Bitcoin Faces Head and Shoulders: Delayed Fuse or Invalidated Pattern?

Bitcoin is testing critical levels as a head and shoulders pattern strengthens. Rising outflows and weakening momentum raise the risk of a deeper pullback unless BTC reclaims $100,000.

Bitcoin is facing renewed volatility as a head-and-shoulders pattern gains strength after last week’s brief fakeout.

The formation has developed over two months and now aligns with a sharp decline that pushed BTC below $100,000.

Bitcoin May Repeat History

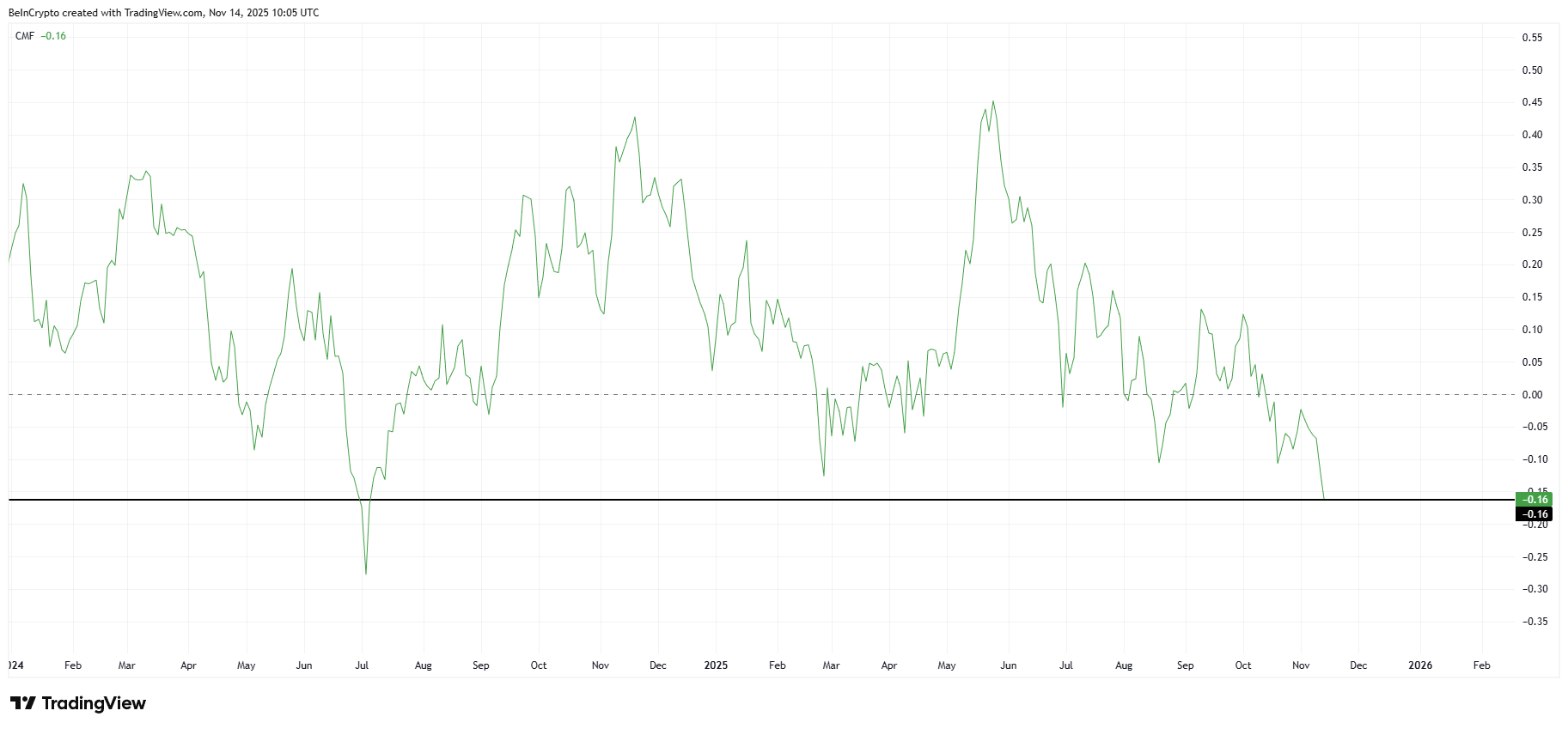

The Chaikin Money Flow shows a significant rise in outflows from Bitcoin. The indicator has dropped to a 16-month low, a level last seen in July 2024. This decline highlights growing caution among investors who are reducing exposure as they question Bitcoin’s ability to mount a quick recovery.

