Stablecoins: A Boost or a Barrier to Financial Inclusion?

The story of stablecoins is evolving.

The story of stablecoins is evolving.

Written by: Jeff Gapusan

Translated by: Block unicorn

As traditional finance (TradFi) faces challenges in adapting to technological innovation and growing consumer demand, stablecoins have become one of the most influential and controversial products. The United States (including policymakers and the private sector) has gradually realized that stablecoins can serve as a powerful tool to provide funding for the world’s largest economy, with U.S. Treasury bonds as its safest financial instrument. A recent research report by Standard Chartered Bank pointed out that stablecoins could negatively impact the stability of financial institutions in developing countries, trigger large-scale deposit outflows, and weaken the strength of local central banks.

The story of stablecoins is evolving, and two completely different financial outcomes may emerge: the most enthusiastic users (emerging markets) may further undermine the economic infrastructure they are trying to protect their wealth with, while further strengthening enterprises in developed markets.

Digital Dollarization: $1 Trillion Stablecoins at Risk

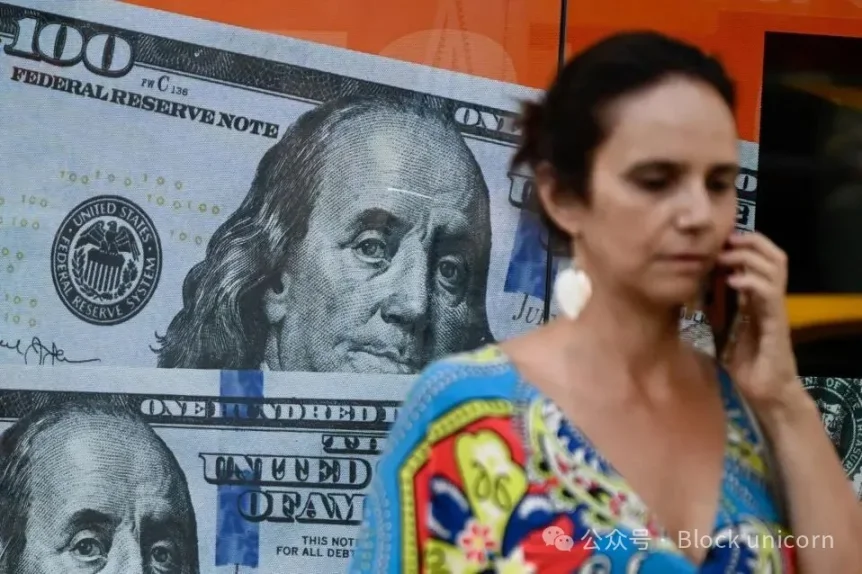

In Buenos Aires, a woman walks past a billboard featuring a $100 bill. Argentinians often exchange pesos for U.S. dollars to protect their savings from "hyperinflation." (Image source: LUIS ROBAYO/AFP via Getty Images)

From Argentina to Africa, exchanging local currency for U.S. dollars is part of daily life. Stablecoins have greatly accelerated this process, providing a convenient digital channel for it.

For decades, citizens of countries with weak and unstable currencies have chosen to exchange their local currency for U.S. dollars or dollar-denominated assets. In Zimbabwe, which has suffered from years of hyperinflation and economic turmoil, about 85% of transactions are denominated in U.S. dollars. In other countries such as Ecuador and El Salvador, the U.S. dollar has become the official currency.

The vast majority of stablecoin usage is concentrated in developing countries. In emerging markets, stablecoins are a necessity, providing protection against hyperinflation and unpredictable political crises.

In developed markets, stablecoins have become a fiat on-ramp for cryptocurrency trading, institutional settlement, or moving from bank deposits into the digital asset space. Users can access alternative digital payment, financial, and investment methods through stablecoins, which can rival many traditional financial solutions in terms of speed, efficiency, and cost.

These two use cases form a stark contrast. One might argue that these two positions are a trade-off between financial advantage and practical necessity.

Standard Chartered Bank, with its extensive business network, local market expertise, and focus on cross-border trade and financial services, has long been a pillar of banking in emerging markets across Asia, Africa, and the Middle East. (Image source: Matthew Lloyd/Getty Images)

Standard Chartered Bank was the first to warn of the potential negative impact of the stablecoin economy. According to a research report released in October, current trends indicate that by the end of 2028, as much as $1 trillion in deposits could flow from emerging market banks into stablecoins. This transfer of wealth is far from theoretical; it could pose a profound threat to the credit systems of many countries.

Stablecoin Growth in Emerging Markets

The core driver of stablecoin growth in emerging markets is self-preservation.

