The US SEC and CFTC may accelerate the development of crypto regulations and products.

US Senate reached a bipartisan agreement, ending the 41-day government shutdown this week, and the SEC and CFTC will resume normal operations. The SEC may prioritize issuing "exemptive relief" to support tokenization and crypto businesses, and continue to investigate digital asset treasury companies; during the shutdown, SOL, Litecoin, HBAR and other crypto ETFs that were launched under uniform listing standards may automatically take effect, supplement inquiries, or be postponed after the SEC resumes. CFTC Acting Chairman Caroline Pham stated that she will push for "spot crypto trading and tokenized collateral" by the end of the year, and is in talks with regulated exchanges to launch leveraged spot trading as soon as next month. The Senate Banking and Agriculture Committees are advancing legislation to allocate SEC/CFTC authority and define "auxiliary assets," which will ultimately need to be coordinated into a version for submission to the President for signing.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ADP data sounds the alarm again: US companies cut 11,000 jobs per week

The government shutdown has delayed official employment data, so ADP data has stepped in to reveal the truth: in the second half of October, the labor market slowed down, and the private sector lost a total of 45,000 jobs for the entire month, marking the largest decline in two and a half years.

The Most Understandable Fusaka Guide on the Internet: A Comprehensive Analysis of Ethereum Upgrade Implementation and Its Impact on the Ecosystem

The upcoming Fusaka upgrade on December 3 will have a broader scope and deeper impact.

Established projects defy the market trend with an average monthly increase of 62%—what are the emerging narratives behind this "new growth"?

Although these projects are still generally down about 90% from their historical peaks, their recent surge has been driven by multiple factors.

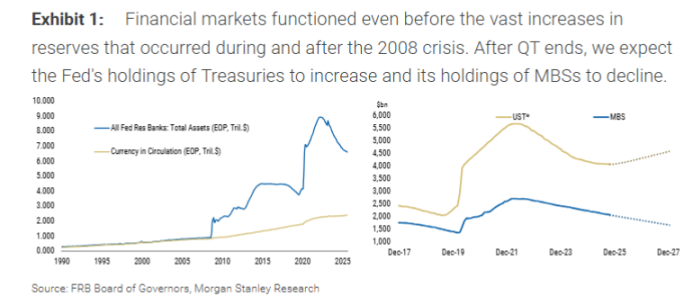

Morgan Stanley: Fed Ending QT ≠ Restarting QE, Treasury's Debt Issuance Strategy Is the Key

Morgan Stanley believes that the Federal Reserve ending quantitative tightening does not mean a restart of quantitative easing.