Behind the surge in privacy coins: a flash in the pan or the dawn of a new era?

Deng Tong, Jinse Finance

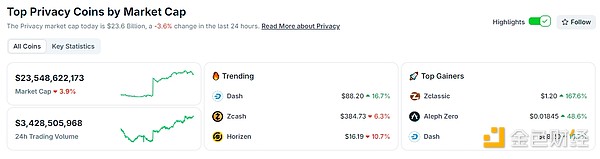

Recently, the privacy sector has shown outstanding performance: ZEC has risen 6.1% over seven days; DASH has surged 68% in seven days; ZK has increased by 53.9% over seven days. As of press time, the total market capitalization of privacy coins has surpassed $23.5 billion.

Why have privacy coins experienced a significant rally recently? Can this trend continue in the future?

I. Soaring Privacy Coins

1. ZEC (Zcash)

ZEC is the native token of the Zcash blockchain network. Zcash is one of the early cryptocurrencies focused on privacy, launched in October 2016.

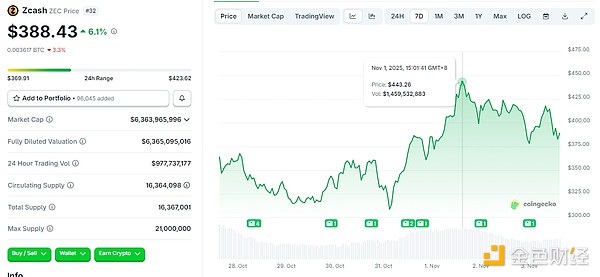

ZEC reached a recent price high of $443 on November 1. As of press time, it is trading at $388.43, with a seven-day increase of 6.1%.

The core of Zcash's privacy model is the shielded address, which uses zero-knowledge proofs (zk-SNARKs) to conceal the sender, receiver, and transaction amount. Transactions sent between shielded addresses enter a pool used to store private transaction tokens. As the pool grows, the anonymity set of the network expands, thereby enhancing privacy protection for all users.

This protected pool has now reached its largest size ever, approaching 4.9 million ZEC.

The supply of shielded Zcash is approaching 30%. Source: Zechub

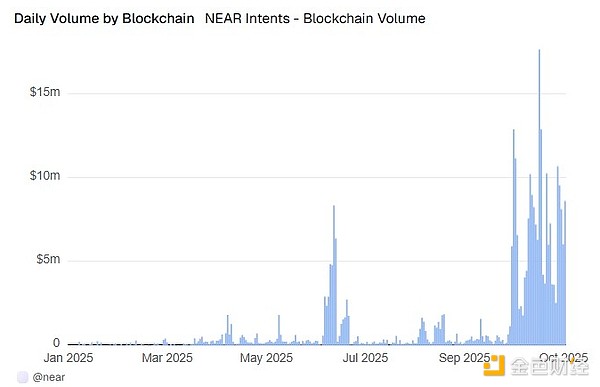

Zcash developer Electric Coin Company launched new features for its Zashi wallet in early October, allowing users to conduct cross-chain swaps and private payments through integration with Near's Intents system. This means users can easily transfer funds between Zcash's privacy layers without going through centralized exchanges or complex bridging interfaces.

This newfound convenience drove the expansion of the protected pool throughout October. At the beginning of October, Zcash saw a surge in transaction activity on Near Intents, with over $17 million in transactions on October 16 alone.

Carter Feldman, founder and CEO of Psy Protocol, pointed out: "People's attention is shifting to projects that are not just issuing tokens for the sake of it, but are building privacy technologies (such as zero-knowledge systems driven by real incentives). These systems can provide privacy protection by default, without requiring users to explicitly opt for anonymity."

2. DASH (Dash)

DASH is a veteran privacy-focused cryptocurrency that was launched in 2014.

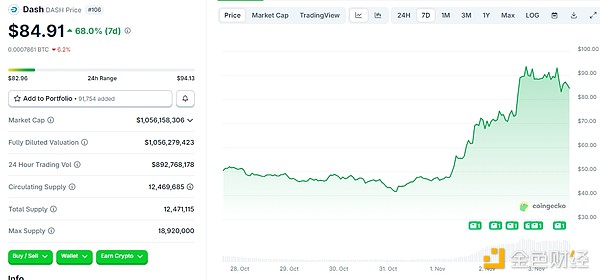

DASH nearly reached $94 on November 2. As of press time, DASH is trading at $84.91, with a seven-day increase of 68%.

Dash's resurgence is remarkable, marking a major turning point for the privacy coin sector. After a prolonged bear market, Dash ended a 968-day decline, which analysts attribute to effective network development initiatives such as "Project Three Billion," aimed at promoting Dash's mass adoption in underserved markets.

DASH's privacy capability comes from its unique PrivateSend mixing protocol, which anonymizes transactions through a process of "fund splitting - mixing - recombination," requiring only cooperation between masternodes and the official wallet, without relying on third-party services. DASH's core positioning is as "decentralized digital cash," aiming to solve the dual pain points of privacy protection and practical payment scenarios in traditional cryptocurrencies. Unlike bitcoin's transparent transactions, DASH offers optional privacy features to meet users' asset confidentiality needs; compared to privacy coins focused solely on technical experimentation, it emphasizes "usability," optimizing transaction speed and lowering the usage threshold to drive large-scale adoption in offline consumption and cross-border remittance scenarios. This positioning—"privacy protection as the foundation, payment application as the core"—has led to a market revaluation under the dual backdrop of stricter global regulation and upgraded payment demand in 2025.

