Aave ‘Push’ Gains Ireland’s MiCA Approval for Euro-to-Crypto Conversion Services

Ireland is positioning itself as a central gateway for Europe’s regulated DeFi expansion after Aave Labs secured full MiCAR approval for its new fiat-to-stablecoin service, Push.

The authorization establishes the country as a compliant on-ramp for digital assets at a time when European regulators are tightening scrutiny and demanding stronger consumer guarantees. Ireland’s growing regulatory clarity also strengthens its role as a preferred base for crypto firms seeking predictable oversight across the European Economic Area (EEA).

Push Introduces Zero-Fee Stablecoin Conversion

According to the press release, Aave Labs plans to launch Push across the EEA following Ireland’s Crypto-Asset Service Provider approval. The service will allow users to move between euros and supported stablecoins at zero cost. It works across Aave Labs’ products and supports GHO and several other major stablecoins. Consequently, the tool gives DeFi users a simple method to convert funds without extra fees or complicated steps.

Related: Aave Labs Unveils Plans to Upgrade its Protocol to Version 4

A new local entity, Push Virtual Assets Ireland Limited, will operate the service directly from Ireland. The entity is fully regulated under MiCA rules, which now mandate consumer-protection safeguards, clear disclosures, and transparent asset handling. Besides offering regulatory clarity, Ireland provides Aave Labs with a market that has established financial-services infrastructure and an active digital-innovation ecosystem.

Ireland Strengthens Its Crypto Position Under MiCA

Ireland’s stance toward digital-asset regulation has changed quickly over the past two years. The Central Bank of Ireland increased supervision of exchanges, wallet providers, and token issuers.

Officials now apply stricter reporting standards, stronger risk checks, and enhanced consumer-protection measures. The country also works closely with European regulators to align its enforcement with MiCA as the framework rolls out across the EEA.

This regulatory clarity has attracted several global crypto and fintech firms to expand their Irish operations. Local policymakers are actively promoting innovation hubs, research partnerships, and talent development, fitting the Aave Labs approval into a broader national strategy focused on regulated growth rather than unrestricted experimentation.

Stablecoins Gain Traction Across Europe

Stablecoins continue to grow across Europe as supply exceeds $300 billion in 2025. A significant portion circulates through Aave’s lending markets, where users rely on predictable liquidity and transparent mechanics. Push aims to streamline access to these markets by linking bank transfers and DeFi services through one regulated channel.

Additionally, Aave Labs maintains the decentralized structure of the Aave Protocol. The MiCA approval applies only to Push, which handles the regulated conversion process. Consequently, users gain a safer entry point to decentralized finance without changing how the underlying protocol functions.

Related: Aave Chain Initiative Founder Faults MakerDAO’s Proposed $1B Allocation Via Morpho Labs

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Latest Updates: While Cryptocurrencies Decline, Major Institutions Reinforce Their Commitment to Long-Term Prospects

