Hourglass’s distribution framework provides a model for stablecoin advancement as regulatory oversight intensifies

- Hourglass completes Stablecoin Deposit Phase 2 with a new allocation mechanism prioritizing proportional asset distribution and real-time volatility mitigation. - The model emphasizes regulatory compliance through automated adjustments, aligning with Japan's scrutiny of stablecoin reserves and scalability challenges. - Competitors like OwlTing focus on low-cost infrastructure, while Hourglass plans public reserve audits to enhance transparency amid evolving market pressures. - BNB's recent stabilization

Hourglass, a prominent force in the stablecoin sector, has wrapped up its Stablecoin Deposit Phase 2, representing a significant milestone in its efforts to boost both liquidity and openness. The company introduced an innovative allocation process

The newly outlined allocation process, described in Hourglass’s recent announcement, emphasizes distributing deposited assets proportionally among stakeholders, in line with the firm’s risk management strategies.

Regulatory compliance remains a cornerstone of Hourglass’s approach. As regulators in Japan and other regions

At the same time, the stablecoin market is adapting to global economic challenges.

Looking ahead, the company plans to conduct a public audit of its reserves, a step meant to further enhance openness and reassure investors. Hourglass is now among a growing number of organizations navigating the crossroads of decentralized finance and regulatory demands, an area where OwlTing and similar firms are also making notable progress.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The community shapes the future of blockchain gaming with SACHI

- SACHI launches "The Origin" NFT event (200 exclusive OGs) to precede $SACHI token launch, offering early access and in-game perks. - CEO Jonas Martisius emphasizes NFTs as symbols of early support, fostering community engagement ahead of November 19 TGE. - Limited availability and "Origin" status incentives aim to drive exclusivity and loyalty in blockchain gaming ecosystem. - SACHI's vision integrates blockchain to create a self-sustaining gaming universe with tokenized rewards for player contributions.

SACHI's NFTs Mark the Beginning of a Player-Led Revolution in Blockchain Gaming

- SACHI launched "The Origin," a 200-NFT mint event granting early access to its blockchain gaming platform and future rewards. - The NFTs, called "SACHI OGs," symbolize early participation and offer exclusive perks like "Origin" status and visibility across official channels. - By integrating blockchain, SACHI aims to create a self-sustaining economy where players become stakeholders through tokenized rewards and digital identity markers. - Analysts predict the limited NFT supply could drive secondary mar

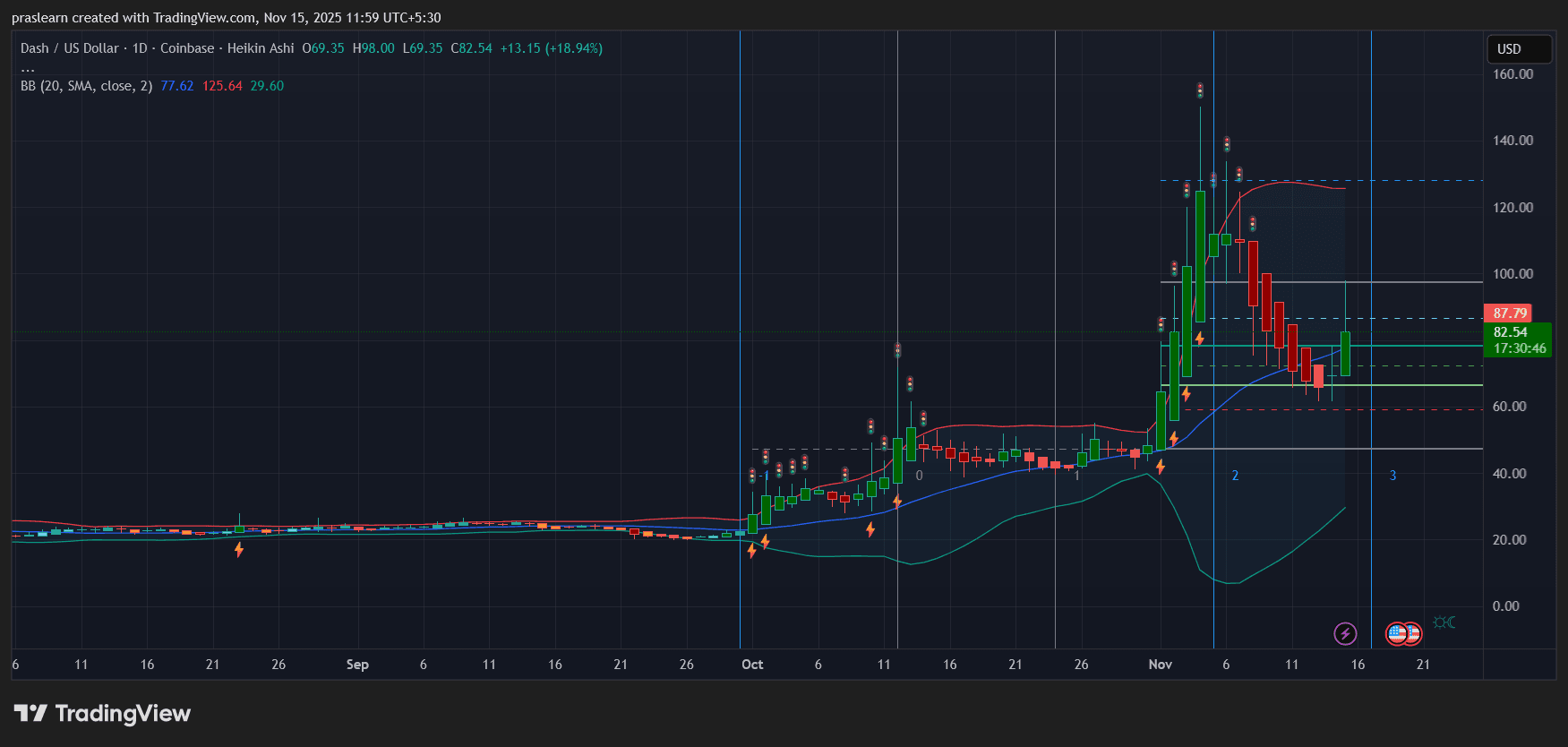

Zcash vs Dash: Which Privacy Coin Looks Stronger As Markets React to Tariff Relief?

Nigeria's Embedded Finance Experiences Rapid Growth Amidst Reforms and International Oil Market Uncertainties

- Nigeria's embedded finance market is projected to reach $4.34 billion by 2025 with a 12.2% CAGR, driven by digital adoption in e-commerce, healthcare , and education. - Economic reforms under President Tinubu led S&P to upgrade Nigeria's credit outlook to "positive," while Moody's raised its rating to "B3" in May 2025. - Fiscal challenges persist as Nigeria raised $2.35 billion via Eurobonds to address 2025 budget deficits amid global oil price volatility and implementation hurdles. - Fintech growth acce