Crypto sentiment index sinks to lowest score since February

Crypto sentiment has dropped to its most fearful level in over eight months, as ongoing macroeconomic uncertainty continues to rattle market participants.

However, crypto analysts are anticipating the bearish mood to be short-lived.

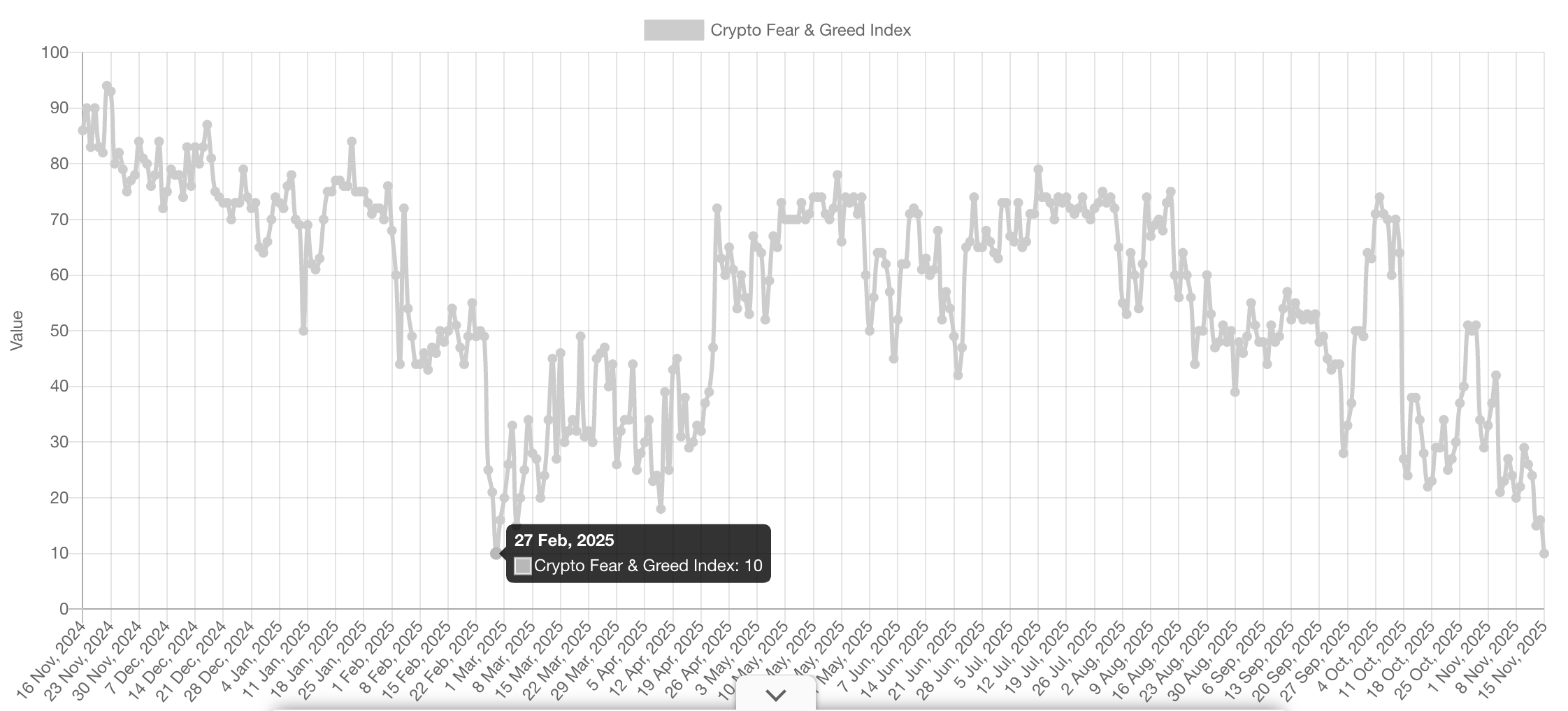

The Crypto Fear & Greed Index, which measures overall market sentiment, posted an “Extreme Fear” score of 10 in its Saturday update, the lowest score it has seen since Feb. 27, as Bitcoin (BTC) fell below $95,000 on Friday and has yet to reclaim above $96,000 at the time of publication, according to CoinMarketCap.

