Pi Coin Tries to Bounce Back After 15% Drop, But Money Flows Still Lag

Pi Coin is showing early signs of recovery after its October drop, with RSI improving but CMF still signaling weak inflows. A breakout above $0.246 could confirm renewed investor strength and further upside potential.

Pi Coin is attempting to recover after weeks of sluggish momentum, with the altcoin currently holding above the $0.217 support level. The recent rebound attempt follows a mild uptick in price action, but concerns remain as investor inflows appear limited.

Sustained bullish momentum will be crucial for Pi Coin to fully recover from its recent 15% decline.

Pi Coin Investors Attempt Recovery

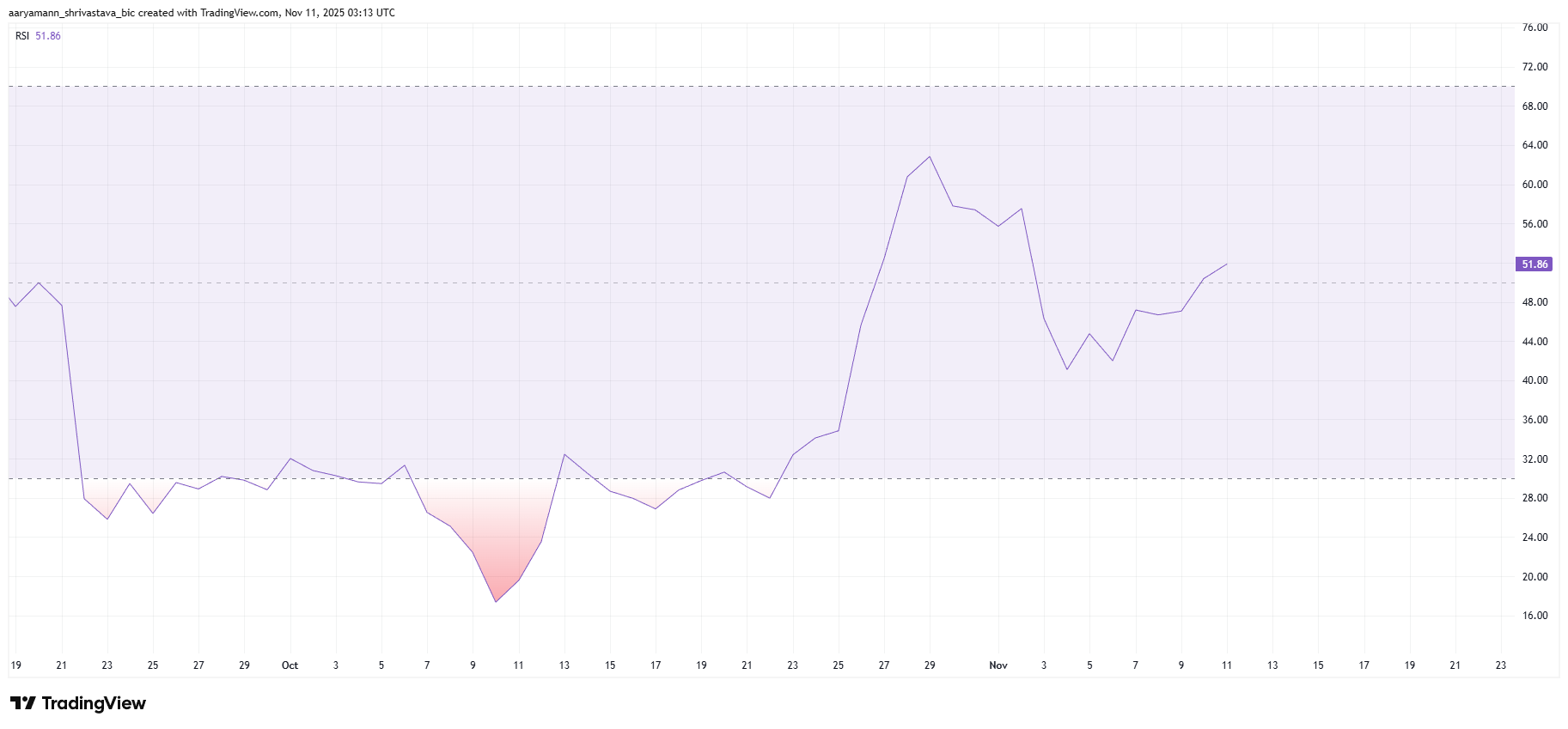

The Relative Strength Index (RSI) indicates that the market has turned slightly bullish after a prolonged period of weakness. The indicator, which had dipped below the neutral mark, has now climbed back into the positive zone. This rebound shows improving momentum and signals that selling pressure is easing while buyers regain confidence.

