Bitcoin ( BTC ) rebounded 8.7% to $107,500 on Tuesday, following its four-month low of $98,900, as whales took advantage of discounted prices to add to their holdings. The price corrected to below $103,000 on Thursday, as $106,000 proved a tough barrier to break.

Key takeaways:

Bitcoin whales recorded their second-largest weekly accumulation of 2025.

Long-term holders continue to sell, frustrating recovery attempts.

BTC sell pressure sits at $106,000, a resistance level that may stop the bulls.

Bitcoin whales scoop up 45,000 BTC

Data from Cointelegraph Markets Pro and TradingView showed a BTC price recovery taking shape after last week’s correction , as it was holding around $103,000.

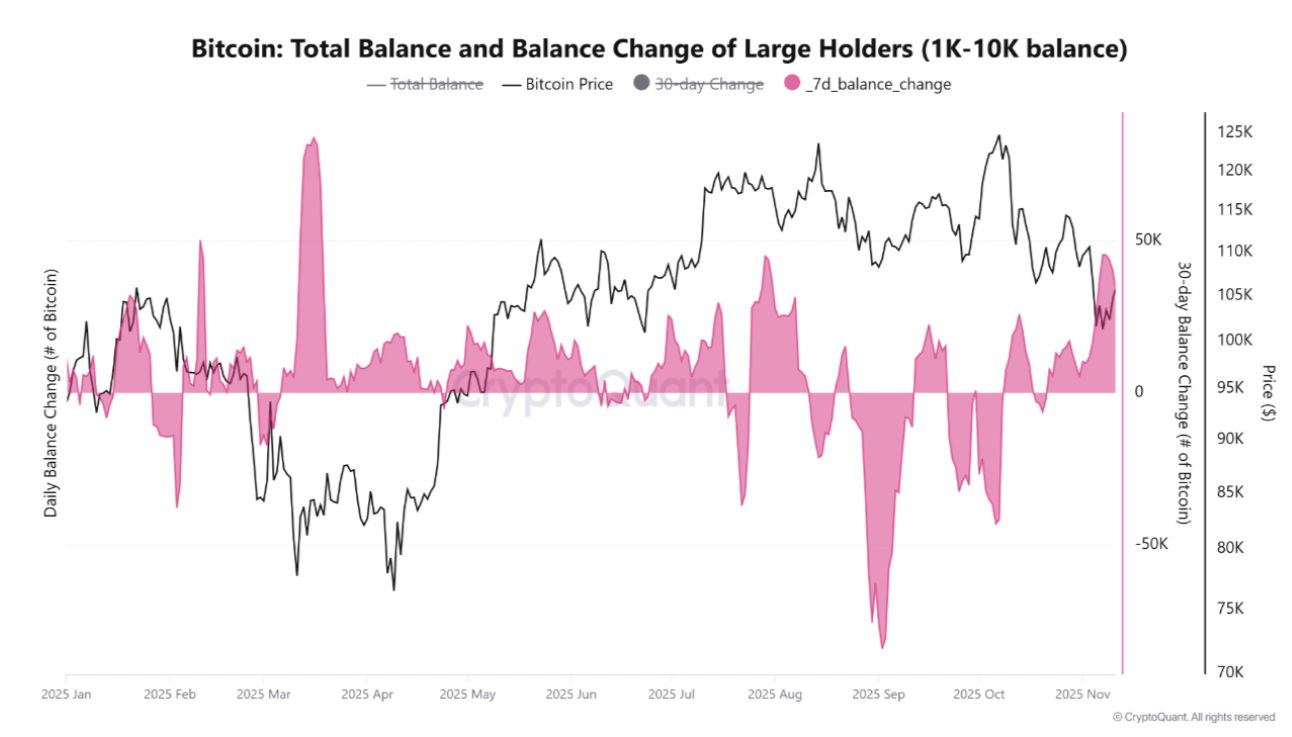

Market participants have observed deliberate posturing by whales, as these large holders recorded their second-largest accumulation of 2025, according to data from market onchain data provider CryptoQuant.

Related: Bitcoin falls to $101K as stocks, gold rally ahead of vote to end government shutdown

In March, whales — entities holding 1,000 BTC or more — initiated the most significant accumulation wave of the year amid a sharp decline in Bitcoin price.

“In the last week, whales accumulated more than 45,000 BTC, marking the second-largest weekly accumulation process in these wallets,” said CryptoQuant analyst Caueconomy in a Wednesday Quicktake analysis, adding:

“Large players are once again taking advantage of the capitulation of small investors to absorb coins.”

Bitcoin whale weekly change. Source: CryptoQuant

Bitcoin whale weekly change. Source: CryptoQuant

Nevertheless, this spot buying volume was insufficient to demonstrate a more widespread buy-the-dip recovery pattern.

There is a need for “renewed conviction and stronger demand from new market entrants” and other investors, such as day traders and retail investors, to push the price to above $106,000, Glassnode said in its latest Week Onchain report.

However, not all Bitcoin whales are accumulating. Long-term whale, Owen Gunden, continued to sell, transferring 2,401 BTC worth $245 million to Kraken on Thursday, according to Onchain Lens .

Owen Gunden has deposited 2,401 $BTC , worth $244.96M, into #Kraken , 3 hours ago.

— Onchain Lens (@OnchainLens) November 13, 2025

Owen still holds 2,499 $BTC , worth $258.58M.

As Cointelegraph reported , OG holders have moved large sums of BTC to exchanges, raising concerns about long-term confidence as Bitcoin loses momentum.

