POPCAT Flash Crash on Hyperliquid Sparks $4.9 Million Manipulation Allegations

Popcat’s $30M crash on Hyperliquid wiped $4.9M from the liquidity provider. Was it a stress test or a manipulative attack? Full breakdown inside.

An anonymous trader burned through $3 million in minutes on Hyperliquid after faking a $20 million buy wall on POPCAT.

The move triggered a cascade of liquidations, resulting in a $4.9 million loss for the platform’s liquidity provider. Analysts now suspect a coordinated “stress test” of Hyperliquid’s system.

$30 Million Long Positions Create Chaos

The incident began when an unknown trader withdrew $3 million USDC from the OKX exchange, splitting it across 19 separate wallets before depositing it into Hyperliquid DEX.

Using these accounts, the trader opened massive long positions on POPCAT, leveraging them approximately 5x. Total exposure reached around $26–30 million, briefly making POPCAT one of the most actively traded tokens on the platform.

According to blockchain intelligence firm Arkham, the trader’s positions were quickly liquidated, resulting in the loss of almost all collateral.

“Someone just passed $5 million of bad debt on POPCAT to Hyperliquid’s Hyperliquidity Provider (HLP)…These 19 accounts were liquidated for a combined $25.5 million of POPCAT, losing $2.98 million in collateral,” Arkham reported.

The on-chain tracker also revealed that HLP lost $4.95 million, a move that effectively closed out remaining positions.

The remaining long positions were passed to the Hyperliquidity Provider (HLP) to liquidate.HLP appears to have lost $4.95M closing out the positions.

— Arkham (@arkham) November 12, 2025

Fake Buy Wall Sparks Mass Liquidations

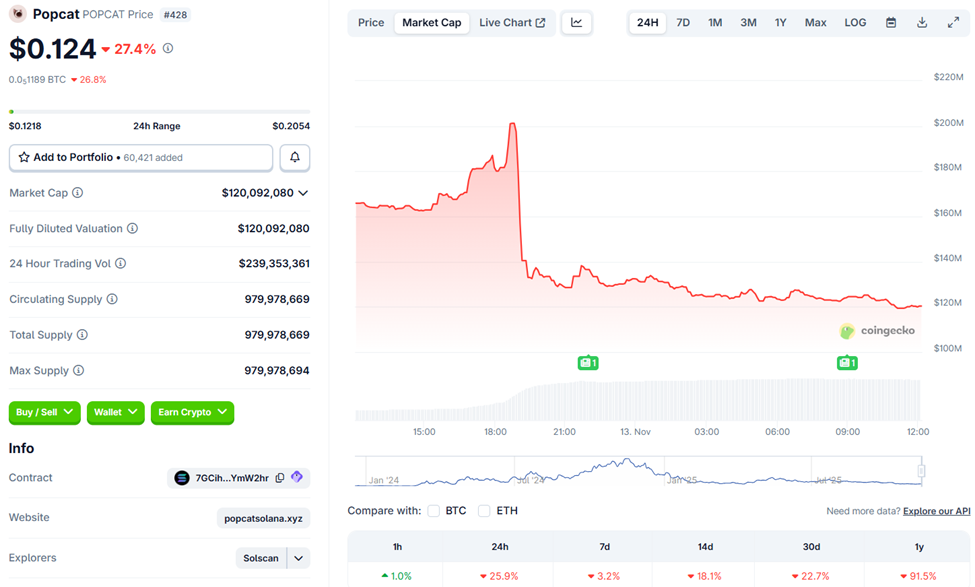

To amplify the chaos, the trader placed a $20 million buy wall at $0.21, creating the illusion of strong demand. As of this writing, the POPCAT price was trading for $0.12, down by almost 30% in the last 24 hours.

This strategic move attracted other traders to enter long positions, as they believed in a bullish momentum. Within minutes, the buy wall vanished, causing POPCAT’s price to collapse.

POPCAT Price Performance. Source:

CoinGecko

POPCAT Price Performance. Source:

CoinGecko

The sudden drop triggered mass liquidations across the market, with HLP absorbing the brunt of the losses.

“The attacker then placed an approximately $20 million buy wall near $0.21, creating the illusion of strong demand — only to cancel the orders, triggering a liquidity collapse that led to mass liquidations. HLP absorbed the positions and lost around $4.9M, while the attacker’s entire $3M stake was wiped out,” blockchain analyst Lookonchain noted.