This shift in sentiment could mark the start of a more sustained recovery phase for Pi Coin. However, for this bullish momentum to solidify, trading volume and investor participation must increase significantly.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

Pi Coin RSI. Source:

TradingView

Pi Coin RSI. Source:

TradingView

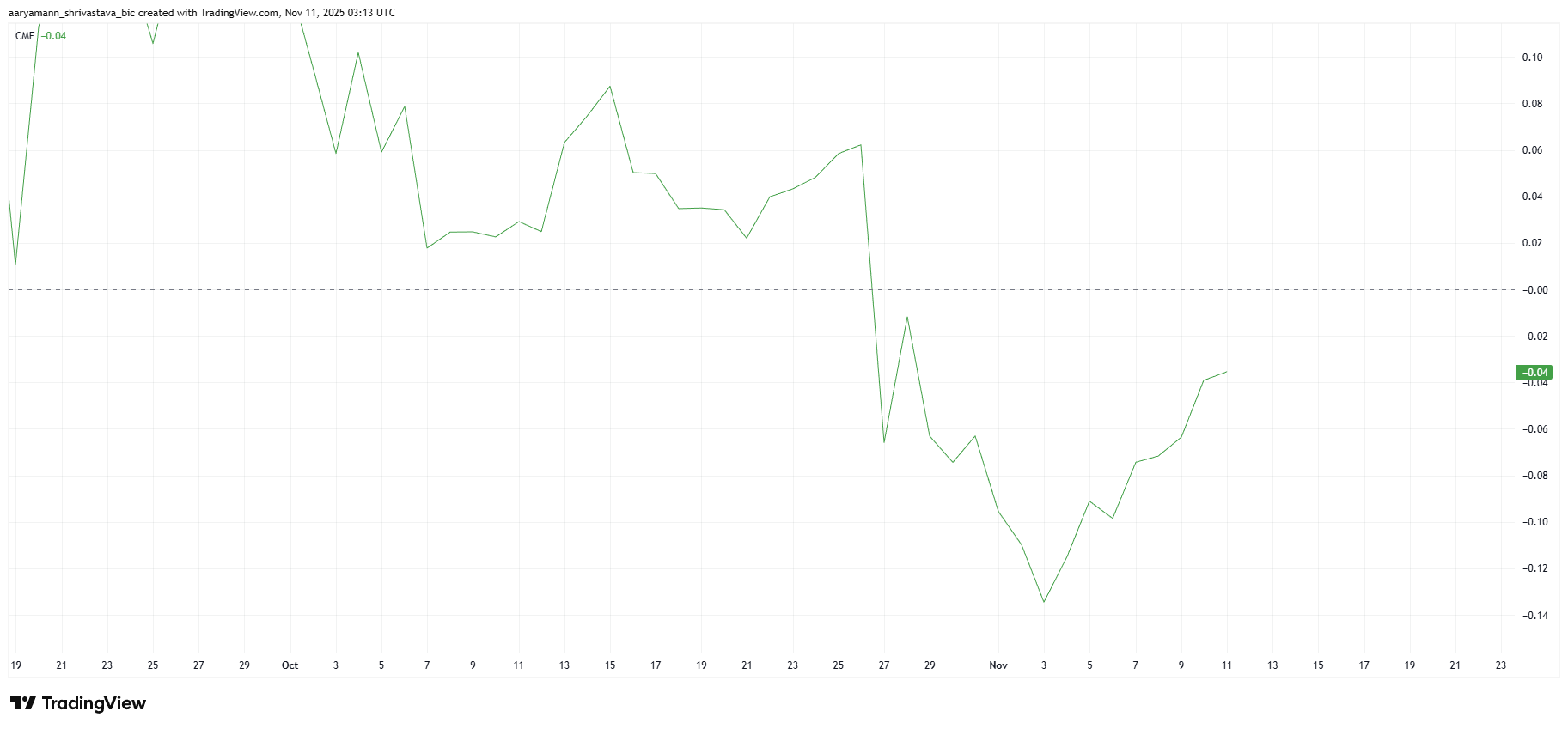

The Chaikin Money Flow (CMF) remains a key indicator for understanding investor behavior surrounding Pi Coin. At present, the CMF continues to sit below the zero line, indicating that outflows still outweigh inflows. While outflows have declined recently, the indicator has yet to cross into positive territory — a necessary condition for confirming lasting market strength.

If Pi Coin manages to push the CMF above zero, it would suggest that inflows are finally dominating, signaling growing investor confidence. This shift could help sustain the ongoing price recovery, potentially allowing Pi Coin to climb higher and stabilize above critical resistance levels.

Pi Coin CMF. Source:

TradingView

Pi Coin CMF. Source:

TradingView

PI Price Can Bounce Off

Pi Coin’s price stands at $0.235 at the time of writing, after successfully breaching the $0.229 resistance level within the last 24 hours. The altcoin now appears to be regaining some lost ground from its late October decline.

For Pi Coin to fully recover from its 15% drop, the price must break through the $0.246 resistance and rally toward $0.260. Achieving this would reinforce the bullish outlook and restore market confidence among cautious investors.

Pi Coin Price Analysis. Source:

TradingView

Pi Coin Price Analysis. Source:

TradingView

However, if the bullish momentum weakens, Pi Coin could slip below $0.229 again and test the $0.217 support level. A breakdown beneath this support would invalidate the bullish thesis and expose the cryptocurrency to further downside risks.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stablecoin Surge Compels Basel to Address Regulatory Inflexibility

