Did One Whale Steal aPriori’s Airdrop? 14,000 Wallets Raise Big Questions

A single entity claimed 60% of aPriori's APR airdrop, sparking debate on crypto fairness.

Liquid staking project aPriori, preparing to join the Monad, has raised $30 million from Tier-1 VCs. However, it now faces accusations that one entity used 14,000 connected addresses to claim more than 60% of its airdrop.

The revelations have rattled markets and raised fresh questions about airdrop design and on-chain verification.

On-Chain Picture Behind aPriori: What Happened?

aPriori (APR) announced the claim portal on October 23, with its public window and split-claim mechanic (early vs. wait) appearing to have been gamed by the clustered wallets.

Airdrop claim is live.Check eligibility and claim at .You have 21 days to choose:• Claim Early: smaller portion now• Wait for Monad Mainnet: unlock majority laterChoose carefully, your selection is final.

— aPriori ⌘ (@aPriori) October 23, 2025

Indeed, Bubblemaps, a visual analytics platform for on-chain trading and investigations, flagged an unusually tight cluster of new wallets that claimed aPriori’s October 23 airdrop.

According to Bubblemaps, the project raised $30 million from tier-1 VCs. However, 60% of its airdrop was claimed by one entity via 14,000 connected or clustered addresses.

Reportedly, the cluster’s behavior involved wallets that were freshly funded via the Binance exchange, with approximately 0.001 BNB, in short windows. They then routed APR to new addresses, suggesting an orchestrated claim-and-redistribute operation rather than an organic, distributed claiming process.

3/ However, 14,000 connected addresses claimed 60%+ of the $APR airdropThese addresses were:> Freshly funded via Binance> Received 0.001 BNB each in tight time windows> Sent $APR to fresh addresses, forming a second layer in the cluster

— Bubblemaps (@bubblemaps) November 11, 2025

Project Messaging and Timing

The fallout was immediate, with a sharp sell-off following the cluster activity. Likewise, there was a dramatic drop in the APR market cap soon after launch.

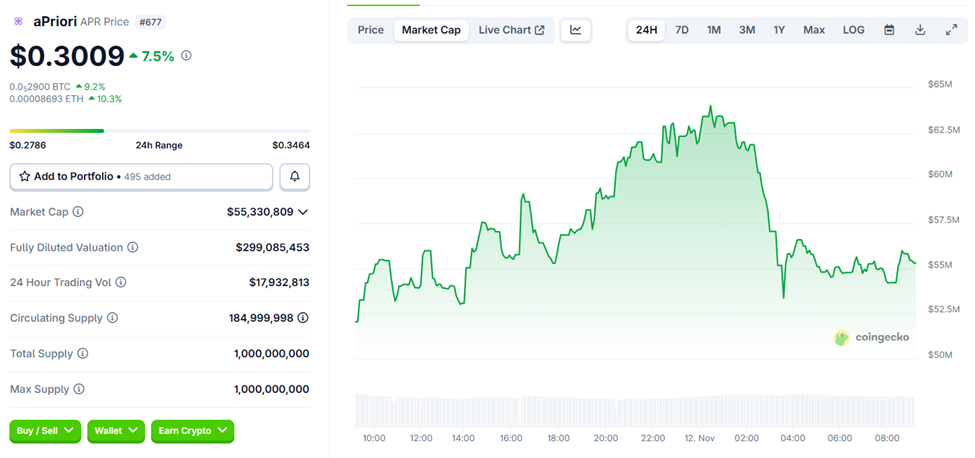

aPriori (APR) Price and Market Cap Performance. Source:

CoinGecko

aPriori (APR) Price and Market Cap Performance. Source:

CoinGecko

Concentrated airdrop claims, especially when claimers flip tokens quickly, can wipe out community trust and trigger steep repricing before a project reaches mainnet.

Why It Matters — Incentives, Verification, And Reputation

Crypto airdrops are meant to decentralize token ownership and bootstrap network effects. When a single actor captures the majority of distributed tokens, three problems arise:

- Incentive misalignment, where the token supply is effectively centralized

- Economic risk, where large concentrated holders can dump and destabilize the price, and

- Reputational damage, where partnerships and future fundraisers can be imperiled.

For aPriori, touted as “one of the biggest projects coming to Monad,” reputational risk now threatens its own rollout as well as associated ecosystem events.

Meanwhile, this scandal comes at a moment when Lighter is being celebrated as a model for institutional-grade DeFi growth. The Layer-2 DEX recently raised $68 million and surpassed $73 billion in weekly perpetual trading volume, emphasizing speed, scalability, and transparent on-chain execution.

Lighter is pursuing a zero-knowledge orderbook model to attract serious liquidity providers. By contrast, aPriori’s airdrop issues remind investors how easily tokenomics can be undermined by automation and poor verification.

Similarly, aPriori’s Sybil-attack-like airdrop highlights the fragility of token distribution mechanics still common in DeFi.

Bubblemaps says it reached out to the aPriori team but received no response; the project has not publicly disputed the cluster analysis.

As investigations continue and on-chain forensics deepen, aPriori’s path to the Monad mainnet and any associated MON sales will be closely monitored and evaluated based on on-chain evidence and, potentially, developer communication.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BFF Bank's Measured Growth Compared to Amex GBT's Rapid AI-Powered Expansion: Contrasting Strategies for Advancement

- BFF Bank's stock rose 1.29% after 33% net profit growth and €5.8B loan expansion, with plans to enter French/Luxembourg markets. - Amex GBT reported 13% revenue growth ($674M) and 9% EBITDA increase ($128M), driven by CWT acquisition and travel demand surge. - BFF improved operational efficiency (46% cost-income ratio) while Amex raised 2025 guidance to $523M-$533M EBITDA and 12% revenue growth. - Divergent strategies emerged: BFF focused on organic expansion and risk management versus Amex's AI-driven t

Abu Dhabi’s AI-Centric Strategy Draws 7,000 Attendees to Blockchain Expo 2025

- Abu Dhabi's Blockchain Show 2025 attracted 7,000 participants, reinforcing its AI/digital innovation leadership through Mondevo's $13B strategy-aligned global HQ and 200+ AI government solutions. - BestChange enhanced crypto accessibility with Telegram integration while Treasure Global invested in OXI Wallet, reflecting growing demand for institutional-grade digital asset platforms. - Dubai Chambers expanded U.S. operations and DBS-Ant collaboration enabled cross-border payments, showcasing Gulf's AI/blo

Rain's Uptop Acquisition Finalizes Comprehensive Stablecoin Rewards Ecosystem

- Rain acquires Uptop to integrate on-chain rewards into its stablecoin-powered payments ecosystem, expanding into retail, entertainment , and dining. - The move follows a $58M Series B funding round and leverages Uptop's proven 21% spend increase and 51% sales boost for sports teams. - Built on Avalanche's low-latency architecture, the platform enables instant, compliant rewards while maintaining simplicity for global enterprise scaling. - Rain CEO emphasizes end-to-end stablecoin infrastructure, position

Hyperliquid News Update: Significant Leverage, Limited Liquidity: POPCAT's $5 Million DeFi Breach

- Hyperliquid suffered a $4.9M loss after a trader manipulated Solana-based memecoin POPCAT through leveraged long positions and a sudden price crash. - The attacker used $3M in USDC from OKX to create a $20–30M leveraged position, inflating POPCAT’s price before triggering cascading liquidations. - Hyperliquid paused its Arbitrum bridge to stabilize the platform, highlighting vulnerabilities in DeFi’s automated liquidation systems and low-liquidity markets. - Experts warn such attacks expose DeFi risks, u