The sell-off in US tech stocks intensifies as rate cut expectations are dampened, fueling market panic.

BlockBeats News, November 14 – On Friday during the US trading session, a sell-off led by technology stocks deepened in the US stock market, with major benchmark indices breaking below support levels as concerns grew that the Federal Reserve might not cut rates at its next meeting.

The S&P 500 index opened 0.8% lower on Friday, extending the tech-led plunge and falling below its 50-day moving average. The sell-off in technology stocks also dragged down the Nasdaq 100 index, which opened down 1%. The blue-chip Dow Jones Industrial Average dropped 1.1%. The Chicago Board Options Exchange Volatility Index climbed above 22.

Brian Jacobsen, Chief Economist at Annex Wealth, said: "There is always something for the market to worry about. Currently, concerns about the Federal Reserve pausing action in December have replaced worries about a prolonged government shutdown. Although the government has reopened, economic data remains in the 'dark,' and it will take more time to resolve this. This is also part of the reason why the stock market has been pulling back and trying to find its footing." (Golden Ten Data)

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The US Dollar Index rose by 0.14% on the 14th.

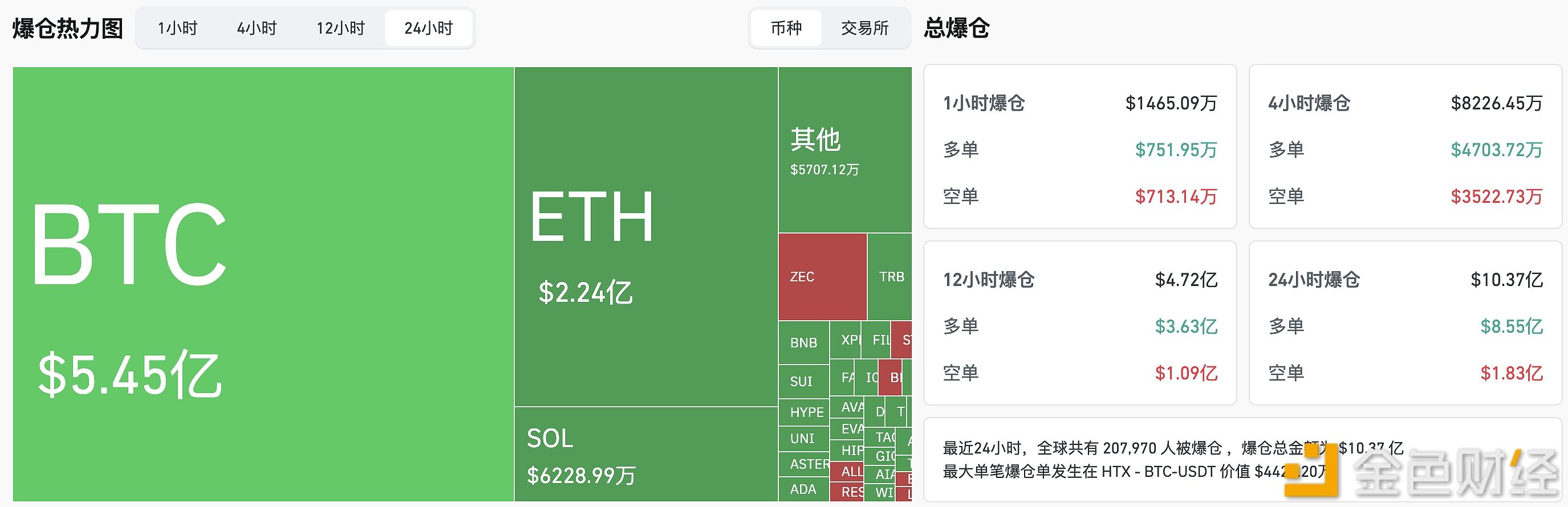

In the past 24 hours, liquidations across the entire network reached $1.037 billion.

Data: 100 WBTC transferred out from Galaxy Digital, worth approximately $9.51 million

Data: 1.927 million ENA flowed into a certain exchange's Prime, worth approximately $5.51 million