Stress Test or Deliberate Attack?

Many in the crypto community suspect this was no accident. Vikas Singh, who observed the event live, compared it to previous manipulative scenarios, such as JellyJelly 2.0, noting the unusual stability of the long wall and its manual maintenance.

Did a JELLYJELLY 2.0 even happen yesterday with POPCAT?My analysis of yesterday Hyperliquid – Popcat orderbook: A 30-min shorts game.$POPCAT orderbook was crazy yesterday for a perp product. Why? because their was a long position which was having a sticky bid of $11M+ when…

— Vikas Singh (vikas.lens) 🌿, in Dubai 🇦🇪 (@HeyVixon) November 13, 2025

Analysts speculate this could have been a targeted stress test to probe Hyperliquid’s automated liquidity systems.

Some community members even speculated about Binance’s former CEO CZ’s involvement. However, CZ responded directly, denying any connection.

“I have not used any other CEX for 8 years,” the Binance executive articulated.

This marks the third major market incident on Hyperliquid this year, raising questions about how the exchange handles liquidity concentration and systemic risk. High-leverage meme tokens, such as POPCAT, are inherently risky and could expose vulnerabilities in decentralized liquidity systems.

Reportedly, the incident also sparked a temporary pause on Hyperliquid’s Arbitrum bridge, though deposits and withdrawals continued unaffected.

DeFi analyst Hanzo suggests exchanges may need stricter leverage limits, real-time monitoring tools, or platform-specific restrictions to mitigate similar attacks in the future.

$30M manipulation on Hyperliquid 🚨Roughly 13 hours before the event, an unknown trader withdrew $3M $USDC from OKX and split the funds across 19 wallets on Hyperliquid.Then he started opening massive long positions on $POPCAT, pushing the total exposure to around $20–30M.…

— Hanzo ㊗️ (@DeFi_Hanzo) November 12, 2025

While Hyperliquid’s team manually stabilized the market, the incident exposes the fragility of automated liquidity mechanisms in high-leverage meme markets.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Mastercard is Transforming Financial Identity Through Blockchain Privacy Initiatives

- Mastercard partners with Humanity Protocol to launch a ZKP-based financial verification system, enabling users to prove income or loan eligibility without sharing sensitive documents. - The system combines Mastercard's open finance APIs with blockchain-stored cryptographic proofs, allowing portable Human IDs for secure, privacy-preserving credit and DeFi access. - Applications span real-time bank approvals and DeFi risk reduction, with Humanity Protocol's token (H) central to tokenized asset markets afte

Ethereum Updates Today: ARK's Move Toward Ethereum Reflects Growing Institutional Adoption of Crypto Assets for Treasury Management

- ARK Invest sold $31.94M Tesla shares, redirecting capital to BitMine's Ethereum treasury strategy via three ETFs. - BitMine's 2.9% ETH stake and $2.1B unrealized losses highlight crypto treasury risks amid aggressive ETH accumulation. - ARK diversified into crypto exchanges and biotech , signaling institutional confidence in digital assets despite market volatility. - Ethereum's $3,500 price and staking partnerships demonstrate crypto treasuries' potential to bridge traditional/decentralized finance.

Interlink Reduces Losses but Falls Short of Revenue Target as Growth Strategies Develop

- Interlink Electronics reported 11% YoY revenue growth to $3.0M in Q3 2025, driven by Calman's force-sensing products and improved 41.8% gross margin. - Despite $0.24M revenue shortfall, the company narrowed its net loss to $336K through capital structure simplification and $1.55M operating expense management. - Strategic moves include FDA/USDA grants for food safety tech, a UK acquisition LOI, and a 38% price target premium reflecting expansion optimism. - Analysts highlight critical success factors: sus

Bitcoin News Update: Senate Divided Over Crypto Regulation: CFTC Authority or SEC Supervision

- U.S. Congress proposes competing crypto frameworks: Senate Agriculture Committee expands CFTC's digital commodity oversight, while Banking Committee grants SEC control over "ancillary assets" via decentralization thresholds. - CFTC's expanded authority would regulate Bitcoin/Ethereum spot markets, requiring custodial safeguards, while SEC's framework creates conditional pathways for tokens to transition from securities to commodities. - Post-shutdown resumption enables SEC/CFTC to restart ETF reviews, wi