BNY forecasts stablecoins and tokenized cash to reach $3.6T by 2030

Key Takeaways

- BNY predicts the stablecoin and tokenized cash market will grow to $3.6 trillion by 2030.

- The trend highlights accelerating institutional adoption of digital asset and blockchain payment solutions.

BNY forecasts the combined market for stablecoins and tokenized cash will reach $3.6 trillion by 2030, highlighting accelerating institutional adoption of blockchain-based payment solutions.

The global bank’s report emphasizes that blockchains will integrate with traditional financial rails rather than replacing them, supporting broader institutional adoption of digital assets.

BNY collaborated with Goldman Sachs to launch a solution for tokenized money market funds, enhancing accessibility for institutional clients in digital asset markets.

Institutions are increasingly embracing stablecoins and tokenized deposits alongside digital money market funds as part of evolving digital cash ecosystems.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates Today: Digital Assets at a Turning Point: Engine for Capitalism or Embracing Socialism?

- Coinbase CEO Brian Armstrong promotes crypto as a capitalist tool, contrasting Poland’s post-Soviet reforms with Venezuela’s socialist collapse. - Brazil mandates crypto firm compliance with AML/cybersecurity standards while debating a $19B Bitcoin reserve to hedge dollar volatility. - New York’s socialist mayor Zohran Mamdani sparks crypto industry fears over wealth redistribution policies and potential business flight. - Proponents highlight crypto’s potential to empower unbanked populations, while reg

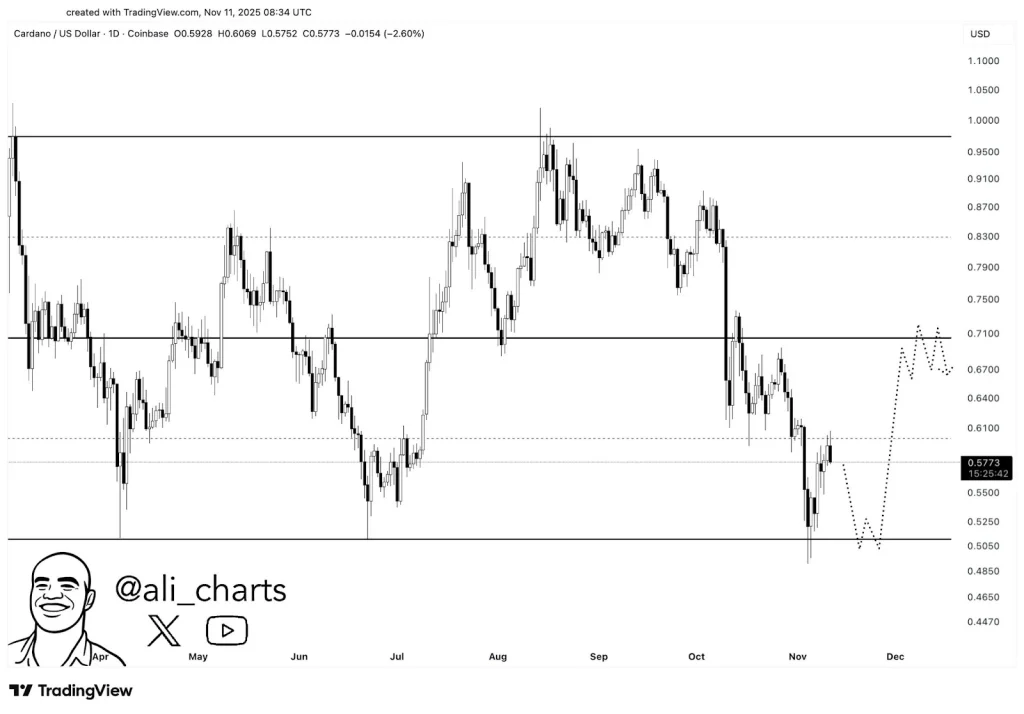

Two Reasons Why Cardano Price Will Hit $0.45 First Before $0.7 Soon

XRP ETF Goes Live Tomorrow, But Bitwise Doubts If It Can Outshine Solana

Bitcoin News Today: Institutions Warm Up to Bitcoin: ETFs Connect the Gap Between Conventional Finance and Crypto

- BlackRock's Bitcoin ETF expands to Australia by mid-2025, boosting institutional adoption through regulated access. - JPMorgan increases IBIT holdings by 64% to $343M, signaling Bitcoin's growing legitimacy as a macro hedge. - U.S. Bitcoin ETFs see $524M net inflows as Ethereum ETFs face outflows, highlighting shifting institutional preferences. - Bitcoin trades near $104K amid corporate treasury losses and volatility, yet institutions innovate with lending programs. - Regulated ETFs bridge traditional-f