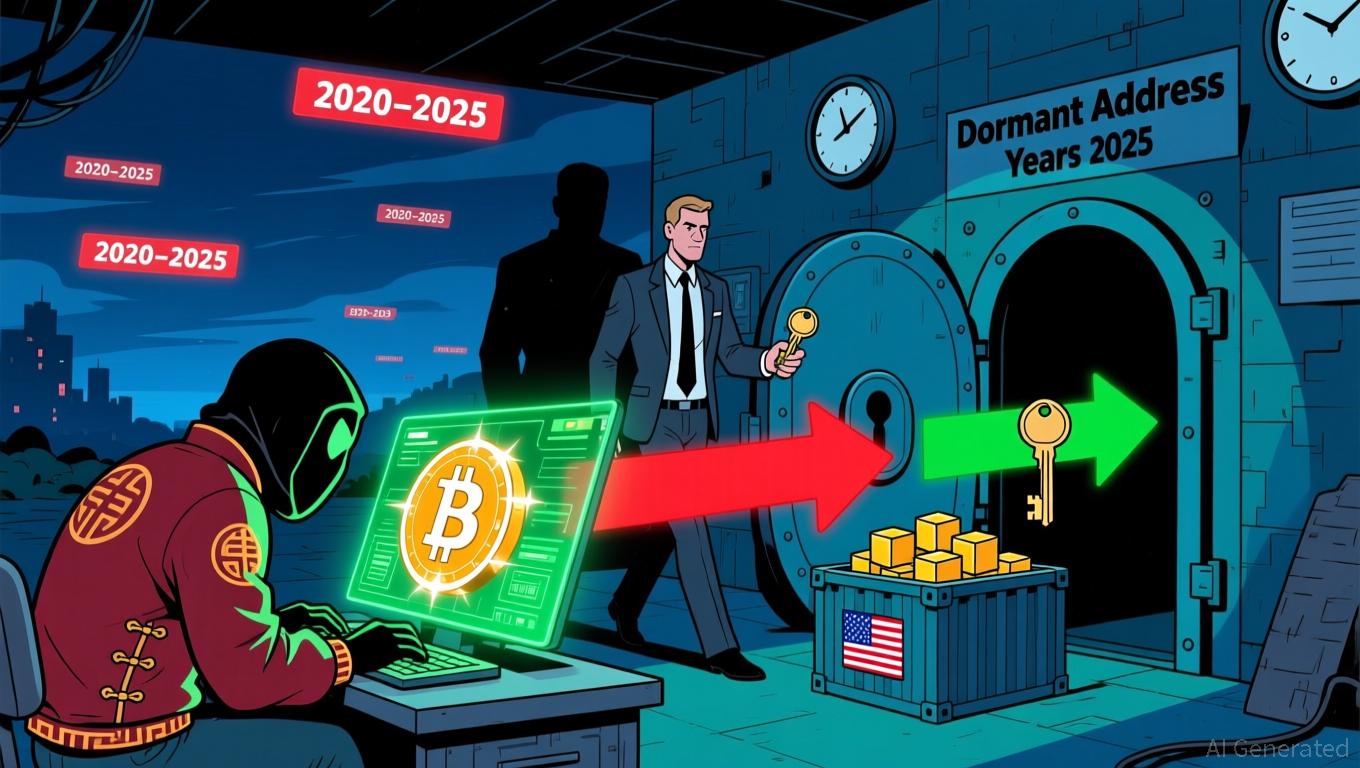

Bitcoin News Today: Digital Sovereignty Clash: US-China Tensions Escalate Over $13B Bitcoin Seizure

- China's CVERC accuses U.S. government of orchestrating a $13B Bitcoin theft from 2020 LuBian mining pool hack. - U.S. denies claims, asserting 2025 seizure targeted criminal proceeds from Cambodian fraudster Chen Zhi's $2B scheme. - Dispute highlights geopolitical tensions over digital sovereignty, with 127,426 BTC (0.65% of total supply) now central to U.S.-China crypto rivalry. - CVERC demands enhanced blockchain security measures as seized assets represent largest U.S. crypto forfeiture in history. -

China’s cybersecurity authorities have accused the United States of carrying out a $13 billion

The controversy revolves around a cyberattack on LuBian in December 2020, which led to the theft of 127,426 BTC—worth $3.5 billion at the time, according to a

The U.S. Department of Justice (DOJ) has justified the seizure, stating the bitcoins were tied to Chen Zhi’s alleged $2 billion cryptocurrency fraud and were confiscated through a civil forfeiture action in October 2025, according to a

This dispute has reverberated throughout the cryptocurrency market, with Bitcoin hovering around $105,000 as investors assess the broader geopolitical fallout. Experts point out that about 0.65% of Bitcoin’s total supply—roughly 127,000 coins—is now entangled in the controversy, which could restrict liquidity and impact long-term price trends, according to an

CVERC has urged the adoption of stronger blockchain security protocols, such as layered defenses and real-time surveillance, to guard against future government-sponsored cyberattacks, according to a

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates: Michael Saylor Continues to Acquire BTC Despite Market Slump, Holdings Remain Robust

- Michael Saylor's MSTR added 8,178 BTC ($835.6M) in November, boosting total holdings to 649,870 BTC valued at $48.37B despite Bitcoin's 7-month low below $95,000. - Strategy's BTC purchases remain profitable with average cost ($74,433) far below current $90K+ price, while unrealized gains persist through market downturns. - Saylor defends Bitcoin as "exponential treasury asset," rejecting sell rumors and hinting at "surprising" activity despite MSTR's 35% YTD stock decline and below-1 market-to-NAV ratio

Panic or Opportunity? As Legal Challenges and Economic Uncertainty Converge, Crypto and Stock Markets Waver

- Crypto markets hit "extreme fear" as Bitcoin's $100k failure sparks broad sell-off, compounding equity turmoil from lawsuits and leadership crises at Primo Brands and WPP . - Primo Brands drops 9% after CEO forced out over integration failures, now faces securities class action; WPP plunges 18% amid fraud allegations and CEO transition. - Fortinet's 22% stock crash follows delayed firewall upgrade disclosure, triggering legal scrutiny; Whirlpool reports strong earnings but remains down 38.7% year-to-date

Trump’s Federal Reserve Strategy: Hassett’s Proposed Reductions Face Resistance from Central Bank Prudence

- Trump plans to nominate Kevin Hassett as Fed chair, prioritizing aggressive rate cuts over Powell's cautious approach. - Hassett's market-driven policies face political risks, with internal resistance warning against destabilizing Fed independence ahead of 2026. - Fed officials remain divided on rate cuts, balancing inflation control against weakening labor market signals. - Critics argue Trump's focus on short-term cuts risks inflation, while Bessent's post-Thanksgiving recommendations will shape U.S. m