Bitcoin Updates: Bitcoin or Gold by 2035? Saylor’s Wager Challenges Skeptics Amid Concerns Over Debt

- Michael Saylor predicts Bitcoin will surpass gold as the largest asset class by 2035, citing its capped supply and growing adoption. - MicroStrategy (MSTR) holds 641,692 BTC ($68B) via perpetual preferred stock issuances, reflecting Saylor's aggressive Bitcoin accumulation strategy. - Critics like Jim Chanos question Strategy's debt-fueled Bitcoin bets, noting its 22% stock decline and Bitcoin's $2.04T market cap lagging gold's $29.2T valuation. - Saylor argues Bitcoin's "hard cap" and institutional adop

Michael Saylor, who serves as executive chairman of

Saylor’s projections have drawn skepticism, especially from short sellers such as Jim Chanos, who recently exited his short position against

For Bitcoin to surpass gold, it would require a significant increase in value. Bitcoin’s market capitalization stands at $2.04 trillion, far below gold’s $29.2 trillion. Saylor recognizes this disparity but sees it as a chance, citing Bitcoin’s distinctive features: programmable money, digital scarcity, and growing institutional interest. By 2035, he noted, 99% of all Bitcoin will have been mined, establishing a “hard cap” that differs from gold, which can still see increased mining output

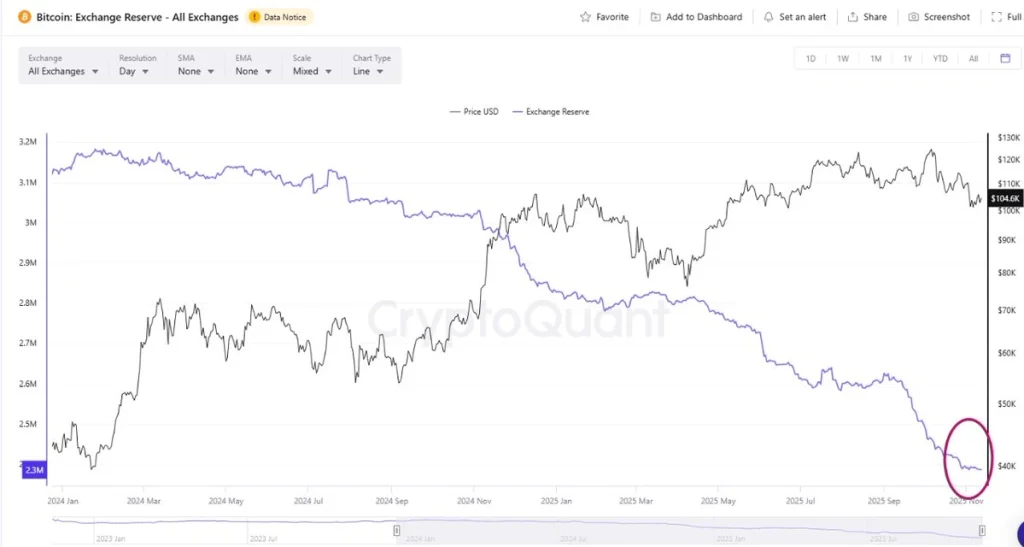

Market conditions remain uncertain. Although Bitcoin has climbed back above $105,000 following the resolution of U.S. government shutdowns and renewed institutional enthusiasm, it still lags behind the S&P 500 and Nasdaq Composite in 2025 returns. Gold’s recent strong performance has been driven by its appeal as an inflation hedge and by central bank purchases, especially in developing economies

The wider cryptocurrency sector also lends weight to his argument. More than 193 publicly listed companies have adopted Bitcoin as part of their treasury strategy, though many have seen their stock prices pressured as market sentiment shifts. Strategy’s competitors—including MARA, Tether-backed Twenty One, and Bullish—collectively hold 53,250 BTC, but none rival Strategy’s holdings or Saylor’s persistent accumulation

Detractors point to risks such as leveraged positions in crypto derivatives and the industry’s vulnerability to regulatory changes. Nevertheless, Saylor asserts that Strategy’s financial structure—which combines equity, convertible bonds, and preferred shares—is built to endure a 90% drop in Bitcoin’s value over a four to five year period

With 2035 approaching, the contest between Bitcoin and gold is still undecided. For now, Saylor’s steadfast optimism and Strategy’s ongoing Bitcoin acquisitions highlight a bold wager on the evolution of digital finance.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Panda, iFerg, Levinho and 50 Other Top Creators Launch Gallaxia, a Player-Owned Gaming Studio

Bitcoin Breaks European Union: Czech Republic and Luxembourg Announce BTC Holdings

XRP News Today: Introduction of XRP ETF Marks Growing Institutional Interest in Altcoins

- Canary Capital's XRPC ETF launches on Nasdaq as first U.S. spot XRP product, holding actual tokens rather than derivatives. - The ETF follows recent altcoin ETF approvals and tracks XRP-USD CCIXber Index, enabling traditional brokerage access to XRP. - Analysts predict strong performance due to XRP's $143B market cap, while Czech National Bank's $1M crypto purchase highlights growing institutional interest in digital assets.

DOGE drops 6.5% amid ETF developments and Treasury actions

- DOGE fell 5.24% in 24 hours, 8.4% in 7 days, and 48.97% in a year amid ETF regulatory developments. - Grayscale listed DOGE ETF in DTCC registry, signaling potential U.S. trading and institutional adoption similar to Bitcoin ETFs. - CleanCore holds 703.6M DOGE ($163.85M value) through treasury strategy, aiming to boost real-world utility despite Q1 2026 losses. - Backtests show DOGE underperforms 3 weeks post-ETF news (-2.3% to -7.5%), contrasting Bitcoin's sustained momentum and highlighting short-term