Morning News | Perpetual contract trading protocol Lighter completes $68 million financing; ALLO announces tokenomics; UNI surges nearly 40% in 24 hours

A summary of major market events on November 11.

Compiled by: ChainCatcher

Key News:

- SoftBank will invest an additional $22.5 billion in OpenAI through Vision Fund 2 in December

- Perpetual contract trading protocol Lighter completes $68 million financing, led by Founders Fund and Ribbit Capital

- Banmuxia: Bitcoin may form a platform-type adjustment structure, with two trading opportunities ahead

- ALLO tokenomics: maximum supply of 1 billion, initial circulating supply accounts for 20.005%

- DBS collaborates with JPMorgan to develop a tokenized deposit interoperability framework

- The US Senate begins voting on the "2026 Continuing Appropriations and Extension Act"

- Uniswap Labs and Foundation propose activating the fee switch and UNI burn mechanism, UNI up nearly 38% in 24 hours

What important events happened in the past 24 hours?

SoftBank will invest an additional $22.5 billion in OpenAI through Vision Fund 2 in December

According to ChainCatcher, SoftBank Group stated that it recorded an investment gain of 2.157 trillion yen from investing in OpenAI. It will invest an additional $22.5 billion in OpenAI through Vision Fund 2 in December. (Golden Ten Data)

Perpetual contract trading protocol Lighter completes $68 million financing, led by Founders Fund and Ribbit Capital

ChainCatcher reports, according to Fortune, that perpetual contract trading protocol Lighter has announced the completion of a new $68 million financing round.

Lighter founder and CEO, 40-year-old Vladimir Novakovski, stated that this round was led by Peter Thiel’s Founders Fund and fintech investor Ribbit Capital, with participation from Haun Ventures and online broker Robinhood (the latter rarely participates in venture capital).

According to sources, this round pushed Lighter’s valuation to about $1.5 billion. Novakovski declined to disclose valuation details but said the round included both equity and token subscription rights.

Banmuxia: Bitcoin may form a platform-type adjustment structure, with two trading opportunities ahead

ChainCatcher reports that Chinese crypto analyst Banmuxia wrote, “Bitcoin’s trend since August may be in a platform-type structure, and the current C wave may be an ending wedge, with this platform possibly forming the entire adjustment’s W wave. Around $108,500 to $110,000, there may be a high risk-reward shorting opportunity. If the subsequent trend makes a new low near $95,000, it is expected to form a triple bullish divergence at the bottom. Combined with the complete end of the platform structure, it may start a Y wave rebound, targeting a recovery to above 0.7 of the W wave’s height, at which point there may be a quality long opportunity. All of the above are predictions and need to be gradually verified in trading.”

ALLO tokenomics: maximum supply of 1 billion, initial circulating supply accounts for 20.005%

ChainCatcher reports, according to a Binance announcement, the ALLO tokenomics are as follows: maximum supply of 1 billion, initial supply of 200,050,000, HODLer airdrop token total is 15,000,000 ALLO (1.50% of the maximum total supply). An additional 20,000,000 ALLO will be used for market activities six months after listing, with detailed rules to be announced separately.

Earlier, ChainCatcher reported,Binance HODLer airdrop has now launched its 58th project – Allora (ALLO).

DBS collaborates with JPMorgan to develop a tokenized deposit interoperability framework

ChainCatcher reports, according to The Block, Singapore’s DBS Bank and JPMorgan’s Kinexys are developing an interoperability framework aimed at enabling tokenized deposit transfers between the two institutions’ blockchain ecosystems. The framework will allow clients to conduct real-time transactions around the clock between public and permissioned blockchain networks, breaking down barriers traditionally caused by limited interoperability and security risks.

Reportedly, customers using JPM deposit tokens built on Ethereum Layer 2 Base will be able to interact with DBS token services running on permissioned blockchains. This collaboration is part of the global trend of financial institution tokenization, with BNY Mellon and major UK banks including Barclays, Lloyds, and HSBC recently announcing similar projects.

According to the BIS 2024 report, nearly one-third of surveyed jurisdictions’ commercial banks have launched, piloted, or researched tokenized deposits.

The US Senate begins voting on the "2026 Continuing Appropriations and Extension Act"

ChainCatcher reports, according to Golden Ten Data, the US Senate has begun voting on the "2026 Continuing Appropriations and Extension Act," which aims to fund the government until January 30 and end the government shutdown.

