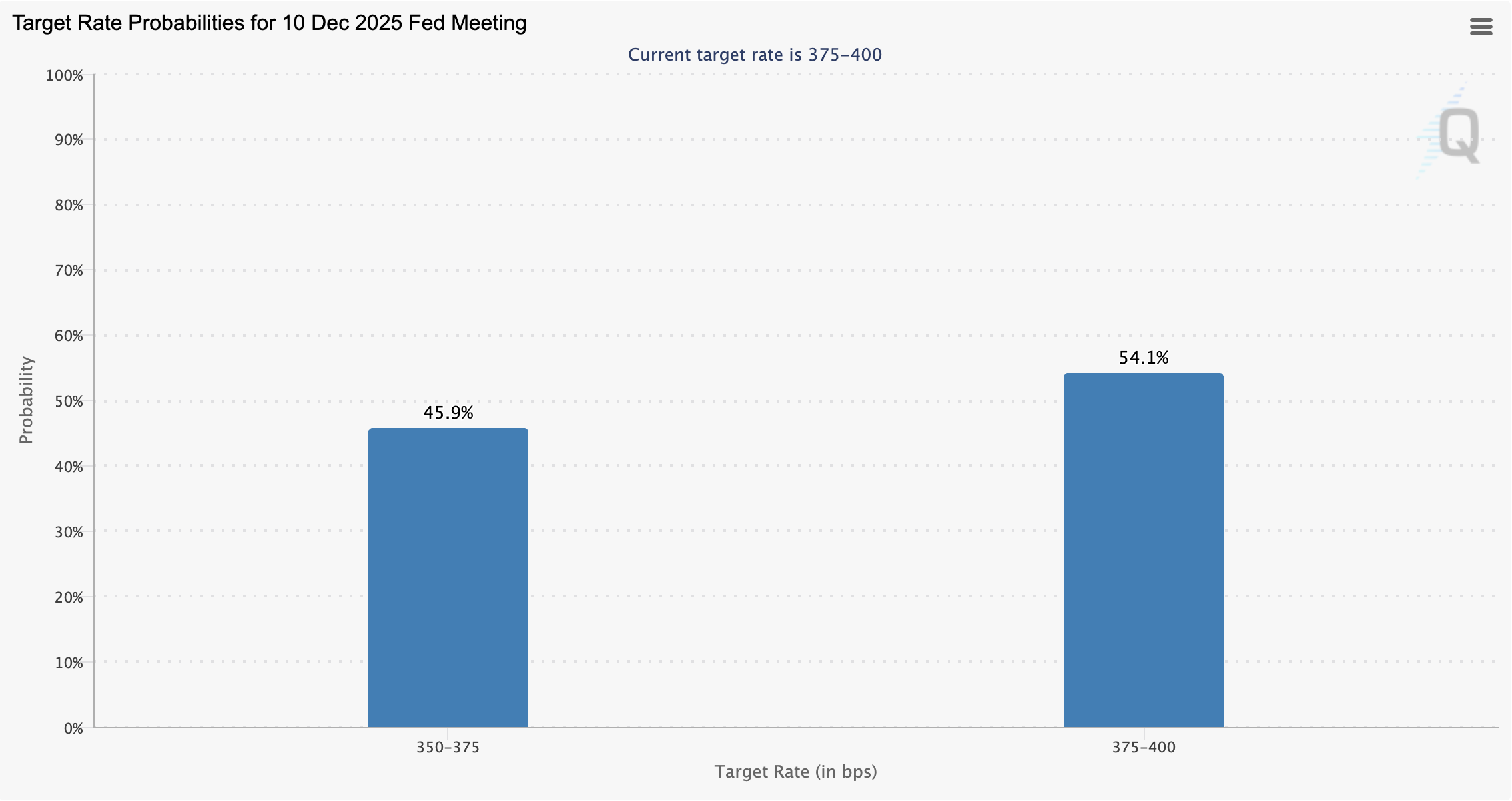

Probability of December interest rate cut falls below 50%

Only 45.9% of investors anticipate an interest rate cut at the next US Federal Open Market Committee (FOMC) meeting in December, amid declining market sentiment and a downturn in the cryptocurrency market.

The odds of a 25 basis point (BPS) interest rate cut in December were nearly 67% on Nov. 7, according to data from the Chicago Mercantile Exchange (CME) Group.

In September, several banking institutions forecast at least two interest rate cuts in 2025, with market analysts at investment banking company Goldman Sachs and banking giant Citigroup each projecting three 25 BPS cuts in 2025.

Interest rate decisions influence crypto prices. Lower interest rates translate into more liquidity flowing into asset markets and propping up prices, while higher rates mean liquidity and prices will be constrained.

The declining odds of a December rate cut are feeding negative market sentiment and may signal that more short-term price pain is coming to the crypto market until the Federal Reserve resumes easing rates.

Related: Stablecoin demand is growing, and it can push down interest rates: Fed’s Miran

Federal Reserve’s Jerome Powell casts doubt on a December rate cut

“There were strongly differing views about how to proceed in December. A further reduction in the policy rate at the December meeting is not a foregone conclusion — far from it. Policy is not on a preset course,” Federal Reserve Chair Jerome Powell said in October.

As expected, the Federal Reserve slashed rates by 25 BPS in October; however, crypto prices extended their decline following the lowered rates.

The October rate cut was “fully priced in” by investors, who widely anticipated the cut months ahead of time, according to Matt Mena, a market analyst at investment company 21Shares.

Economist and former hedge fund manager Ray Dalio warned that the Federal Reserve is cutting rates into record-high asset prices, relatively low unemployment and low credit spreads, a historic anomaly.

In November, Dalio said the Federal Reserve is likely stimulating the economy into a bubble, adding that this is a feature typical of debt-laden economies headed toward hyperinflation and currency collapse.

Magazine: If the crypto bull run is ending… it’s time to buy a Ferrari: Crypto Kid

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

RWA Tokens Set for a Major Breakout? Santiment Data Shows Developer Momentum Surging

Czech National Bank Buys Bitcoin in a Small-Scale Test

SIERRA Token Connects DeFi and Conventional Finance Through Adaptive Hybrid Returns

- Sierra Protocol launches SIERRA, a DeFi token blending institutional RWAs and blue-chip protocols to offer fee-free, liquid yield without lockups. - The token dynamically rebalances reserves between U.S. Treasuries and DeFi platforms like Aave via OpenTrade's infrastructure and Fireblocks custody. - Avalanche's RWA ecosystem now holds $1.24B in tokenized assets, with SIERRA enabling instant yield generation and real-time portfolio transparency. - The hybrid model bridges traditional finance security with

ZEC Rises 9.28% in 24 Hours as Privacy-Oriented Treasury Debuts

- Cypherpunk Technologies established a $50M Zcash (ZEC) treasury, acquiring 1.25% of total supply via $58.88M private placement led by Winklevoss Capital. - CEO Douglas Onsi emphasized long-term Zcash commitment, with plans to accumulate up to 5% supply while transitioning to Nasdaq listing (CYPH ticker). - Tyler Winklevoss called Zcash "encrypted bitcoin ," highlighting privacy features as complementary to Bitcoin amid rising demand for confidential transactions. - ZEC surged 9.28% in 24 hours, reflectin