Ethereum Flashes a Reversal Setup — Now It Just Needs the ‘Mega’ Confirmation

Ethereum is flashing a clean reversal setup on the daily chart, but major holders are still reducing exposure. One key zone now decides whether the bullish pattern expands or fails.

Ethereum price fell nearly 11.5% over the past 24 hours. It has since recovered roughly 2.5%, now trading above $3,230. Yet, the 24-hour ticker still shows a near 6% dip.

The corrective move, however, has printed a bullish reversal pattern on the chart, but the question is whether it can play out while large holders continue to step back.

Reversal Pattern Appears, but Whale Activity Still Shows Weakness

Ethereum has formed a bullish harami on the daily chart. This pattern happens when a small green candle sits inside the body of a larger red candle from the previous day. It often shows selling pressure slowing and buyers trying to regain control.

A similar setup appeared on November 5, but the bounce failed because buying strength faded quickly. That failure puts more weight on the current pattern and whether buyers can sustain momentum this time.

Bullish Pattern Identified:

TradingView

Bullish Pattern Identified:

TradingView

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

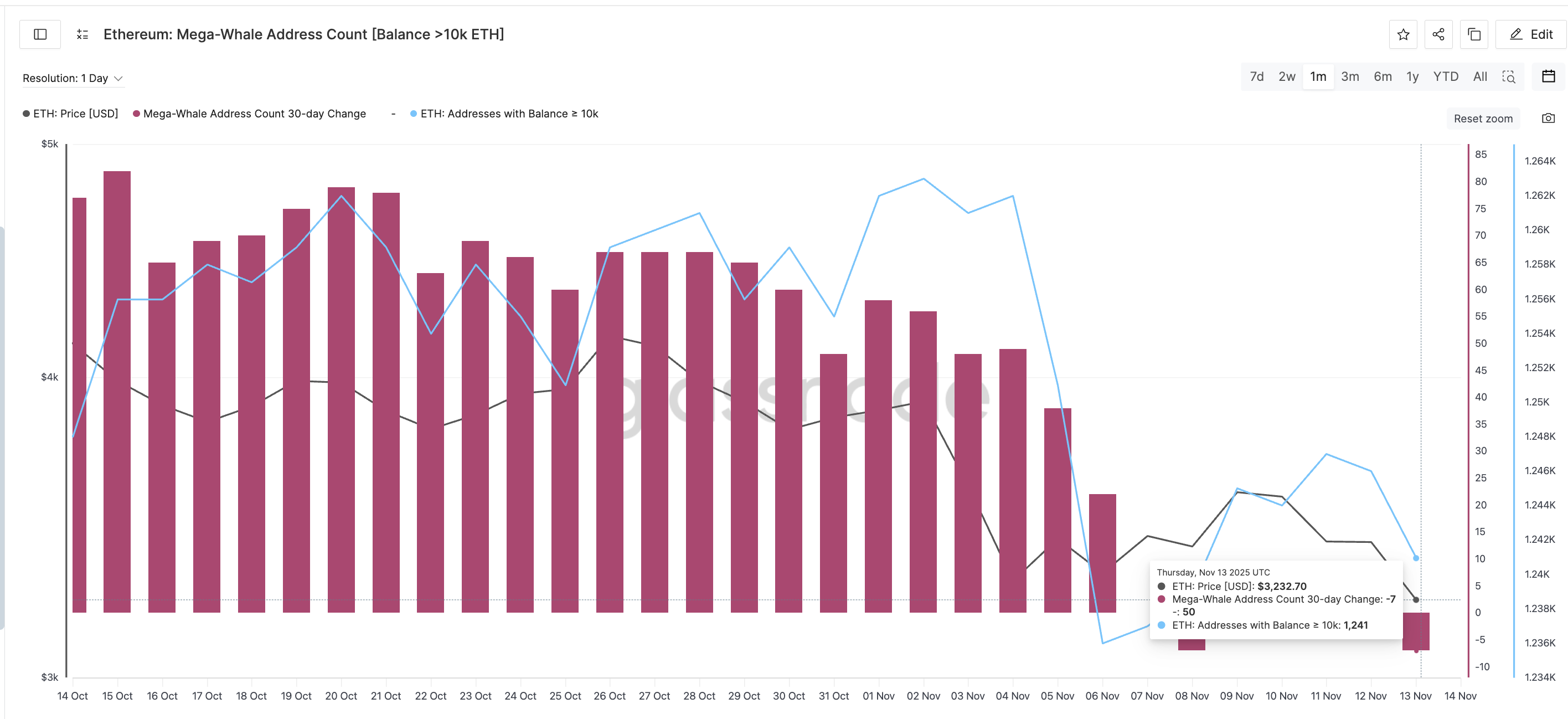

The pressure comes from whale behavior. The mega-whale address count, which tracks the 30-day change in wallets holding over 10,000 ETH, has dropped again. It is now back to the same negative level seen on November 8.

The number of addresses holding 10k ETH has also been falling since November 2. There was a small pickup from November 6 to 11 during a short-lived rebound, but the decline returned immediately after. That decline in holdings coincided with Ethereum’s bearish crossover, a risk we highlighted earlier.

Mega ETH Whales Not Convinced:

Glassnode

Mega ETH Whales Not Convinced:

Glassnode

So even though the bullish harami is active, whales are not supporting the move yet. That keeps the Ethereum price reversal setup weaker than it looks on the chart.

Key Levels Now Decide Whether the Ethereum Price Reversal Expands or Fades

If the bullish pattern holds, Ethereum’s next test sits near $3,333, a short-term level that has limited rebounds this week. That level is mentioned later when we discuss the Ethereum price chart.