- Global regulators, led by the Basel Committee, face pressure to revise strict 1,250% capital requirements for stablecoins as their role in institutional finance expands. - The U.S. Fed, Bank of England, and EU reject current rules, citing impracticality, while stablecoins like USDT/USDC now underpin regulated crypto derivatives and yield products. - Basel chair Erik Thedéen acknowledges the need for a "different approach" to risk-weighting stablecoins, which now enable institutional access to crypto mark

Markets Trapped Between Fear and Optimism for the Future

- U.S. markets face volatility as delayed September NFP data creates uncertainty over Fed rate-cut timing, with crypto and equities reacting sharply. - Bitcoin erased 2025 gains amid waning sentiment and liquidity strains, while AI stocks like Nvidia falter on profitability concerns. - Gold struggles near $4,080 as hawkish Fed signals boost the dollar, contrasting with Kraken's $20B IPO optimism in crypto diversification. - Upcoming NFP report and Fed minutes could determine market direction, balancing sho

Zcash (ZEC) Price Rally: Renewed Interest in Privacy Coins Fueled by Institutional Engagement and Clearer Regulations

- Zcash (ZEC) surged 10.72% to $683.14 on Nov 15, 2025, driven by institutional adoption and regulatory clarity. - Major investors like Cypherpunk ($146M) and Winklevoss ($58.88M) boosted ZEC's market cap to $7.2B, surpassing Monero. - U.S. Clarity/Genius Acts legitimized Zcash's optional-privacy model, distinguishing it from untraceable coins amid regulatory scrutiny. - Price volatility and technical indicators suggest potential for $875 if institutional demand and regulatory support persist. - Zcash's st

Ethereum Updates Today: Can Bulls Defend the $2,850 Level or Will Bears Take Over?

- Ethereum's $3,000 price tests $2,800–$2,950 support zone amid bullish wedge patterns and bearish breakdown risks. - Analysts split: Erik warns $2,850 break could trigger $800–$1,000 drop, while Matt Hughes calls $2,870 pullback a normal correction. - Technical indicators show mixed signals - ETH above 100-day EMA but below 50-day EMA, with Bollinger Bands framing $2,850–$3,150 key levels. - On-chain data suggests potential "liquidity reset" could precede bullish expansion, but delayed recovery risks prol