Tom Lee’s BitMine Acts Fast as Ethereum Whale Pattern Breaks | US Crypto News

Ethereum whales are breaking from their long-standing pattern as some exit at breakeven while others accumulate billions. Tom Lee’s BitMine is moving aggressively, buying another 9,176 ETH from Galaxy Digital while the price stalls near $3,100.

Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee because of how whales are splitting. Institutions are quietly loading up, and Tom Lee’s BitMine is moving faster than anyone as a major on-chain pattern breaks. With Ethereum (ETH) stuck in the $3,100 range, and volatility spiking across the market, a new battle line is forming between panic sellers and high-conviction buyers.

Crypto News of the Day: BitMine Buys 9,176 ETH From Galaxy Digital OTC

Ethereum’s biggest players are suddenly split, and Tom Lee’s BitMine is moving faster than anyone. As ETH hovers near $3,100 with mixed technical signals, whales are either panic-selling at breakeven or doubling down with record-size buys. BitMine has firmly chosen its side.

Ethereum (ETH) Price Performance. Source:

Ethereum (ETH) Price Performance. Source:

Despite a sharp market downturn, BitMine continues to accumulate at scale. On-chain data from Lookonchain shows a new BitMine-linked wallet, 0x9973, receiving 9,176 ETH, valued at $29.14 million, directly from a Galaxy Digital OTC wallet.

“Despite the market downturn, Tom Lee’s Bitmine is still buying $ETH,” Lookonchain reported, highlighting Lee’s aggressive strategy.

This follows earlier activity confirming a total accumulation of 19,500 ETH in BitMine, positioning the firm among the most active institutional buyers in November.

🚨 BREAKINGWHALES AND INSTITUTIONS ARE BUYING THE DIP!SATOSHI WHALE BOUGHT 420,000 $ETHFIDELITY BOUGHT 2,000 $BTCSTRATEGY BOUGHT 17,600 $BTCBITMINE BOUGHT 19,500 $ETHANCHORAGE DIGITAL BOUGHT 4,000 $BTCCRAZY ACCUMULATION HAPPENING BEHIND THE SCENES RIGHT NOW 🤯

— 0xNobler (@CryptoNobler) November 14, 2025

Whales Break Pattern: Some Sell at Breakeven, Others Buy Billions

A closer look at additional on-chain transactions suggests that broader whale activity is fragmented. A long-term holder, wallet 0x0c19, has just sold 2,404 ETH tokens, valued at $7.7 million, which they had held since August 2021. At today’s prices, the whale appears to be exiting at breakeven, signaling fading confidence after years of inactivity.

Meanwhile, a super-whale known as #66kETHBorrow is doing the opposite. They added another 16,937 ETH ($53.9 million), bringing their total to 422,175 ETH ($1.34 billion) in just a few days. Despite sitting on approximately $126 million in unrealized losses, this whale continues to accumulate with conviction.

Update:Whale #66kETHBorrow just bought another 16,937 $ETH($53.91M)Total purchases: 422,175 $ETH($1.34B)

— Lookonchain (@lookonchain) November 14, 2025

Machi Brothers Add Leverage Even While Deep in the Red

Traders Machi Big Brother and Machi Small Brother have also doubled down. Both increased their long positions on Hyperliquid:

- Machi Big Brother: 7,400.7 ETH ($23.55 million), liquidation at $3,040

- Machi Small Brother: 5,000 ETH ($15.9 million), liquidation at $2,794

Lookonchain notes that both traders added margin as ETH fell to avoid liquidations, signaling confidence in a rebound despite being heavily underwater.

Tornado Cash Wallet Sparks Richard Heart Speculation

Elsewhere, a Tornado Cash-linked wallet, 0xa13C, sold 4,978 ETH ($16.29 million) at $3,273. On-chain data shows this same entity previously deposited 162,937 ETH, funds associated by analysts with Richard Heart, founder of HEX and PulseChain.

Another wallet, 0xa13C, received 4,978 $ETH ($16.29M) from and sold it at $3,273 eight hours ago.Previously, Richard Heart(, founder of HEX, PulseChain, and PulseX) deposited all 162,937 $ETH($619M) he bought at $3,800 last year into…

— Lookonchain (@lookonchain) November 14, 2025

No confirmation has surfaced, but the sale adds to the narrative of whale divergence.

“Crazy accumulation happening behind the scenes,” DeFi researcher 0xNobler said.

The next major catalyst for Ethereum arrives in December, the Fusaka upgrade. Crypto Rover noted that the smaller Pectra upgrade pushed ETH up 50%, adding weight to expectations for renewed volatility.