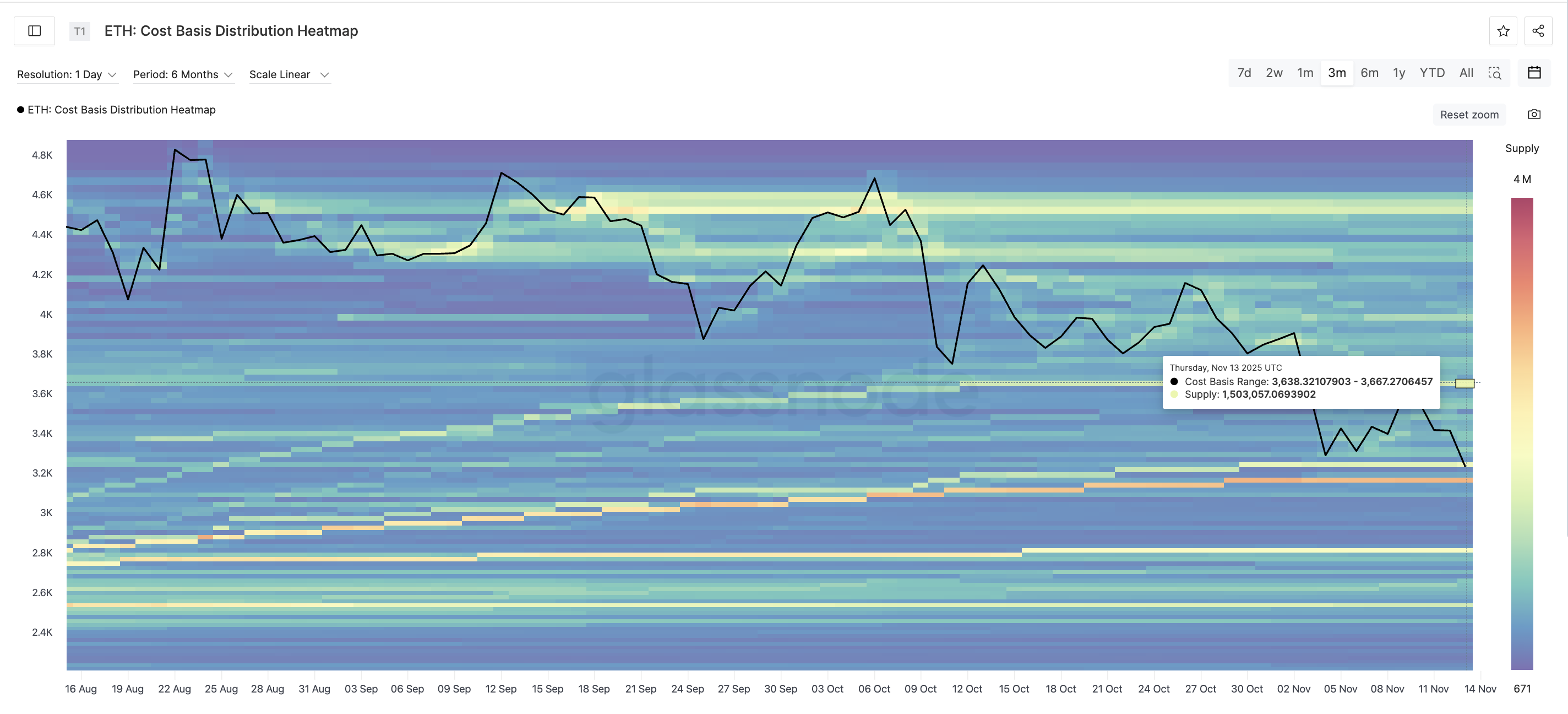

The stronger hurdle is $3,650, which requires a 12% move from the recent low. Data from the cost-basis distribution heatmap, a tool that maps where large amounts of ETH last changed hands, shows that $3,638–$3,667 holds one of the biggest supply zones.

Ethereum Supply Cluster:

Glassnode

Ethereum Supply Cluster:

Glassnode

It contains more than 1.5 million ETH, so clearing it would show strong buyer commitment. This is why the $3,650 level becomes all the more important.

A close above this band would confirm that the bullish harami is working and could open a broader recovery. But if the Ethereum price loses support near $3,150, the pattern weakens fast.

Ethereum Price Analysis:

TradingView

Ethereum Price Analysis:

TradingView

A sharp drop below $3,050 would invalidate the structure and allow sellers to push lower, repeating what happened after the failed harami earlier this month.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin’s Sharp Decline: What Sparks Anxiety During a Bullish Market?

- Bitcoin's 2025 bull market collapsed 30% to $83,824 amid Fed policy shifts and liquidity contractions, defying typical risk-on dynamics. - A 0.72 correlation to Nasdaq 100 and $19B leveraged liquidation event exposed Bitcoin's vulnerability to macro risks and institutional sentiment shifts. - AI-driven algorithms and algorithmic feedback loops amplified volatility, with Treasury yields and dollar strength triggering cascading sales. - Market psychology metrics (Fear & Greed Index, stablecoin outflows) an