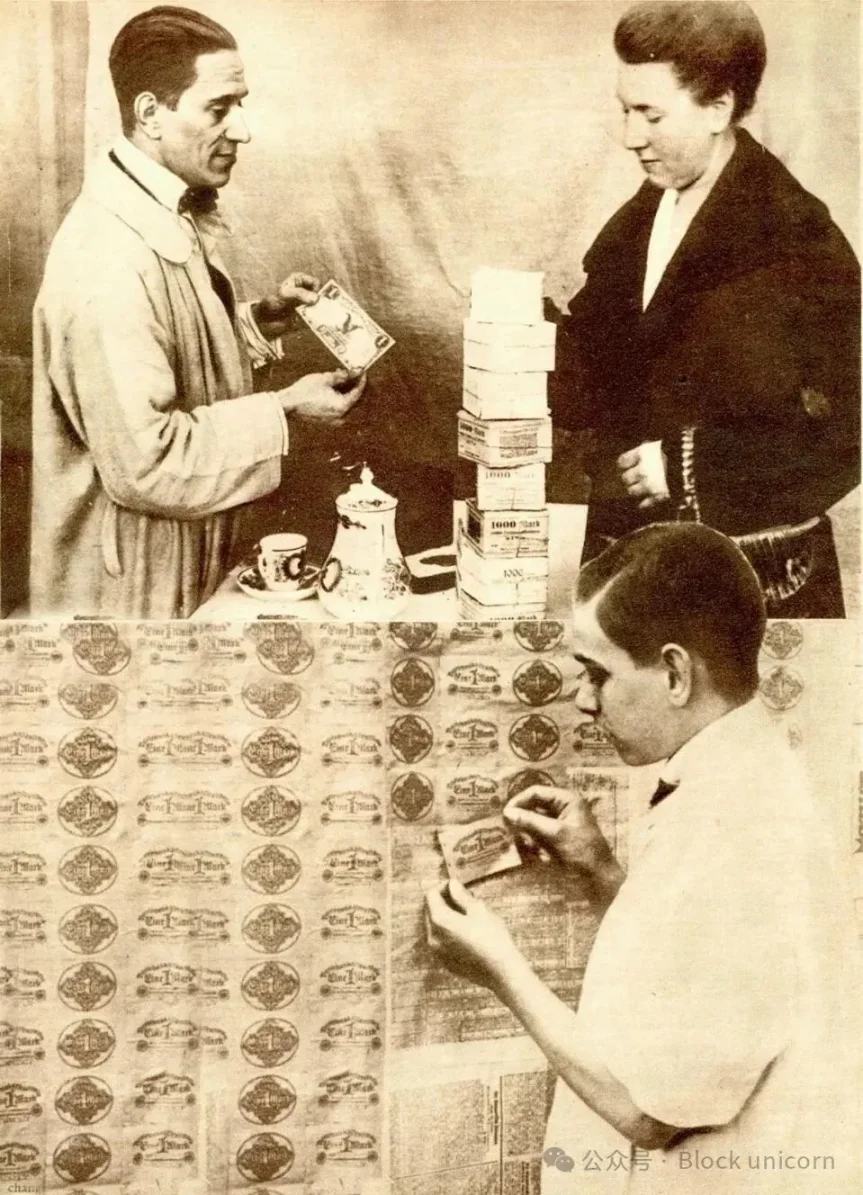

People want to preserve the wealth they have worked hard to earn. According to Standard Chartered Bank, for citizens of countries facing hyperinflation or currency devaluation, "return of capital is more important than return on capital."

Like Germany during the hyperinflation of 1923-1924, emerging markets are more concerned with the return of capital than the return on capital. (Image source: Universal History Archive / Getty Images)

Stablecoins provide a reliable, instant, and borderless way to store dollar-pegged wealth in digital wallets. When citizens cash out their local currency (such as Turkish lira, Argentine peso, or Nigerian naira) to purchase stablecoins, the liquidity of these local currencies disappears from the domestic banking system. The consequences of this capital outflow are multifaceted and very serious for local governments.

Fractional Reserve Banking: The Traditional Financial Operating System

The fractional reserve banking system allows financial institutions to hold only a portion of deposit funds as reserves, thereby facilitating economic expansion. This enables them to issue mortgages and car loans to consumers. (Image source: Mario Tama/Getty Images)

The fractional reserve banking system is the mainstream banking model globally. It allows banks to keep a certain proportion of customer deposits as reserves, lending out the rest to borrowers. As commercial banks lose their cheapest and most reliable source of funding (retail deposits), their ability to provide credit to local businesses and consumers is restricted, driving up borrowing costs and suppressing domestic economic growth.

Monetary Policy Management

Central banks set monetary policy, thereby influencing their respective economies. Seal of the U.S. Federal Reserve Board (Image source: MANDEL NGAN/AFP via Getty Images)

Central banks rely on traditional tools (such as raising interest rates) to manage money supply and curb inflation. However, when large amounts of local currency are exchanged for offshore dollar tokens, and these exchanges are not regulated by the central bank, the traditional monetary policy transmission mechanism is severely weakened. Regulators will not be able to grasp the true scale of dollar flows or assess the effectiveness of their policy measures.