The massive $ETH Fusaka upgrade is coming this December.The smaller Pectra update pushed $ETH up 50%.Prepare accordingly.

— Crypto Rover (@cryptorover) November 14, 2025

With whales deeply divided and institutions silently accumulating, Ethereum’s next move may hinge on whether BitMine and other large buyers can flip sentiment before December’s upgrade window.

Chart of the Day

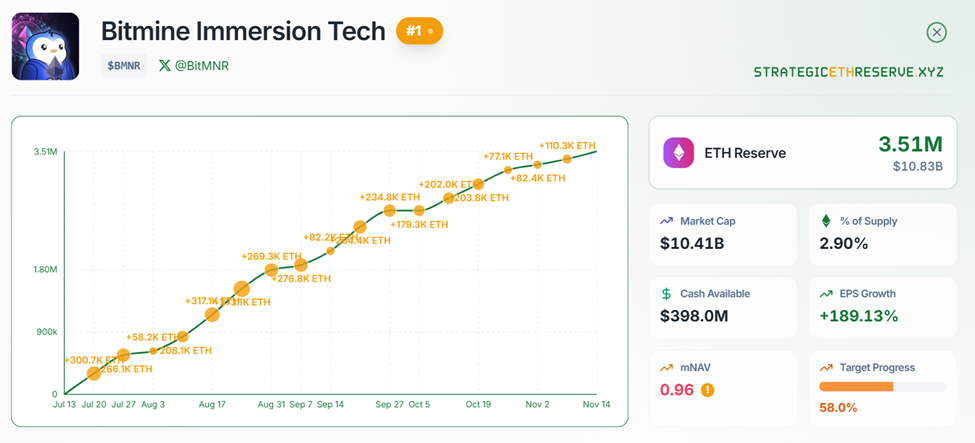

BitMine Ethereum Holdings. Source:

BitMine Ethereum Holdings. Source:

Byte-Sized Alpha

Here’s a summary of more US crypto news to follow today:

- UAE’s new law sparks ‘Bitcoin ban’ fears after harsh penalties.

- How Grayscale holds XLM as the price drops more than 50%.

- Democrats and Republicans find rare common ground on Bitcoin, new data shows.

- Analysts liken stress levels to FTX era as crypto liquidations exceed $1.1 billion.

- Circle stock sinks back to IPO Price amid rising insider unlocks and volatility fear.

- Not ETF buzz, nor whales — This group can save Dogecoin (DOGE) price from a breakdown.

- Bitcoin death cross in 48 hours — is this the real bottom or a drop to $70,000?

- Nearly $5 billion in Bitcoin and Ethereum options expire today amid a market on edge.

Crypto Equities Pre-Market Overview

| Company | At the Close of November 13 | Pre-Market Overview |

| Strategy (MSTR) | $208.54 | $202.41 (-2.94%) |

| Coinbase (COIN) | $283.14 | $274.51 (-3.05%) |

| Galaxy Digital Holdings (GLXY) | $27.24 | $26.06 (-4.33%) |

| MARA Holdings (MARA) | $12.78 | $12.35 (-3.36%) |

| Riot Platforms (RIOT) | $13.88 | $13.30 (-4.18%) |

| Core Scientific (CORZ) | $15.16 | $14.87 (-1.91%) |

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Risks and Insights from the COAI Token Fraud: A 2025 Handbook for Cryptocurrency Due Diligence and Safeguarding Investors

- COAI Token's 2025 collapse caused $116.8M losses, exposing systemic risks in algorithmic stablecoins and centralized governance. - Project's 96% supply concentration in ten wallets, opaque team identities, and weak tokenomics flagged regulatory red flags. - Global regulators froze $150M in assets but exposed jurisdictional gaps, while EU and US introduced crypto frameworks with conflicting standards. - Investors now prioritize AI audits, multi-sig wallets, and KYC compliance to mitigate risks in speculat

COAI's Unexpected Downturn in Late 2025: A Warning Story on AI Stock Valuations and Governance Risks

- COAI Index's 88% YTD drop highlights systemic risks in speculative AI equities and crypto assets amid strong AI infrastructure growth. - C3 AI's Q3 revenue growth contrasts with non-GAAP losses, underscoring AI sector's profitability challenges vs. disciplined tech peers like Benchmark Electronics. - CLARITY Act's regulatory ambiguity and EU AI Act compliance costs deter institutional investment, exacerbating COAI's governance and liquidity issues. - COAI's "fake decentralization" and C3 AI's leadership

Vanguard opens platform to Bitcoin ETFs and ends two-year blockade

3 Strong Altcoin Picks Showing Clear Growth Momentum — GIGA, ALGO, and NOT