Buyers Still Want a Piece of Pi Coin — But That Might Not Be a ‘Smart’ Move Now

The PI Coin price is holding better than the market, but the signals behind it don’t match. Money flow shows buyers, yet volume and smart money tell a different story.

Pi Coin price is down almost 5% today and roughly 2.3% this week. It has kept only 1% of its monthly gains. It also held better than the broader crypto slide, with the market falling about 6% while Pi Coin sank 4.8%. That looks like strength at first glance, but this kind of “holding better” often happens when an asset is simply lagging, not leading.

The indicators show why the move is not as stable as it looks.

Buyers Are Active, but the Support Behind Them Looks Weak

The Money Flow Index (MFI), which tracks whether money is entering or leaving an asset by combining price and volume, has been rising since November 12. Even during the latest three-day dip, MFI did not fall; instead, it continued to push upward and stayed above its recent lows.

This means dip-buying exists. People are still stepping in to accumulate Pi Coin whenever the price pulls back, and the interest is not fake.

Pi Coin Buyers Exist:

TradingView

Pi Coin Buyers Exist:

TradingView

But if you look at the broader pattern, the MFI is still moving under the trendline and has made a lower low (when Pi Coin price made higher lows) since November 4. This bearish divergence means that the dip buying pressure is there, but weak.

And when we place MFI next to On-Balance Volume (OBV), the picture becomes clearer.

OBV measures whether volume is flowing in on green candles or red candles. It broke below its rising trendline from October 22. That breakdown matters because it shows that the buyers are present, but not strong enough to lift the market. And the buying pressure is gradually weakening.

Lack Of Volume Is An Issue:

TradingView

Lack Of Volume Is An Issue:

TradingView

MFI says dip-buying exists. OBV says the buying isn’t strong. The gap between these two is the core warning in the chart. It tells us buyers want PI, but they are not backing it with enough volume for the move to turn into a real push higher.

Key Pi Coin Price Levels Show Why Buyers Might Not Be “Smart” Enough

The Pi Coin price chart adds the next layer. PI sits near $0.209, a support level with several past reactions. If this level breaks, sellers have room to push toward $0.192 and even $0.153.

The near-term downside risk from here is roughly 3%. On the other hand, reclaiming strength means first clearing $0.236. That level has repeatedly capped rebounds, and breaking it would open the door to about 9% upside toward $0.285.

So the setup is tight. PI has a shallow downside near $0.209 and the potential for a larger upside if it can break resistance. At a glance, this might look balanced — but the Smart Money Index changes the equation.

The Smart Money Index tracks how informed, patient traders position themselves. When the index rises, it shows stronger hands are buying. When it falls, it signals hesitation.

Pi Coin Price Analysis:

TradingView

Pi Coin Price Analysis:

TradingView

Right now, the Smart Money Index is not rising with the PI price. Instead, it has started moving away from the signal line. It shows that the more informed group is not betting on a strong rebound.

This matches the weak OBV reading and goes against the small rise in MFI. In simple terms: buyers exist, but the “smart” side of the market isn’t supporting them.

That is why the downside move of over 3% for the Pi Coin price looks more likely. Only a push above $0.236 invalidates the bearishness. But that would need the MFI indicator crossing above the descending trendline.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana News Update: Major Institutions Invest Billions While Solana Boosts Its Scarcity Approach

- Solana developers propose reducing future SOL emissions by 22M tokens to accelerate disinflation, targeting 1.5% terminal inflation twice as fast. - Institutional adoption grows via staking-enabled ETFs like VanEck's and Bitwise's BSOL , creating dual-income streams through exposure and yield. - Despite $424M in BSOL assets, Solana's price fell below $140 support, with derivatives data signaling short-term selling pressure and crowded long positions. - Coinbase's Vector acquisition enhances Solana's inst

Bitcoin Latest Updates: Macroeconomic Factors and Earnings Challenges Drive 44% DeFi Downturn

- Market analysts predict a 44% correction in DeFi and crypto sectors due to macroeconomic risks, Fed policy uncertainty, and weak corporate earnings. - HIVE Digital faces scrutiny over Bitcoin holdings reduction and shareholder dilution, while Hyster-Yale reports Q3 losses amid industry margin pressures. - Data center infrastructure emerges as a growth outlier with $11.1B backlog and $320B 2030 market projection, though labor shortages and permitting delays persist. - Goldman Sachs adjusts energy sector o

Ethereum Updates Today: Institutional Confidence Faces Challenges Amid Ethereum's Price Fluctuations and Upcoming Upgrades

