XRP News Today: XRP's Surge Accelerates as Large Investors and ETF Anticipation Drive Optimism—Yet Potential Threats Remain

- XRP surged 12% in 24 hours, driven by $550M accumulation from whales and ETF approval speculation. - On-chain data shows 216M tokens ($556M) withdrawn from exchanges, signaling institutional confidence in future price growth. - Technical indicators like RSI breakout above 50.0 and $2.50 price stability support bullish momentum toward $2.64-$2.75 targets. - Ripple's SEC lawsuit resolution and Mastercard/Gemini partnerships boost institutional interest, though legal risks and Bitcoin volatility remain conc

XRP experienced a price jump of more than 12% within a single day, driven by major investors accumulating $550 million worth of the token and rising speculation about possible exchange-traded fund (ETF) approvals,

This surge came after a significant amount of

Interest from institutional investors is on the rise, spurred by greater regulatory certainty after Ripple’s partial victory in its SEC case and ongoing rumors about ETF launches. Multiple asset management firms have applied for spot XRP ETFs, and market trackers estimate a 95% likelihood of approval by mid-November. Such products could open regulated investment channels for large-scale investors,

Despite the positive sentiment, some caution remains. Although XRP’s technical setup looks promising, analysts caution that failing to break above $2.64 could lead to a pullback to the $2.36 support level, which would undermine the bullish scenario. Additionally,

Crypto analyst STEPHISCRYPTO stressed that the current investor stance is "not optimistic enough," arguing that the RSI breakout and large-scale accumulation by whales point to a stronger rally ahead. "Should this pattern persist, XRP’s recovery could extend well beyond its present range," the analyst stated

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The community shapes the future of blockchain gaming with SACHI

- SACHI launches "The Origin" NFT event (200 exclusive OGs) to precede $SACHI token launch, offering early access and in-game perks. - CEO Jonas Martisius emphasizes NFTs as symbols of early support, fostering community engagement ahead of November 19 TGE. - Limited availability and "Origin" status incentives aim to drive exclusivity and loyalty in blockchain gaming ecosystem. - SACHI's vision integrates blockchain to create a self-sustaining gaming universe with tokenized rewards for player contributions.

SACHI's NFTs Mark the Beginning of a Player-Led Revolution in Blockchain Gaming

- SACHI launched "The Origin," a 200-NFT mint event granting early access to its blockchain gaming platform and future rewards. - The NFTs, called "SACHI OGs," symbolize early participation and offer exclusive perks like "Origin" status and visibility across official channels. - By integrating blockchain, SACHI aims to create a self-sustaining economy where players become stakeholders through tokenized rewards and digital identity markers. - Analysts predict the limited NFT supply could drive secondary mar

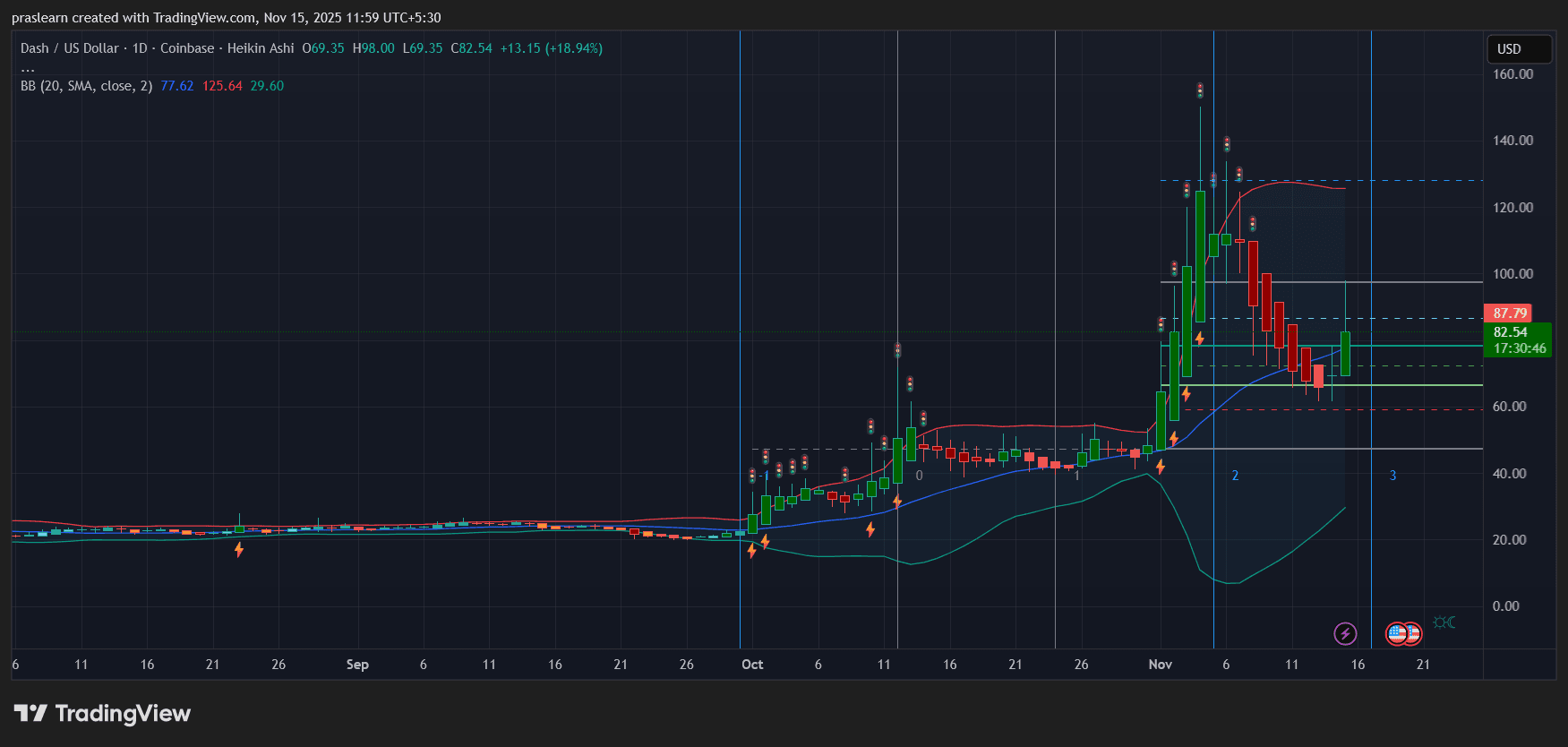

Zcash vs Dash: Which Privacy Coin Looks Stronger As Markets React to Tariff Relief?

Nigeria's Embedded Finance Experiences Rapid Growth Amidst Reforms and International Oil Market Uncertainties

- Nigeria's embedded finance market is projected to reach $4.34 billion by 2025 with a 12.2% CAGR, driven by digital adoption in e-commerce, healthcare , and education. - Economic reforms under President Tinubu led S&P to upgrade Nigeria's credit outlook to "positive," while Moody's raised its rating to "B3" in May 2025. - Fiscal challenges persist as Nigeria raised $2.35 billion via Eurobonds to address 2025 budget deficits amid global oil price volatility and implementation hurdles. - Fintech growth acce