Japanese company Startale launches super app for Sony Soneium blockchain ecosystem

ChainCatcher reports, Startale Group and Sony Blockchain Solutions Lab jointly announced the launch of the Startale App, an integrated super app designed as the entry point to Sony’s Ethereum Layer 2 network Soneium and its ecosystem. The app will serve as the gateway for future token generation events, airdrops, and Soneium ecosystem rewards.

According to the official announcement, multiple projects on the network plan to distribute airdrops, rewards, and exclusive experiences through this app. The announcement states that the Startale app uses account abstraction technology, eliminating the need for mnemonic phrases, enabling gas-free transactions, and simplifying wallet management to promote Soneium ecosystem activity. The app supports mini-program functionality, allowing developers to build applications directly on the network without independent websites. The app is currently in closed testing, with an official launch date yet to be announced.

YZi Labs announces investment in regenerative medicine company Renewal Bio

ChainCatcher reports, according to official sources, YZi Labs has announced an investment in regenerative medicine company Renewal Bio, marking YZi Labs’ first biotech investment since expanding its investment scope in early 2025.

Renewal Bio focuses on using its proprietary Stembroid™ platform to generate DNA-matched human cells and tissues from patients’ own cells, aiming to address the global organ shortage crisis. Over 150,000 organ transplants are performed globally each year, but less than 10% of demand is met. Renewal Bio reprograms ordinary skin or blood cells into stem cells by simulating early human developmental environments, generating various functional cells, including hematopoietic, liver, heart, and pancreatic cells.

The company was founded in 2022 by Professor Jacob Hanna of the Weizmann Institute of Science and his two PhD students, Vladislav Krupalnik and Ohad Gafni. This round of financing will accelerate the preclinical development of Stembroid-derived hematopoietic stem cells for the treatment of leukemia and immune diseases, and support the expansion of laboratory infrastructure.

Uniswap Labs and Foundation propose activating the fee switch and UNI burn mechanism, UNI up nearly 38% in 24 hours

ChainCatcher reports, according to The Block, Uniswap is planning to launch the protocol fee switch based on the “UNIfication” governance proposal submitted by Uniswap Labs and the Uniswap Foundation on Monday.

The plan aims to reduce the supply of Uniswap’s native UNI token by activating the burn mechanism and other measures. The “UNIfication” plan takes a multi-pronged approach to reducing token supply. On one hand, protocol fees earned by the Uniswap decentralized exchange and Unichain sequencer will be used to burn tokens; on the other hand, 100 million UNI tokens currently held in the Uniswap treasury, which were supposed to be burned after the fee switch was activated at token issuance, will be directly burned. At the same time, the proposal will prevent Uniswap Labs from earning fees through the interface, wallet, and API, with its Ethereum frontend having accumulated $137 million so far. The proportion of fees used for token burning is still unclear, but Uniswap’s various versions are expected to generate annualized revenue of over $2 billion. In addition to implementing plans to reward token holders, the “UNIfication” plan will merge the nonprofit Uniswap Foundation into Labs, which is responsible for developing the protocol and Unichain L2.

Coingecko data shows that the UNI token is now priced at $9.01, with a 24-hour increase of 37.9%

Nvidia (NVDA.O) pre-market decline widens to 1%, reports say SoftBank Group liquidated Nvidia holdings and cashed out $5.8 billion

ChainCatcher reports, according to Golden Ten Data, Nvidia (NVDA.O) pre-market decline widened to 1%, with reports saying SoftBank Group liquidated its Nvidia holdings and cashed out $5.8 billion.

DAT capital inflows plummet 95%, company purchasing power significantly declines

ChainCatcher reports, according to beincrypto, that after bitcoin retreated from its highs, corporate purchasing volume plummeted. DeFiLlama data shows that weekly digital asset treasury (DAT) capital inflows peaked at about $5.57 billion in July 2025, but fell to $259 million in November, a drop of over 95%, indicating a general decline in institutional purchasing power and confidence.

Latest data shows that the sell-off of DAT-related stocks far exceeds the decline of their underlying assets. According to Artemis, bitcoin has fallen about 10% in the past three months, while DAT-related stocks have fallen as much as 40% to 90% over the same period.

Previously, Sequans Communications sold about $100 million worth of 970 bitcoins (about 30% of its holdings) to repay convertible bonds, becoming the first treasury company to choose to sell crypto assets. In the current market environment where bitcoin prices are under pressure, this has raised questions about the sustainability of the DAT strategy.

