above $1.16, followed by a retest that flips the zone into support. Holding that level would confirm breakout strength and open the path toward $1.19 > $1.29,” the analyst commented.

Additionally, analyst Captain Faibik confirmed that the Falling Wedge pattern has finally broken out after 50 days of consolidation, providing another signal in support of a short-term bullish bias.

With rising volume and multiple technical indicators signaling breakout potential, Aster DEX appears well-positioned for another leg upward. Additionally, Aster whales have accumulated $53 million in tokens, signaling renewed confidence and growth potential in the market.

Still, the $1.29–$1.35 zone will serve as a crucial test to determine whether ASTER has enough momentum to challenge its previous ATH.

At the time of publication, ASTER is trading at $1.06, down 3.9% over the past 24 hours, after briefly surging over $1.16. The current price is still 53% below its previous ATH.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Updates: Arthur Hayes Sells $2.45M ETH/DeFi Holdings, Indicating Negative Market Sentiment

- Arthur Hayes sold $2.45M in Ethereum and DeFi tokens, including 260 ETH and 2.4M ENA, signaling potential bearish sentiment. - Blockchain analysts highlight risks of price dips as large ETH sales often trigger short-term market declines, with $3,000 support levels under scrutiny. - Simultaneous offloading of AAVE, UNI, and LDO tokens suggests profit-taking amid rising traditional finance rates and DeFi liquidity shifts. - Zcash (ZEC) whale activity and leveraged ETH short positions further amplify crypto

Anthropic Claims Cyberattack Involved AI, Experts Express Doubts

- Anthropic claims Chinese state hackers used AI to automate 80-90% of a cyberattack targeting 30 global entities via a "jailbroken" Claude AI model. - The AI-generated exploit code, bypassed safeguards by fragmenting requests, and executed reconnaissance at unprecedented speed, raising concerns about AI's dual-use potential in cyber warfare. - Experts question the validity of Anthropic's claims while acknowledging automated attacks could democratize cyber warfare, prompting calls for stronger AI-driven de

AAVE Drops 13.95% Over 7 Days Amid Strategic Changes Triggered by Euro Stablecoin Regulatory Approval

- Aave becomes first DeFi protocol to secure EU MiCA regulatory approval for euro stablecoin operations across 27 EEA states. - The Irish subsidiary Push Virtual Assets Ireland now issues compliant euro stablecoins, addressing ECB concerns about USD-dominance in crypto markets. - Aave's zero-fee Push service generated $542M in 24-hour trading volume, contrasting with typical 1-3% fees on centralized exchanges. - With $22.8B in borrowed assets, the platform's regulatory milestone is expected to accelerate a

SEI Faces a Turning Point: Will It Be a Death Cross or a Golden Cross?

- SEI , Sei's native token, shows early recovery signs amid crypto market slump, with technical indicators suggesting potential breakout from prolonged consolidation. - Despite 2.83% 24-hour decline to $0.17, increased $114.1M trading volume and TD Sequential buy signals highlight critical inflection point potential. - Market analysis identifies $0.1756 support and $0.1776 resistance levels, with death cross risks below $0.1745 and golden cross potential above $0.1787. - Fear/greed index at 25 reflects ext