- Galaxy Digital's 7,098 ETH withdrawal from Binance raises concerns over Ethereum's institutional activity and market stability amid macroeconomic pressures. - ETH faces $993M long liquidation risk below $2,600 and $1.07B short liquidation risk above $2,900, highlighting leveraged position fragility. - Institutional staking inflows remain steady despite declining ETH futures open interest (-7% weekly) and reduced ETF net inflows ($10M vs. $65M in October). - Upcoming Dencun upgrade (EIP-4844) aims to redu

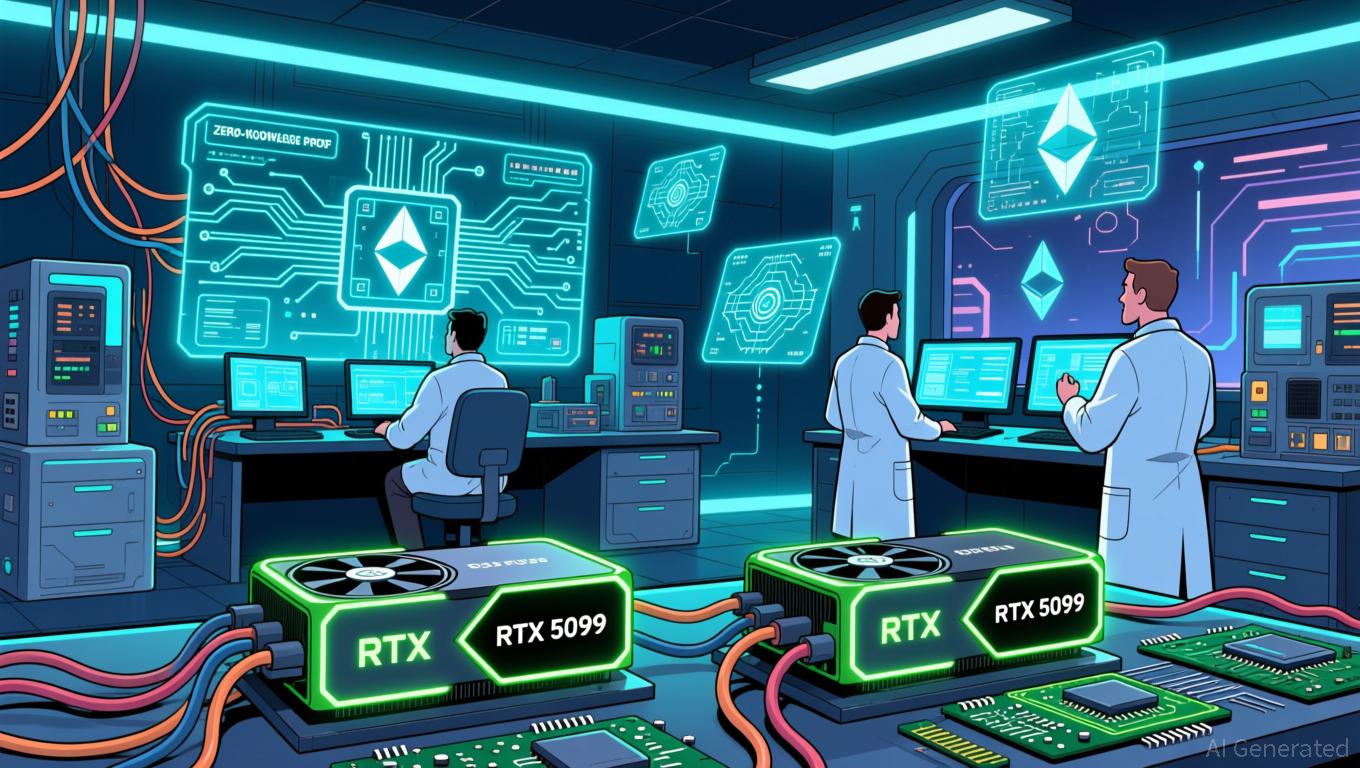

Ethereum Updates: Consumer Graphics Cards Drive Cost-Effective and Decentralized Ethereum Scaling

- zkSync's Airbender prover achieved L1 block proofs using two RTX 5090 GPUs, praised by Vitalik Buterin as a "huge milestone" for Ethereum's scalability. - The breakthrough enables "gigagas L1" expansion, potentially reducing fees and enabling near-zero L2 costs through consumer-grade hardware accessibility. - Succinct's SP1 Hypercube demonstrated 99.7% real-time L1 proving under 12 seconds with 16 RTX 5090s, advancing ZK tech alongside zkSync's progress. - Buterin cautioned against over-optimism, noting