Nearly $5 Billion Bitcoin and Ethereum Options Expire Today Amid A Market on Edge

Nearly $5 billion in Bitcoin and Ethereum options expire today on Deribit, setting the stage for significant short-term volatility. Max pain levels, put/call ratios, and rising open interest suggest BTC and ETH may gravitate toward key strike prices.

Almost $5 billion in Bitcoin and Ethereum options are set to expire on November 14, 2025, at 8:00 UTC on Deribit. These options expiry could shake the prices of BTC and ETH, potentially moving them toward their respective strike prices as expiration approaches.

Today’s expiry is slightly lower than last week’s $5.4 billion, but the stakes are higher today as the market shows weakness. Therefore, traders and investors should closely watch max pain levels and positioning, both of which could impact short-term price action.

Bitcoin Options Market Shows Cautious Optimism

Bitcoin options positioning highlights renewed caution after the pioneer crypto dipped to levels below $100,000 for the second time in a week.

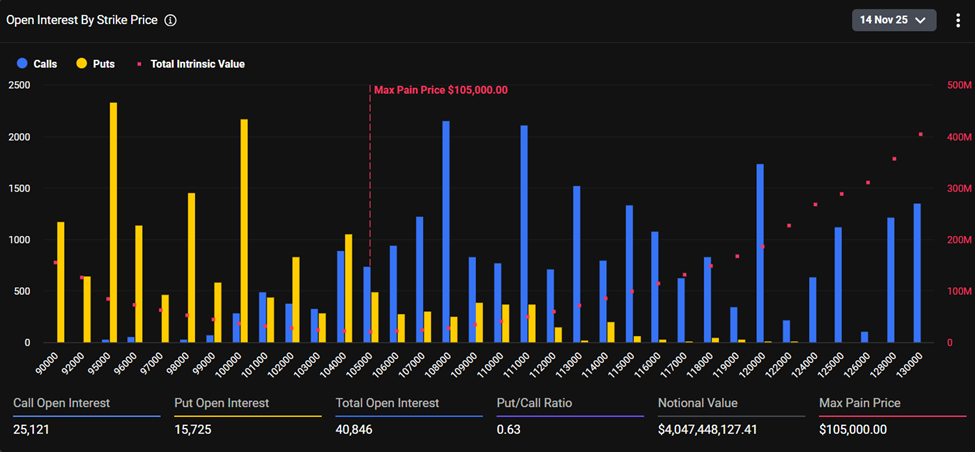

Data on Deribit shows that the maximum pain sits at $105,000, where most traders are bound to suffer the most losses as the options near expiration.

Expiring Bitcoin Options. Source:

Deribit

Expiring Bitcoin Options. Source:

Deribit

Meanwhile, the Put-to-Call ratio (PCR) is 0.63, indicating that there are fewer put options being traded than call options. This inclination suggests a bullish or optimistic market sentiment, as traders are placing more substantial bets on the market to rise.

As of this writing, Bitcoin was trading for $99,092, down by almost 3% in the last 24 hours. Therefore, the bullish bets align with the maximum pain theory, which states that prices tend to move toward their maximum pain (strike price) levels due to the influence of smart money.

A closer look at the chart reveals active hedging, rather than panic, with open interest concentrated near the $95,000 and $100,000 puts (yellow vertical bar) and the $108,000 and $111,000 calls (blue vertical bars), making these key battlegrounds as expiration nears.

Total open interest stands at 40,846 contracts, with calls (25,121) outnumbering puts (15,725). The notional value exceeds $4.04 billion, reflecting the magnitude of this expiry.