Analyst Nic Carter believes that as the US dollar strengthens and bitcoin weakens, digital asset management companies may sell bitcoin in exchange for dollars.

CZ clarifies: Community rumor that autobiography is "Beyond Borders" is fake news, beware of AI scams

ChainCatcher reports, Binance founder CZ posted on social media regarding the community rumor that "Beyond Borders" is his autobiography, stating, "This is not a book I wrote. Please beware of people using artificial intelligence for scams."

ChainCatcher reports, US Treasury Secretary Yellen said the Treasury Department and IRS have released new guidelines on crypto exchange-traded products.

ETP guidelines provide a clear path for holding digital assets.

Data: 1,011 insider whales increase long positions by over 10,000 ETH, position size rises to $180 million

ChainCatcher reports, according to Hyperinsight monitoring, insider whales have just increased their long positions by over 10,000 ETH (UTC+8), bringing their total ETH long position to 51,132 ETH, worth about $180 million. They are still increasing their positions through limit orders, with their 5x ETH long position currently floating a profit of $2.94 million (+8.62%), with an average entry price of $3,462.

Meme Hot List

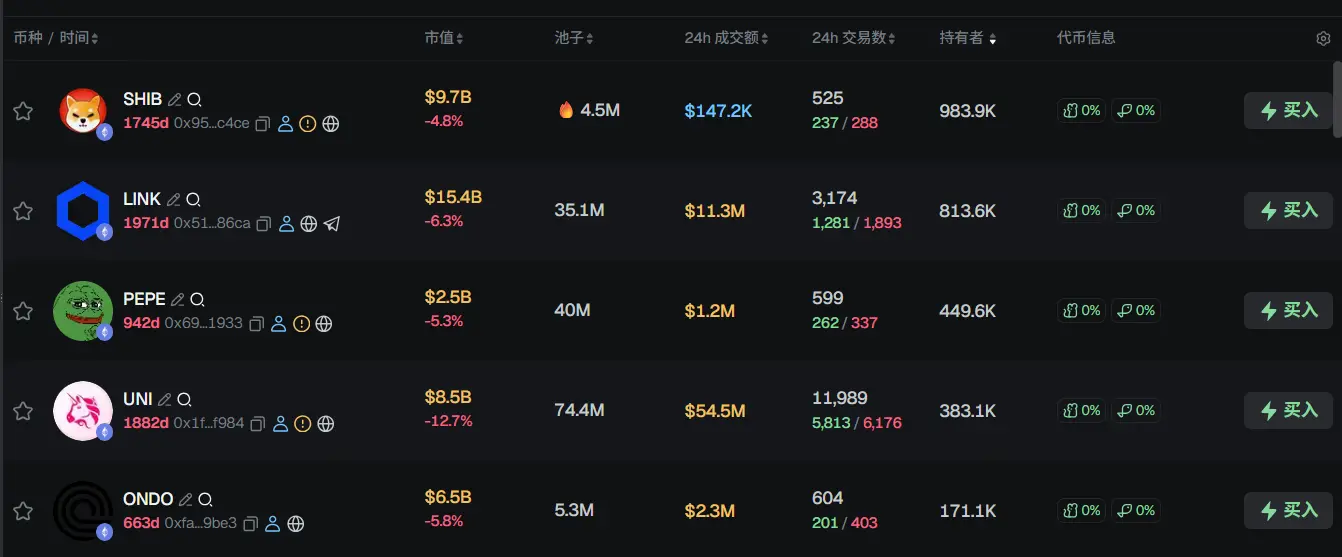

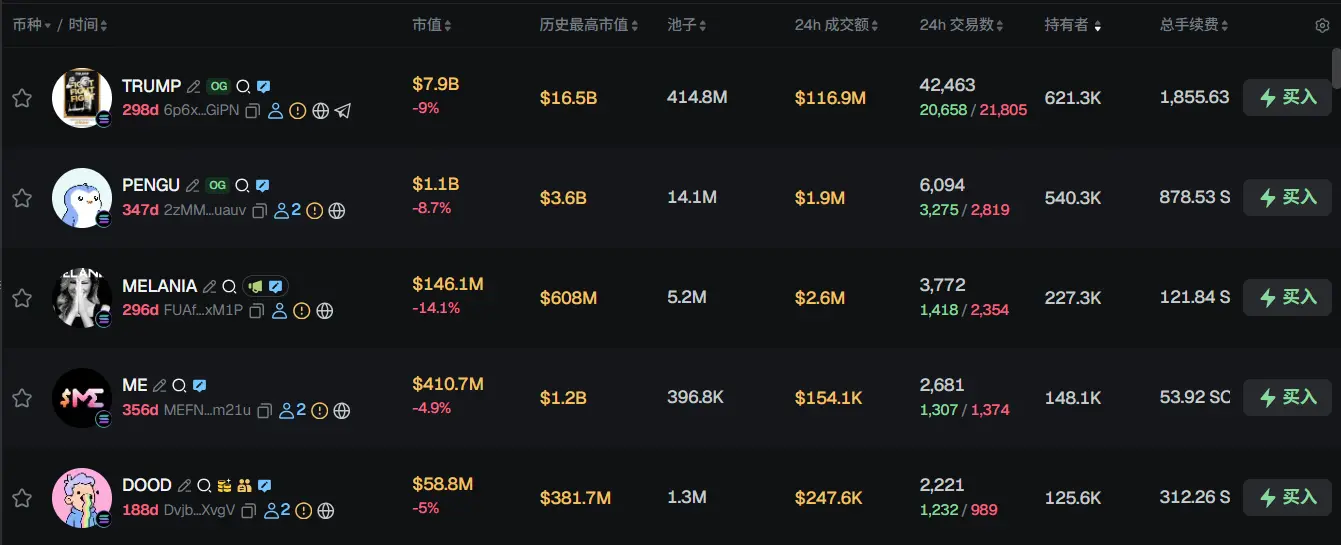

According to data from meme token tracking and analysis platform GMGN, as of November 12, 09:00 (UTC+8),

The top five trending ETH tokens in the past 24h are: SHIB, LINK, PEPE, UNI, ONDO

The top five trending Solana tokens in the past 24h are: TRUMP, PENGU, MELANA, ME, DOOD

The top five trending Base tokens in the past 24h are: ZORA, VIRTUAL, USI, TOSHI, BRETT

What are some great articles worth reading from the past 24 hours?

CZ unfollows in bulk: Has the absurd “follower business” finally collapsed?

On November 10, a comparison chart of X followers ignited heated discussion in the crypto community. Binance founder CZ unfollowed over 300 people from his X account in less than two months, a number far exceeding routine maintenance, which was seen as a precise purge and revealed a once highly active but hidden gray industry chain: accounts followed by CZ were publicly traded for tens of thousands of dollars.

Burning, Uniswap’s last trump card

Waking up, UNI rose nearly 40%, driving the entire DeFi sector up.

