Is the x402 Crypto Ecosystem Losing Steam? What the Data Shows

The AI-powered x402 network faces a sharp activity slowdown, yet new Chainlink and Bio Protocol integrations have kept adoption rising and pushed its market cap above $12 billion.

The x402 ecosystem has experienced a significant decline in activity, with its 30-day trading volume plummeting by nearly 90% and transaction counts falling in tandem.

The drop raises broader concerns about whether the crypto meta may finally be losing momentum.

Sharp Decline in Trading Activity Signals Waning Interest in x402

x402 is an internet payment protocol built to enable autonomous AI agents to execute verifiable, automated on-chain payments through standard web infrastructure.

BeInCrypto previously reported that the ecosystem gained significant traction in October, drawing widespread attention from the crypto community. In fact, many low-cap coins within the x402 ecosystem saw their values quadruple amid the surge in interest.

However, the latest data from x402scan highlights a modest downturn in ecosystem activity. On November 3, the protocol processed about 3 million transactions alongside $2.8 million in daily trading volume.

The latest snapshot shows the transaction counts slipped to 1.3 million, marking a 56% decrease. Meanwhile, the trading volume has also dropped to around ₹329,000. Coinbase accounted for most of the ecosystem activity, handling more than 873,500 requests and $306,730 in volume in the last day.

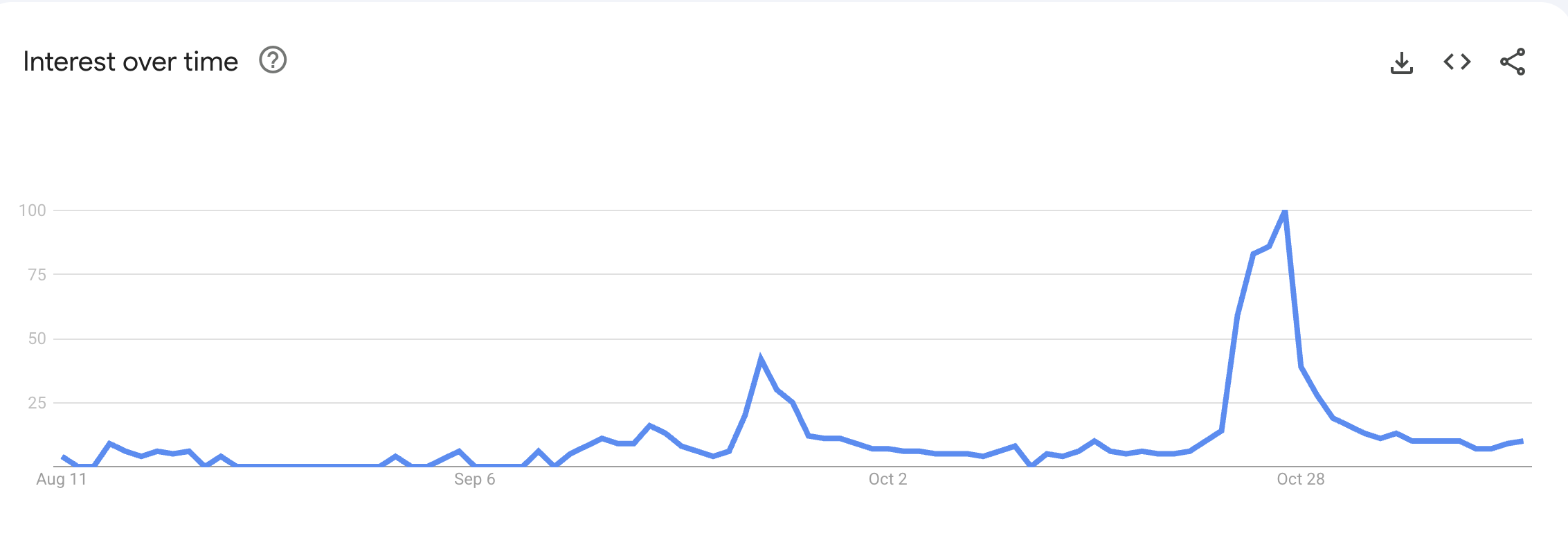

The contraction has also been echoed in retail sentiment. Google Trends shows that global search interest in “x402” dropped from a peak score of 100 to 10, signaling a decline in public attention.

x402 Retail Interest. Source:

Google Trends

x402 Retail Interest. Source:

Google Trends

Ecosystem Growth Remains Strong

Despite this, the x402 protocol has continued to build institutional credibility. Last week, Chainlink (LINK) integrated an X402 endpoint into its Chainlink Runtime Environment (CRE).