Bullish Sentiment Seen in Ethereum Positioning

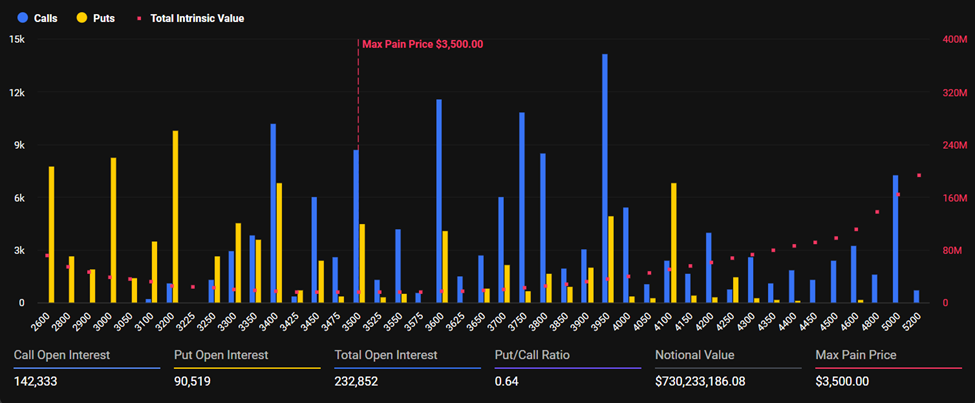

Ethereum options maintain a defensive stance, trading near $3,224 as of this writing, with max pain close to $3,500. Ethereum options’ notional value sits above $730 million.

The put/call ratio is 0.64, slightly higher than that of BTC, suggesting strong bullish sentiment in the market. This indicates that traders are purchasing significantly more call options than put options, anticipating future price increases.

Expiring Ethereum Options. Source:

Deribit

Expiring Ethereum Options. Source:

Deribit

Indeed, the chart above shows call options at 142,333, against only 90,515 put options, translating to a 1.5x+ difference. The total open interest is 232,852.

Meanwhile, today’s options expiry comes amid broader market chaos that goes beyond Bitcoin’s dip below $100,000. Analysts at Greeks.live highlight catalysts such as the recently resolved US government shutdown.

“The US government ended an unprecedented 43-day shutdown, during which a significant amount of economic data was not released on schedule, forcing macroeconomic analysis to rely heavily on projections. The latest CPI data was also not published, significantly amplifying the importance and uncertainty surrounding the next release, as it grants the data agency greater “maneuvering room,” they wrote.

However, they highlight the December Federal Reserve interest rate meeting as the most pivotal event, amid rising uncertainty in macroeconomic data, geopolitical tensions, and the AI boom.

The analysts also note that both open interest (OI) and trading volume continue to rise in the options market, with a notable increase in out-of-the-money option trades.

This indicates growing divergence among market participants regarding future outcomes, reflected in slight increases across major implied volatility (IV) maturities.

“Block trades have also become more active, skew is moving toward equilibrium, and the short-term curve has become more fragmented,” they explained.

Taking all these factors together, they collectively signal heightened market uncertainty about near-term price movements. Thus, a plausible “reason” emerges as a trigger for a market reversal.

Traders should therefore brace for volatility as these options near expiration, but understand that stability comes after, as the markets adjust to the new trading environment.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin’s Sharp Decline: What Sparks Anxiety During a Bullish Market?

- Bitcoin's 2025 bull market collapsed 30% to $83,824 amid Fed policy shifts and liquidity contractions, defying typical risk-on dynamics. - A 0.72 correlation to Nasdaq 100 and $19B leveraged liquidation event exposed Bitcoin's vulnerability to macro risks and institutional sentiment shifts. - AI-driven algorithms and algorithmic feedback loops amplified volatility, with Treasury yields and dollar strength triggering cascading sales. - Market psychology metrics (Fear & Greed Index, stablecoin outflows) an

Infrastructure Initiatives Fuel Real Estate Growth in Upstate New York: The Impact of Local Government Projects on Industrial Market Transformation

- Webster , NY leveraged a $9.8M FAST NY grant to transform a 300-acre Xerox brownfield into a high-tech industrial hub, slashing vacancy rates to 2%. - Infrastructure upgrades attracted food processing and semiconductor firms , with a $650M fairlife® dairy plant expected to create 250 jobs by 2025. - Strategic site readiness and pre-leased industrial space at the NEAT site reduced investor risk, driving 10.1% residential property value growth since 2023. - The model highlights underpenetrated markets' pot

ZEC Rises 4.81% After Major Investor Increases Long Position with 10x Leverage

- ZEC surged 4.81% in 24 hours to $330.5 amid a whale's 10x leveraged long position on HyperLiquid targeting $333.46. - The whale also holds 20x ETH and 5x DYDX longs but faces $2.7M total losses, highlighting risks of leveraged trading during crypto volatility. - Grayscale's ZEC ETF filing and Chainlink's ETF launch signal growing institutional interest in altcoins, potentially boosting ZEC liquidity and demand. - ZEC's 482.71% annual gain contrasts with 27.45% weekly drop, reflecting its cyclical nature

Amazon takes on rivals by introducing on-site Nvidia ‘AI Factories’