Bitcoin News Update: Short Sellers Hit Hard as $341M in Crypto Liquidations Sparks Volatility Spike

- Bitcoin's $106,000 surge triggered $341.85M in crypto liquidations, with short sellers losing $106.75M as leverage-driven volatility spiked. - Senate's shutdown resolution boosted Bitcoin 3.93% in 24 hours, alleviating regulatory uncertainty and injecting market optimism. - Hyperliquid's $18.96M single liquidation highlighted risks of 1,001:1 leverage, as platforms amplified price swings through stop-loss mechanisms. - November's $20B in crypto derivatives liquidations revealed systemic fragility, with E

Within a single day, the cryptocurrency market saw liquidations reach $341.85 million as

This price rally contradicted the prevailing bearish outlook. Many traders had expected Bitcoin’s decline to continue after ETF outflows and a 40-day U.S. government shutdown raised liquidity fears, according to Yahoo Finance. Yet, the Senate’s passage of a funding bill to end the shutdown sparked renewed optimism, lifting Bitcoin by 3.93% in just 24 hours, as reported by

Throughout November 2025, volatility driven by leverage continued, with $20 billion in crypto derivatives liquidated as Bitcoin dipped under $100,000, according to

Investor sentiment showed a shift in risk tolerance. While U.S. crypto funds saw $1.17 billion withdrawn, European markets remained steady, with Germany and Switzerland recording inflows, as noted by Crypto.news. Some altcoins, such as

Regulatory shifts further contributed to market uncertainty. The CFTC’s proposal for leveraged spot crypto products and a Senate draft bill to clarify the roles of the SEC and CFTC aimed to bring more structure to the derivatives space, according to the Bitget report. Still, analysts cautioned that key issues—like unchecked leverage and fragmented regulation—have yet to be addressed, the Bitget report stated.

The total value of the crypto market bounced back to $3.56 trillion, marking a 3.91% rise as investor confidence improved, according to Yahoo Finance. However, the Crypto Fear & Greed Index stayed at 26, indicating ongoing caution, as per the Crypto.news update. Experts warned that while Bitcoin’s $106,000 milestone brought short-term hope, lasting growth would rely on the Federal Reserve’s policy decisions and global political stability, as highlighted in the Crypto.news update.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

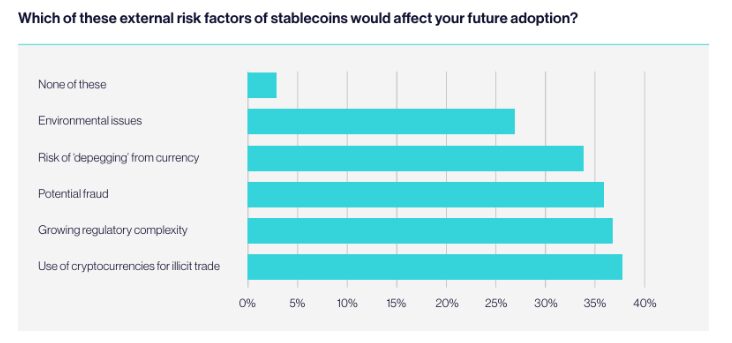

European Tech Startups Eye Stablecoins, But Risks Stall Adoption

Stellar News Today: Turbo Energy's tokenization opens up clean energy investment to everyone

- Turbo Energy partners with Taurus and Stellar to tokenize hybrid renewable energy projects, targeting the $74.43B EaaS market. - The pilot uses blockchain to fractionalize solar storage PPA debt, leveraging Stellar's low-cost infrastructure for transparent green finance. - Tokenization aims to democratize clean energy investment, with Turbo's CEO highlighting scalability and security in AI-optimized storage solutions. - The initiative aligns with sustainable development goals, driving a 12.5% premarket s

Cardano News Update: MoonBull's AI Wager—Will It Surpass Cardano and Ethereum by 2025?

- MoonBull's $590,000 presale gains traction as a 2025 crypto contender, leveraging AI features and community governance. - Cardano partners with Wirex to launch ADA-branded crypto payment cards, aiming to bridge blockchain and traditional finance. - NFT and memecoin markets show 12-11% weekly gains, while Ethereum and TRON compete with MoonBull for 2025 growth narrative. - Regulatory risks and macroeconomic pressures persist, challenging projects like JFrog and Bumble amid crypto market volatility.

Bitcoin Updates: China Challenges Validity of US $13 Billion Crypto Seizure

- China accuses U.S. of central role in 2020 LuBian $13B Bitcoin heist, alleging state-linked hacking involvement. - CVERC disputes U.S. seizure legitimacy, citing 4-year dormancy and 2024 government wallet transfers as atypical criminal behavior. - DOJ claims $13B seizure is "largest forfeiture in history," while China frames it as geopolitical strategy to undermine crypto influence. - Dispute highlights escalating U.S.-China tensions over digital asset governance and cross-border enforcement norms.