Infrastructure Initiatives Fuel Real Estate Growth in Upstate New York: The Impact of Local Government Projects on Industrial Market Transformation

- Webster , NY leveraged a $9.8M FAST NY grant to transform a 300-acre Xerox brownfield into a high-tech industrial hub, slashing vacancy rates to 2%. - Infrastructure upgrades attracted food processing and semiconductor firms , with a $650M fairlife® dairy plant expected to create 250 jobs by 2025. - Strategic site readiness and pre-leased industrial space at the NEAT site reduced investor risk, driving 10.1% residential property value growth since 2023. - The model highlights underpenetrated markets' pot

ZEC Rises 4.81% After Major Investor Increases Long Position with 10x Leverage

- ZEC surged 4.81% in 24 hours to $330.5 amid a whale's 10x leveraged long position on HyperLiquid targeting $333.46. - The whale also holds 20x ETH and 5x DYDX longs but faces $2.7M total losses, highlighting risks of leveraged trading during crypto volatility. - Grayscale's ZEC ETF filing and Chainlink's ETF launch signal growing institutional interest in altcoins, potentially boosting ZEC liquidity and demand. - ZEC's 482.71% annual gain contrasts with 27.45% weekly drop, reflecting its cyclical nature

Amazon takes on rivals by introducing on-site Nvidia ‘AI Factories’