"Global financial markets caught in a struggle as the Federal Reserve weighs concerns over inflation against the need for liquidity"

- Fed officials' divided views on rate cuts triggered global market declines, with Asian and European indices falling amid inflation concerns. - UK unemployment rose to 5.0% while Switzerland secured a 15% US tariff cut, boosting growth projections and bilateral investments. - Data gaps before the Fed's December meeting intensified uncertainty, with investors pricing in shifting cut probabilities and hoarding $7.535T in cash. - Central banks face balancing acts as 10-year Treasury yields climbed to 4.125%,

This week, both European and American markets experienced fresh volatility as Federal Reserve officials expressed differing opinions on future interest rate moves, heightening investor uncertainty. Stock markets worldwide, including major Asian indices such as Japan’s Nikkei and South Korea’s Kospi, declined following

The downturn also affected European stocks, where the STOXX 600 index showed mixed results. Although

Yields on U.S. Treasuries moved higher as investors adjusted their expectations for the Fed’s next steps. The 10-year yield climbed to 4.125%, while the 2-year yield remained at 3.597%, highlighting the ongoing struggle between inflation threats and the need for short-term funds

Despite the prevailing uncertainty, there were some positive trade developments. Switzerland

The Fed’s future decisions remain uncertain due to missing data, as inflation and employment figures for October and November are likely to be unavailable before the December meeting

With markets preparing for more swings, analysts are monitoring how central banks will juggle their desire to lower rates with the risk of sparking renewed inflation. In the meantime, the lack of clear direction has led investors to play it safe, pushing money market fund holdings

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

AAVE drops 1.47% amid Aave’s overhaul of its multichain approach

- Aave's multichain strategy shift caused AAVE to drop 1.47% despite 7.08% weekly gains. - Governance proposal aims to consolidate operations on high-revenue chains like Ethereum , phasing out low-performing deployments. - Strategy prioritizes capital efficiency and risk management by focusing liquidity on core networks with stronger revenue potential. - Unanimous DAO support signals industry trend toward quality-focused chain selection over maximalist expansion in DeFi.

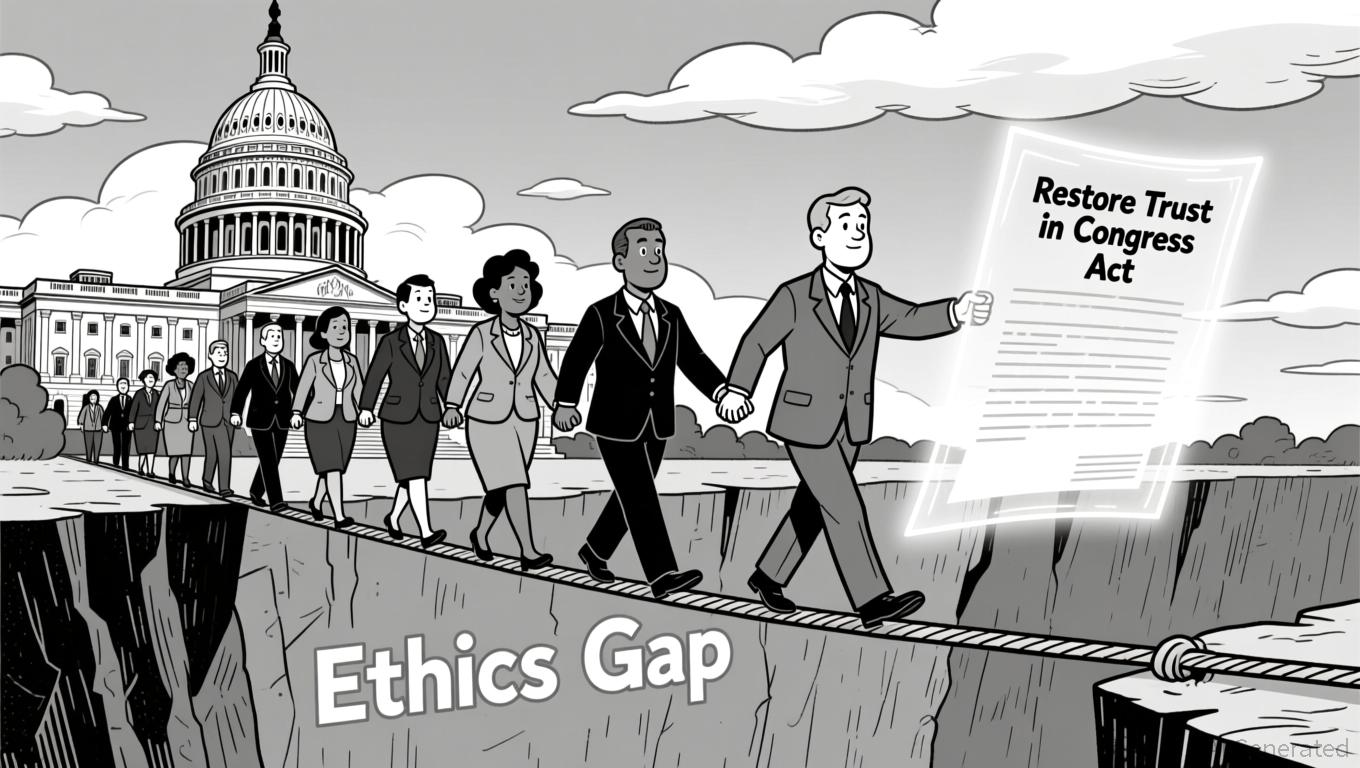

LUNA Price Remains Steady as U.S. Lawmakers Advance Stock Trading Ban

- LUNA's price remained stable at $0.0727 in 24 hours but fell 82.47% annually amid U.S. legislative efforts to restrict congressional stock trading. - Rep. Anna Paulina Luna's bipartisan bill seeks to ban lawmakers, spouses, and children from individual stock trading to address ethical conflicts. - The bill, supported by 100+ co-sponsors, faces opposition over financial flexibility concerns for lower-income legislators amid unchanged congressional salaries since 2009. - A discharge petition aims to force

PENGU Price Forecast for 2026: Managing Fluctuations and Momentum from Key Catalysts After the 2025 Market Adjustment

- 2025 crypto market correction reshaped altcoin dynamics as Bitcoin/Ethereum declined amid macroeconomic uncertainty and regulatory pressures. - Pudgy Penguins (PENGU) saw sharp volatility post-correction, with technical indicators suggesting potential $0.069 rebound by 2026 if adoption metrics align. - Strategic partnerships with Bitso and cross-chain integrations, plus Kung Fu Panda NFT collaborations, aim to boost PENGU's liquidity and mainstream adoption. - Despite 12% early 2026 price drop, Pudgy Inv

ZEC Value Increases by 4.82% Following Recent Exchange Listing

- Zcash (ZEC) surged 4.82% in 24 hours after Bitget listed it for spot trading on Dec 3, 2025, boosting short-term liquidity and visibility. - Zcash’s zero-knowledge proof technology enables encrypted transactions while maintaining blockchain integrity, distinguishing it as a privacy-focused asset. - Bitget’s UEX model supports multi-chain access, aligning with Zcash’s goal to balance transparency and privacy, though recent 7-day and 1-month declines highlight market volatility risks.