Bitcoin faces stiff resistance above $106,000

The BTC/USD pair failed to break $106,000 as its rebound stopped short of a bull market comeback.

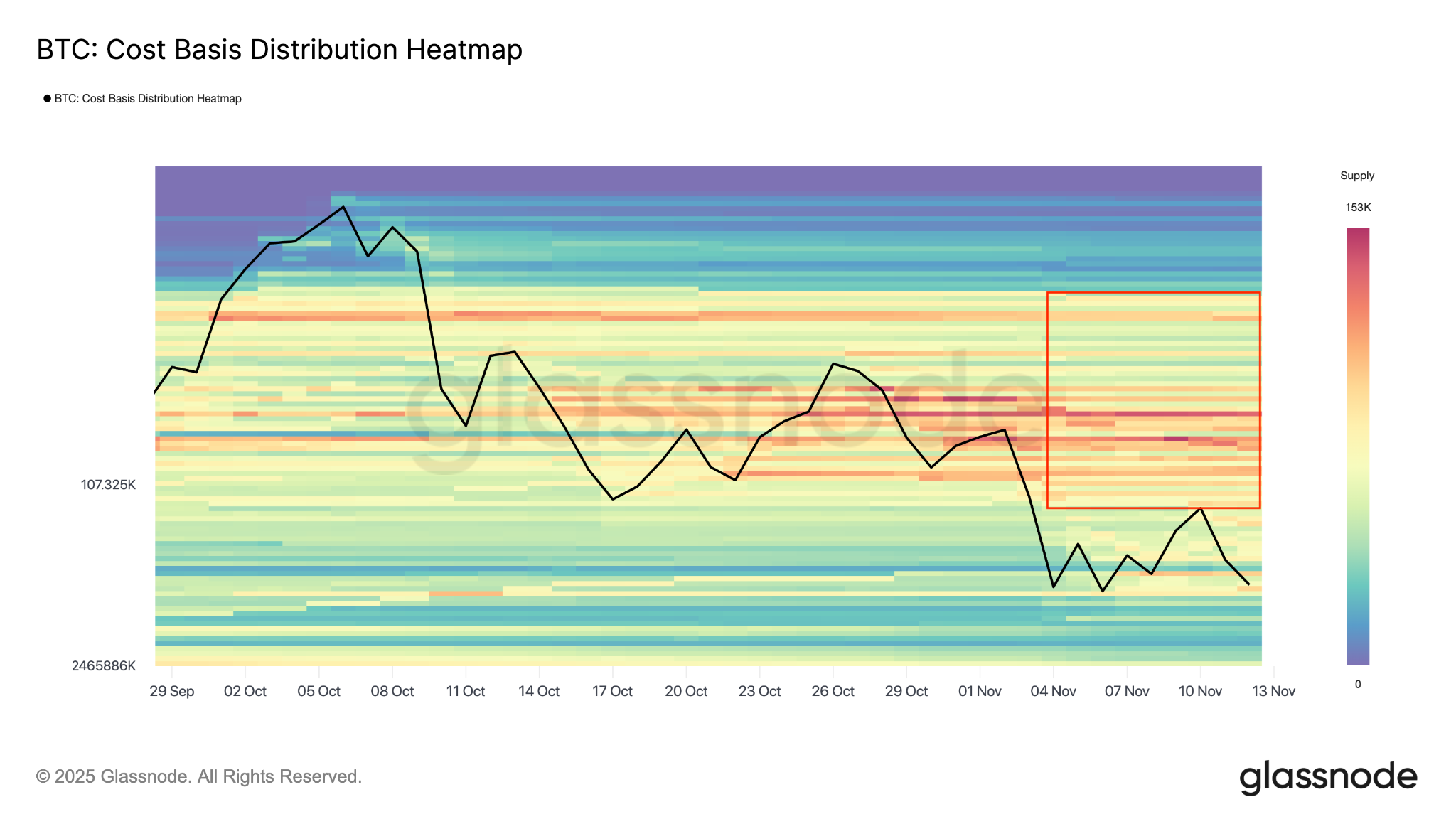

This is due to “a dense supply cluster between $106K and $118K that continues to cap upward momentum, as many investors use this range to exit near breakeven, said Glassnode.

According to Bitcoin’s cost basis distribution heatmap , investors hold about 417,750 BTC at an average cost of between $106,000 and $107,200, establishing a resistance zone.

Glassnode added:

“This overhang of latent supply creates a natural resistance zone where rallies may stall, suggesting that sustained recovery will require renewed inflows strong enough to absorb this wave of distribution.”

Bitcoin: Cost Basis Distribution Heatmap. Source: Glassnode.

Bitcoin: Cost Basis Distribution Heatmap. Source: Glassnode.

Traders say the BTC/USD pair must flip the resistance between $106,000 and $107,000 into support to target higher highs above $110,000.

“BTC is trending up on the lower time frame,” said analyst Daan Crypro Trades in a recent X post, adding:

“But it needs to break that $107K area. If it can do so, it would turn this into a decent deviation and retake back into the range.”

BTC/USD daily chart. Source: Daan Crypto Trades

BTC/USD daily chart. Source: Daan Crypto Trades

Technical analyst CRYPTO Damus said BTC price to “make a higher high above 106K and breakout above the down trend line at $107,350 to flip the script bullish.”

“If we want to break upward, I’d rather want to see a break north of $108K-$110K, and then we’ll see a new ATH,” MN Capital founder Michael van de Poppe said in a Friday post on X.

As Cointelegraph reported , a break and close above the breakdown level of $107,000 would signal that the bulls are back in the driver’s seat.