Through this update, autonomous agents can now discover CRE workflows, verify outcomes using Chainlink, and settle directly on-chain. Furthermore, it allows workflow creators to earn per use.

“This integration also unlocks programmatic payouts and a reusable workflow marketplace. For example, an insurer covering farmers against drought can verify rainfall through CRE and route instant onchain payouts all without a claim filed,” Coinbase posted.

In parallel, Bio Protocol (BIO), one of the notable projects in Decentralized Science (DeSci), revealed that its agents now use X402 and embedded wallets to enable instant USDC micropayments on Base, a clear sign of growing real-world adoption across emerging decentralized sectors.

“What this unlocks: Hypothesis review marketplaces, AI agents pay each other and human researchers for specialized analysis, Pay-per-query instead of subscriptions, On-demand access to premium datasets,” the team noted.

With these integrations, the total market capitalization of the X402 ecosystem has increased to over $12 billion from just $800 million in late October — a gain of more than 1,300% in approximately two weeks.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DeFi's Automation Shortfall Addressed: Orbs Introduces dSLTP to Achieve CeFi-Grade Risk Control

- Orbs launches dSLTP, a decentralized stop-loss/take-profit protocol for DEXs, bridging CeFi automation with DeFi. - The protocol automates risk management via on-chain orders, reducing real-time monitoring needs during volatility. - Built on Orbs' Layer-3 infrastructure, it enhances DEX functionality with CeFi-grade tools while maintaining decentralization. - This innovation addresses DeFi's automation gap, potentially driving DEX adoption and institutional-grade on-chain trading.

XRP Latest Updates: XRP ETFs Enhance Market Liquidity, Large Holder Sell-Offs Postpone Price Increases to 2026

- XRP ETFs launched in late 2025 (e.g., Grayscale's GXRP) expanded institutional access, but whale sales delayed price gains until 2026. - XRP traded near $2.12 as 41.5% of its supply remains in loss, with whale-driven volatility and structural supply imbalances persisting. - Ripple secured $500M institutional backing for XRP Ledger infrastructure, while projects like XRP Tundra accelerated tokenization plans. - XRP trails Ethereum in market cap ($129B vs. $373B) due to lack of smart-contract capabilities,

Dogecoin News Today: Grayscale's Alternative Coin ETFs Indicate Change: Bitcoin Withdrawals Differ from Rising Interest in Altcoins

- Grayscale launches GDOG and GXRP ETFs on NYSE, offering direct exposure to Dogecoin and XRP via spot ETPs. - ETFs convert private trusts to public offerings, aligning with industry trends to boost liquidity and attract institutional capital. - GXRP competes with existing XRP products ($422M inflows), while GDOG follows DOGE's rise to 9th-largest crypto by market cap. - SEC's "Project Crypto" framework and FalconX partnership strengthen Grayscale's position in regulated altcoin investment vehicles. - Altc

Bitcoin Update: Federal Reserve Postponements and $1.2 Billion ETF Withdrawals Trigger 26% Drop in Bitcoin Value

- Bitcoin falls 26% to $83,000 amid Fed's delayed rate-cut timeline and $1.2B ETF outflows, marking its longest losing streak since 2024. - Analysts warn of structural risks, with Bloomberg's Mike McGlone projecting a potential $10,000 drop and Cathie Wood revising bullish 2030 forecasts. - Market volatility intensifies as JPMorgan's index exclusion proposal sparks crypto sector backlash and S&P 500 defensive sector shifts highlight interconnected risks. - Fed's December rate-cut speculation and upcoming i