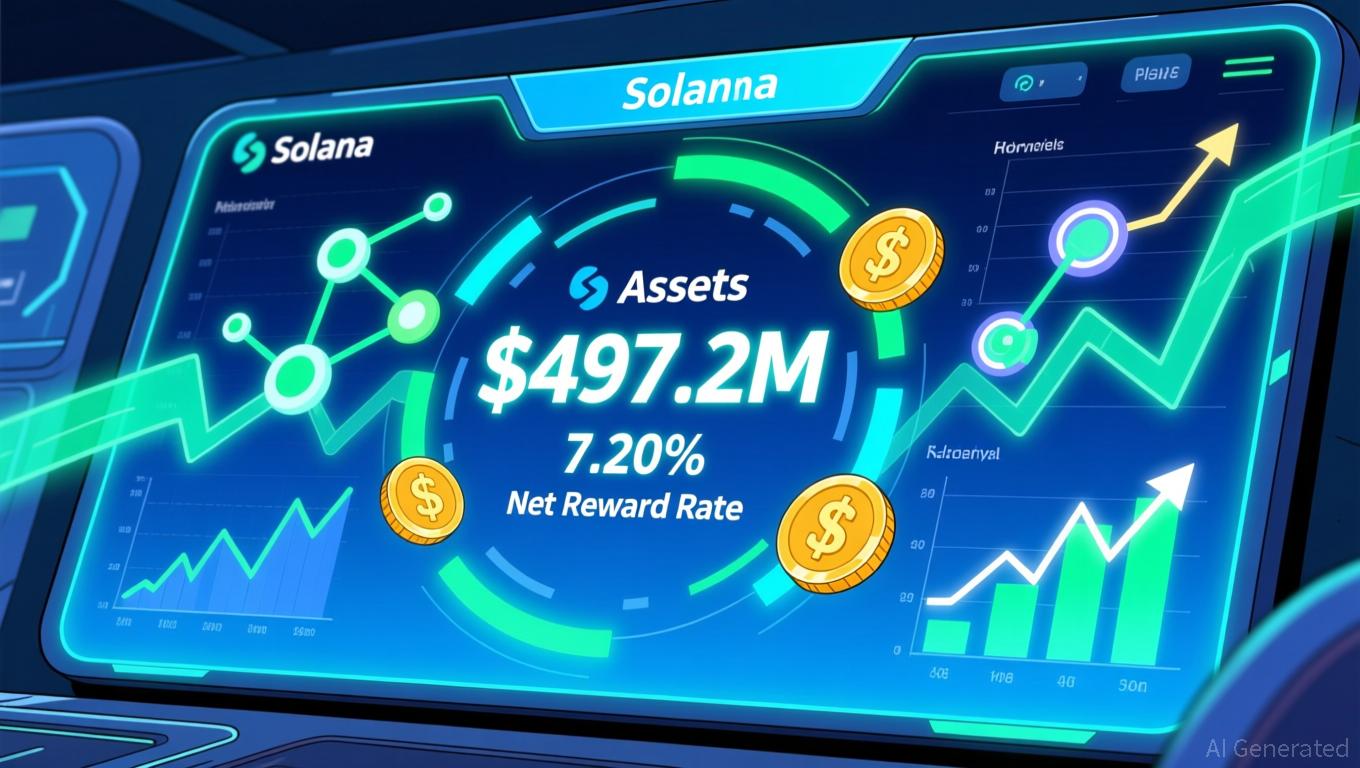

- Bitwise CEO Hunter Horsley asserts crypto's long-term fundamentals remain strong despite recent market selloffs, citing ETF growth and regulatory progress. - Bitwise's $497M Solana Staking ETF (BSOL) dominates 98% of Solana ETF flows, offering 7.20% staking rewards and options trading since November. - U.S. regulators advance crypto-friendly measures including leveraged spot trading plans, while institutions like BlackRock expand digital asset offerings. - Despite Bitcoin's $95k dip and bearish technical

LUNA Rises 9.00% in a Day Following Debut of Namibian High-End Resort and Expansion of Mining Drilling Operations

- LUNA surged 9% in 24 hours but fell 79.24% annually amid mixed technical indicators. - Gondwana Collection Namibia launched the Luna Namib Collection, a luxury desert retreat opening July 2026 with private stargazing and tailored experiences. - NGEx Minerals began Phase 4 drilling at Lunahuasi, targeting 25,000 meters of high-grade copper, gold , and silver deposits with C$175M funding. - The "Luna" name gained cross-sector relevance in tourism and mining, prompting backtesting strategies to analyze pric

COAI's Latest Price Decline: An Overreaction by the Market and a Chance for Undervalued Investment

- COAI Index plunged 88% YTD in Nov 2025 amid AI/crypto AI sector selloff, driven by C3.ai's leadership turmoil, $116.8M losses, and regulatory ambiguity. - C3.ai's Q1 2025 revenue rose 21% to $87.2M, with 84% recurring subscription income, highlighting resilient business fundamentals despite unprofitability. - AI infrastructure stocks like Celestica (CLS) surged 5.78% as analysts raised price targets to $440, contrasting crypto AI's freefall and signaling market overcorrection. - Regulatory clarity on AI/

Aave News Update: MiCA Green Light Spurs Aave’s No-Fee On-Ramp, Accelerating Widespread DeFi Integration

- AAVE token gains bullish momentum as on-chain growth and MiCA regulatory approval align for potential $450 price surge. - Technical indicators like TD Sequential signal strong buy opportunities, with $250 breakout likely to trigger renewed uptrend. - Aave becomes first DeFi protocol authorized under MiCA, enabling zero-fee euro-crypto conversions across EEA via GHO stablecoin. - Protocol's $542M daily volume and $22.8B borrowed assets highlight operational growth outpacing undervalued market price. - MiC