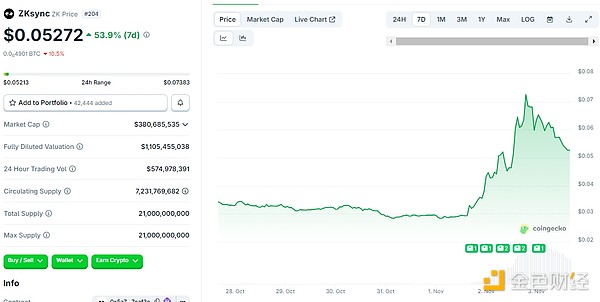

3. ZK (ZKsync)

Unlike traditional privacy coins, ZK is not a token focused solely on privacy features, but rather the core asset rising from the "privacy + scalability + ecosystem" attributes of the zkSync network.

ZK reached a recent high of $0.07 on November 2. As of press time, ZK is trading at $0.05275, with a seven-day increase of 53.9%.

ZK's core positioning is as the "value carrier and governance credential" of the zkSync network, empowering the Ethereum Layer2 ecosystem to achieve both privacy protection and large-scale application.

ZK's rally began last Friday, when ZKsync founder Alex Gluchowski announced the launch of the Atlas upgrade, highlighting institutional-grade scalability, interoperability, and transaction speed as its key features. Gluchowski stated that this update allows Layer-2 protocols to rely on Ethereum for liquidity and new institutional capital inflows during deployment, as well as cross-chain transactions and asset tokenization.

Vitalik gave a shout-out to zkSync, noting: "ZKsync has done a lot of undervalued but very valuable work in the Ethereum ecosystem. I'm glad to see them launch this product!" "Immutability is the most important feature of Ethereum."

II. What Is Driving the Surge in Privacy Coins?

1. Regulatory Drivers

Cryptocurrencies are under continuous scrutiny, including Know Your Customer (KYC) checks, exchange monitoring, and advanced blockchain analytics. For example, blockchain forensics experts use machine learning to track wallets and build behavioral profiles. Their systems can link identities, map relationships between wallets, and predict when assets will be transferred to exchanges.

Governments around the world are also tightening controls. On August 18, the U.S. Treasury solicited public comments on artificial intelligence, blockchain monitoring, digital identity credentials, and "privacy-enhancing tools" used to detect illegal activities involving digital assets. The agency stated that this feedback would inform new guidelines and potential rules under the GENIUS Act.

In the European Union, cryptocurrency exchanges must treat transfers to or from self-custody wallets as high-risk transactions and implement stricter due diligence measures, including verifying wallet control. These regulations have been in effect since December 30, 2024.

As governments weigh the use of intrusive tools to monitor online behavior and companies collect more data, privacy technology is being redefined as a market opportunity.

2. Halving Expectations

David Duong, Head of Institutional Research at Coinbase, wrote that Zcash will undergo a halving in November 2025. With the halving, Zcash's issuance is expected to drop significantly, reducing the implied inflation rate from double digits in the early 2020s to single digits in the late 2020s. ZEC's block reward halves every four years; the current block reward is 3.125 coins, and after the next halving, it will drop to 1.5625 coins, reducing daily supply by about 1,500 coins. This rally can be seen as the market's early response to the "halving event."

3. Entry of Major Players

In October, a16z's latest crypto report pointed out that privacy protection is returning to the spotlight and may become a prerequisite for mass adoption. Signs of increased attention include: a surge in Google searches related to crypto privacy in 2025; Zcash's shielded pool supply growing to nearly 4 million ZEC; Railgun's monthly transaction volume exceeding $200 million. Meanwhile, the Ethereum Foundation has established a new privacy team; Paxos has partnered with Aleo to launch a private and compliant stablecoin (USAD); and the Office of Foreign Assets Control has lifted sanctions on the decentralized privacy protocol Tornado Cash. We expect this trend to gain even more momentum in the coming years as crypto technology continues to go mainstream.

III. Can the Current Privacy Coin Rally Continue?

In October, Hayes made a bullish prediction for ZEC, with Zcash's price soaring from $272 to a peak of $355 within a few hours, outperforming all other top 50 tokens by market cap during the same period. Crypto trader AB Kuai Dong noted: An endorsement from a "legendary Silicon Valley investor" prompted "everyone to follow the trend and join in, which then triggered a month-long FOMO market frenzy."

In the short term, this privacy coin rally is related to market sentiment, halving expectations, and policy drivers. However, in the long run, real-world application scenarios and policy direction are the fundamental factors determining the outlook for privacy coins.

Currently, privacy coins account for only 11.4% of global crypto trading, and their market share growth is not fast enough to have a significant impact on the overall crypto market. However, the underlying technologies—ring signatures, stealth addresses, and zero-knowledge proofs—have the potential to fundamentally change mainstream perceptions of financial privacy.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CryptoQuant: Stablecoin reserves reach all-time highs, Bitcoin may be poised for a new surge.

Matrixport: UNI May Be About to Receive a New Catalyst

Market Forecast and Technical Analysis for Gold, Bitcoin, and US Stocks Over the Next Two Years

The real large-scale liquidity release may not happen until May next year, after Trump takes control of the Federal Reserve, similar to what happened in March 2020.

From trading, prediction, and gaming to AI Agents: the next wave of builders is gathering on Monad

A brief selection of projects curated by Monad Momentum.