Rising outflows signal waning confidence and may leave Bitcoin vulnerable to further price weakness. As skepticism builds, liquidity continues to soften, increasing the possibility of an extended downturn. If this trend continues, BTC may struggle to hold key support levels in the short term.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

Bitcoin CMF. Source:

Bitcoin CMF. Source:

Bitcoin’s macro momentum is weakening as its exponential moving averages move closer to a potential Death Cross. Historically, similar setups have led to average declines of about 21% before the market stabilizes and begins to recover. This raises the probability of a sharper pullback if BTC fails to regain momentum.

A comparable decline today would bring Bitcoin toward $89,400. While past events do not guarantee outcomes, the current structure resembles previous periods when bearish momentum intensified.

Bitcoin EMAs. Source:

Bitcoin EMAs. Source:

BTC Price Can Note A Reversal

Bitcoin trades at $96,851, sitting just below the critical $100,000 psychological level. This support has been broken four times this month, reflecting indecision and growing pressure from sellers. Market sentiment remains fragile as BTC attempts to stabilize under increased volatility.

The emerging head and shoulders pattern points to a potential 13.6% decline that aligns with the projected target of $89,407. If Bitcoin fails to hold $95,000, the move toward this level becomes more probable. The overlap with the potential Death Cross adds weight to the bearish scenario.

Bitcoin Price Analysis. Source:

Bitcoin Price Analysis. Source:

However, if investor demand strengthens, Bitcoin could reclaim $100,000 as support. A decisive bounce from that level may open the path toward $105,000. Such a move would invalidate the bearish thesis and restore confidence among traders seeking renewed upside momentum.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana News Update: SEC's Crypto ETF Disagreement: Bitcoin Sees $1.6B Outflow, Solana Attracts $26M

- SEC's regulatory decisions drive divergent crypto ETF flows: Bitcoin ETFs lost $1.6B while Solana ETFs gained $26.2M in November 2025. - Traditional firms like Qualigen (now AIxCrypto) and Coincheck pivot to blockchain, signaling growing institutional adoption of decentralized technologies. - South Korea's Dunamu saw 300% Q3 profit growth linked to U.S. crypto regulatory progress, while Harvard invested $442M in Bitcoin ETFs. - SEC's focus on utility-driven crypto projects may accelerate ETF approvals fo

Hyperliquid News Today: Phantom Brings Chains Together, Simplifying Crypto with HyperEVM

- Phantom Wallet integrates Hyperliquid's HyperEVM blockchain, enhancing cross-chain interoperability for crypto users. - Users can now manage HyperEVM assets, trade, and access liquidity directly within Phantom, reducing multi-wallet complexity. - Hyperliquid's $10.6B market cap and high-performance trading features position it as a key player in decentralized derivatives markets. - The integration aligns with industry trends toward simplifying multi-chain interactions, potentially accelerating mainstream

Bitcoin Updates: Turning Point or Opportunity? Recent STH Bitcoin Sales Signal Upcoming Bull Market Rebound

- Bitcoin's recent price drop below $100,000 triggered mass capitulation as short-term holders (STHs) dumped 148,000 BTC at a loss in 48 hours. - Institutional outflows worsened the sell-off, with $866.7M in Bitcoin ETF redemptions on Nov 13, led by Grayscale and BlackRock . - Long-term holders sold 815,000 BTC since Jan 2024, but whale wallets absorbed 45,000 BTC weekly, signaling potential market rebalancing. - Technical indicators show Bitcoin testing $94,000 support, with STH selling risks pushing pric

Bitcoin News Update: MARA Deposits $58M in Bitcoin—Strategic Move or Indication to Sell?