The reason for the rise is that Uniswap played its last trump card. Uniswap founder Hayden released a new proposal, with the core content revolving around the long-discussed “fee switch” topic. In fact, this proposal has been raised seven times in the past two years and is no longer new to the Uniswap community.

However, this time is different. The proposal was initiated by Hayden himself, and in addition to the fee switch, it also covers token burning, the merger of Labs and Foundation, and a series of other measures. Some whales have already expressed support, and in the prediction market, the probability of the proposal passing is as high as 79%.

On-chain finance, danger! Run!

DeFi is once again in the spotlight.

As the most vital narrative direction in the industry over the past few years, DeFi carries the expectation for the crypto industry’s continued evolution and expansion. As a firm believer in its vision, I have been accustomed to deploying more than 70% of my stablecoin positions in various on-chain yield strategies, and am willing to take on a certain level of risk for this.

However, with the recent fermentation of multiple security incidents, the chain reaction of some historical events, and the gradual exposure of inherent problems that were previously hidden, the entire DeFi market is now shrouded in a sense of danger. Therefore, the Odaily author personally chose to withdraw the vast majority of on-chain funds last week.

Complete guide for crypto KOLs to start on X: from profile optimization to ranking strategies

In this article, I will explain all 12 key points in an extremely easy-to-understand way, detailing how to profit on the X platform at zero cost even without many followers or a big V account.

Even if Kaito’s Yappers and previous information monetization models are about to become obsolete, the methods shared here can still help you continue to profit on X. Playstyles may become outdated, but opportunities always exist. Even if you don’t have many followers, those who start now can still reap rewards.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Consensus and SALT Launch Premier Institutional Crypto Summit in Hong Kong

Conflux Integrates USDT₀ and CNHT₀, Strengthening Global Stablecoin Infrastructure

1exchange and Dinari Partner to Expand Regulated Access to Tokenized U.S. Securities

DMZ Finance and Mantle Launch World’s First DFSA-Approved Tokenized Money Market Fund On-chain