61% of institutions plan to boost crypto exposure despite October crash: Sygnum

Institutional investors are maintaining confidence in digital assets despite a sharp market correction in October, with most planning to expand their exposure in the months ahead, according to new research.

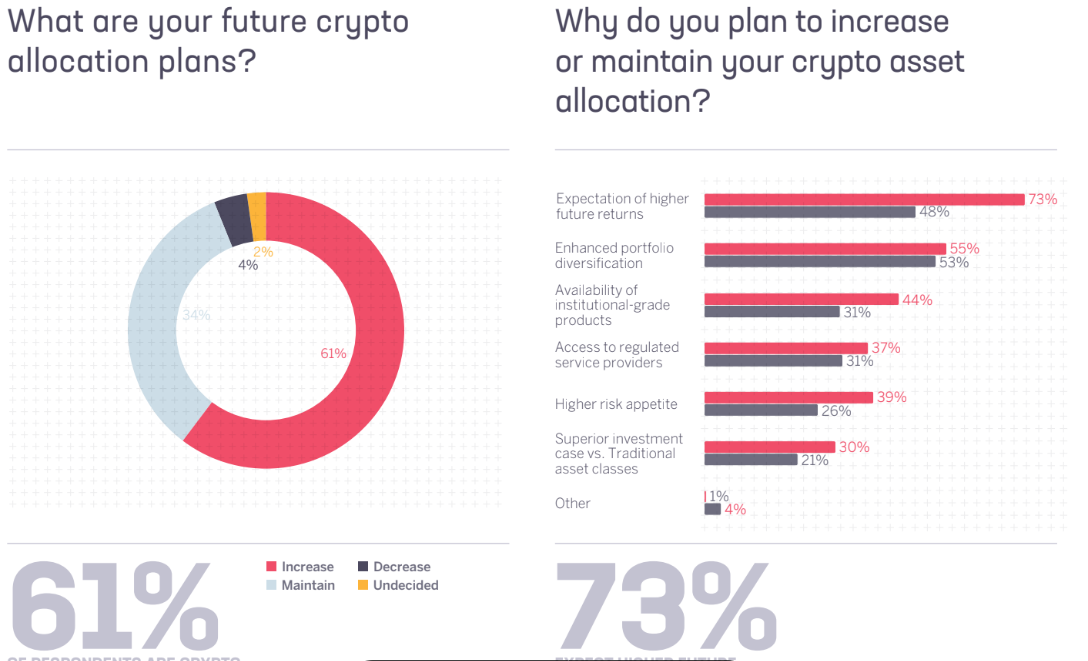

Over 61% of institutions plan to increase their cryptocurrency investments, while 55% hold a bullish short-term outlook, Swiss crypto banking group Sygnum said in a report released on Tuesday. The survey covered 1,000 institutional investors globally.

Roughly 73% of surveyed institutions are investing in crypto due to expectations of higher future returns, despite the industry still recovering from the record $20 billion market crash at the beginning of October.

However, investor sentiment continues facing uncertainty due to delays in key market catalysts, including the Market Structure bill and the approval of more altcoin exchange-traded funds (ETFs).

Institutional crypto allocation plans. Source: Sygnum

Institutional crypto allocation plans. Source: Sygnum

While this uncertainty may carry over into 2026, Sygnum’s lead crypto asset ecosystem researcher, Lucas Schweiger, predicts a maturing digital asset market, where institutions seek diversified exposure with long-term growth expectations.

“The story of 2025 is one of measured risk, pending regulatory decisions and powerful demand catalysts against a backdrop of fiscal and geopolitical pressures,” he said, adding:

“But investors are now better informed. Discipline has tempered exuberance, but not conviction, in the market’s long-term growth trajectory.”

Despite October’s correction, “powerful demand catalysts” and institutional participation remained at an all-time high, with the growing ETF applications signaling more institutional demand, added Schweiger.

At least 16 crypto ETF applications are currently awaiting approval, which were delayed by the ongoing US government shutdown , now in its 40th day.

Crypto staking ETFs may be the next institutional catalyst

Crypto staking ETFs may present the next fundamental catalyst for institutional cryptocurrency demand.

Over 80% of the surveyed institutions expressed interest in crypto ETFs beyond Bitcoin and Ether, while 70% stated that they would start investing or increase their investments if these ETFs offered staking rewards.

Staking means locking your tokens into a proof-of-stake (PoS) blockchain network for a predetermined period to secure the network and earn passive income in exchange.

Meanwhile, investors are now anticipating the end of the government shutdown, which could bring “bulk approvals” for altcoin ETFs from the US Securities and Exchange Commission, catalyzing the “next wave of institutional flows,” according to Sygnum.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto wallets are transforming into comprehensive platforms, connecting Web3 with traditional financial services

- D'CENT Wallet's v8.1.0 update enables multi-wallet management for up to 100 accounts, streamlining digital asset handling across investment, NFTs, and events. - Competitors like Exodus and Blaqclouds advance crypto adoption through features like Mastercard-linked debit cards and decentralized identity systems with biometric security. - Innovations such as fee-free transactions (D'CENT GasPass) and on-chain identity management (.zeus domains) highlight industry focus on accessibility and security for main

Grayscale's Public Listing: Advancing Crypto Adoption as Regulations Vary Worldwide

- Grayscale files U.S. IPO via S-1, joining crypto firms like Circle and Bullish in public markets. - IPO details remain undetermined, contingent on SEC review and market conditions. - Japan's TSE tightens crypto listing rules amid volatile "crypto hoarding" stock collapses. - U.S. regulators advance crypto rulemaking post-shutdown, potentially accelerating Grayscale's approval. - Grayscale's IPO highlights crypto's institutional push amid global regulatory divergence.

BNY's Stablecoin Fund Connects Conventional Finance with Around-the-Clock Digital Markets

- BNY Mellon launches BSRXX, a regulated fund enabling stablecoin issuers to hold GENIUS Act-compliant reserves without direct stablecoin investments. - The fund supports 24/7 digital markets by providing ultra-safe, short-term liquidity under federal requirements for stablecoin backing. - Anchorage Digital's participation highlights growing institutional adoption, with stablecoin reserves projected to reach $1.5 trillion by 2030. - BNY's $57.8T custody expertise positions it as a key infrastructure provid

Durov's Legal Victory Highlights the Ongoing Struggle Between Privacy and Government Oversight

- French authorities lifted a travel ban on Telegram CEO Pavel Durov after he complied with judicial supervision for a year. - Durov faces charges of complicity in alleged Telegram misuse for crimes, with potential 10-year prison and $550k fine if convicted. - He criticized French legal procedures and Macron's policies, highlighting tensions over digital privacy and blockchain integration. - The case underscores regulatory challenges for encrypted platforms, balancing user rights with accountability in a "