Accelerated Capital Outflows: Stablecoins vs ATMs

In July 2015, the world witnessed crowds of Greek citizens withdrawing cash from ATMs across the country. To stop capital flight, the Greek government imposed capital controls. (Image source: Getty Images)

In July 2015, during the Greek debt crisis, photos and videos of Greek citizens lining up at ATMs across the country to withdraw their hard-earned savings spread around the world, as the world witnessed the outbreak of this crisis.

As with the Greek debt crisis, the 1997 Asian financial crisis, or even the Silvergate or Silicon Valley Bank collapses, capital flight is often a precursor to an impending liquidity crisis. Stablecoins provide a seamless, round-the-clock channel for capital to escape local currencies, which can accelerate exchange rate volatility and lead to bank failures. They have the potential to enable instant digital capital flight, a scenario that traditional regulatory mechanisms are simply unable to address.

The most vulnerable countries include those with weak fiscal positions and high dependence on remittances, such as Egypt, Pakistan, Bangladesh, Sri Lanka, and others.

Financing U.S. Debt Through Stablecoins

If $1 trillion potentially flows out of the developing world, where will this capital ultimately go?

The demand for stablecoins in emerging markets inevitably leads to demand for the safest collateral—U.S. Treasury bonds. This mechanism is the key to the stablecoin paradox, effectively consolidating the financial core of the United States.

Stablecoins, especially those designed to comply with regulations and achieve 1:1 pegging, must hold highly liquid and low-risk reserves. These reserves mainly consist of cash, cash equivalents, and short-term U.S. Treasury bonds.

Research by institutions such as the Federal Reserve Bank of Kansas City highlights this crucial financial link. As stablecoin development continues, their total market capitalization is expected to grow from the current $300+ billion to trillions of dollars within just three years, stimulating demand for U.S. short-term government bonds.

The Federal Reserve Bank of Kansas City noted in its analysis that while stablecoins may replace demand for other short-term instruments such as money market funds, they will create a significant incremental demand for U.S. debt.

A New Anchor of Stability

At a time when fiscal and monetary policy are under the spotlight, the growing demand for U.S. Treasury bonds will greatly benefit the United States. Research by the Federal Reserve confirms that stablecoins are not just a cryptocurrency phenomenon, but a vital new component of the U.S. government’s financing system.

The U.S. National Debt Clock tracks the U.S. national debt and its share per American household in real time, serving as a stark reminder of America’s growing fiscal burden. (Image source: Selcuk Acar/Anadolu via Getty Images)

The size of the U.S. national debt has reached $38 trillion and is still growing rapidly! The ever-increasing demand for U.S. Treasury bonds will absorb massive U.S. government debt issuance and may help lower borrowing costs.

Shadow banking is often a pejorative term, but as financial institutions develop stablecoins, shadow banking may proliferate further. (Image source: Ernst Haas/Ernst Haas/Getty Images)

Ironically, the popularity of stablecoins has fueled the spread of a taboo term in banking—shadow banking. By mandating that reserve assets must be of extremely high quality and liquidity, regulation has effectively turned the digital asset industry into a "captive investor" of U.S. debt.

Stablecoins Promote a Strong Dollar Policy

As people around the world choose dollar-denominated stablecoins, the strength and importance of the dollar will increase. (Image source: Matias Baglietto/NurPhoto via Getty Images)

Every issuance of a dollar-denominated stablecoin is essentially a vote of confidence in the dollar, reinforcing its status as the world’s reserve currency. The digital infrastructure built by stablecoins makes it easier for people in other parts of the world to transact and save in dollars, further consolidating the dollar’s global financial dominance during today’s period of global financial turmoil.

The Global Interconnection and Regulatory Challenges of Stablecoins

Global financial leaders must examine how to leverage stablecoin technology while avoiding potential negative impacts on the economies that rely most on stability. (Image source: Andrew Harnik/Getty Images)

The stablecoin market has created a direct and instant channel for capital transfer: the risk-averse mentality in developing countries has driven unlimited global demand for safe assets backed by U.S. Treasury bonds, especially in emerging markets.

When people exchange their local currency for U.S. dollars to hedge against inflation and economic instability, these exchanged funds ultimately strengthen the U.S. financial system. Dollar-denominated stablecoins can complete capital operations in seconds that would take the global financial system days to accomplish.

While opening the door for people affected by hyperinflation and economic instability, the rapid growth of stablecoins also presents challenges for global financial regulators and banks, as they must find ways to leverage the advantages of stablecoin technology (cheaper cross-border payments and financial inclusion) without undermining the stability of the most vulnerable economies they serve.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

SignalPlus Macro Analysis Special Edition: Is Work Resuming Soon?

Macro assets faced a tough week, with the Nasdaq Index experiencing its worst weekly decline since the "Liberation Day" in April, mainly due to concerns over an artificial intelligence bubble...

487 new BTC for Strategy, Saylor's appetite does not wane

XRP Price Prediction: Is $6 the Next Big Target?