The February low came just days after spot Bitcoin ETFs saw their worst-ever single-day outflows of $1.14 billion, as Bitcoin fell from $102,000 at the start of the month to $84,000.

Indicators suggests market is less bearish than previous downturns

Crypto market participants use sentiment indexes to gauge the broader market’s sentiment toward the sector and inform their decisions on whether conditions favor buying or selling.

However, Bitwise’s European head of research, Andre Dragosh, argued the situation isn’t as bleak as it may appear when compared with past downturns.

“Sentiment index is bearish but less so than during previous corrections despite lower prices,” Dragosh said in an X post on Friday, pointing to Bitwise’s crypto sentiment index showing signs of reversal.

“Our Cryptoasset Sentiment Index also continues to show a positive divergence,” Dragosh said.

While US President Donald Trump recently signed a bill ending the longest government shutdown in US history, an event some crypto market participants had blamed for recent volatility, uncertainty persists around the US Federal Reserve’s interest-rate cut decision, which is often linked to the crypto market.

Bitcoin chart signaling “potentially positive” move ahead

Meanwhile, NorthmanTrader founder Sven Henrich told his 503,400 X followers on Friday that Bitcoin’s price chart is showing “something potentially positive” for Bitcoin bulls. “Falling wedge, positive divergence,” Henrich said.

A Messari research manager, known online as “DRXL,” said that in his eight years working in the crypto industry, he has never seen “such dissonance between the headlines and the sentiment.”

Related: ‘We are buying’: Michael Saylor denies reports of Strategy dumping BTC

“Everything we once dreamed of is happening, yet it somehow feels… over,” he said.

Some analysts see the lack of a year-end surge as a healthy sign. Bitwise chief investment officer Matt Hougan recently told Cointelegraph that “The biggest risk was [if] we ripped into the end of 2025 and then we got a pullback.”

Magazine: 2026 is the year of pragmatic privacy in crypto: Canton, Zcash and more

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Trump Alleges BBC Engaged in "Dishonesty" in $5 Billion Libel Case Regarding Altered Speech

- Trump sues BBC for $1B–$5B over edited 2021 speech, claiming it falsely portrayed him as inciting Capitol riot. - BBC apologized for "judgment error" but refused compensation, asserting no legal basis for defamation claims. - BBC's director-general and news head resigned amid political backlash, while UK officials defended its journalistic integrity. - Legal experts debate viability, with BBC arguing the U.S.-unbroadcast edit was unintentional; Trump claims "overwhelming harm." - Critics fear taxpayer-fu

Conflicting Strategies and Stalemates Worsen the U.S. Housing Affordability Problem

- A real-estate executive warns post-pandemic interventions entrenched housing unaffordability for a generation, worsening structural cost issues. - Democrats leverage affordability as a political issue, contrasting Trump's 50-year mortgage proposals with concerns over favoring lenders over households. - Treasury Secretary Bessent prioritizes financial market stability to support affordability, while Dallas FHLB allocates $8.7M for storm-resistant affordable housing. - Fed Chair Powell emphasizes cautious

Hyperliquid (HYPE) Price Fluctuations: Changing Market Sentiment During DeFi Liquidity Developments

- Hyperliquid (HYPE) faced 2025 liquidity crises from market manipulation and API outages. - November POPCAT spoofing caused $4.5M+ bad debt via leveraged position attacks. - July API outage exposed centralized infrastructure risks during $14.7B open interest. - TVL surged to $2.15B despite whale-driven volatility and anchoring bias effects. - Investors must balance DeFi innovation with systemic risks in fragile liquidity pools.

Uniswap News Today: Uniswap's CCA Makes Token Launches More Accessible, Reducing Whale Influence

- Uniswap v4 launches Continuous Clearing Auctions (CCA), a permissionless protocol for transparent, community-driven token launches with Aztec. - CCA divides token sales into blocks settled at market-clearing prices, reducing volatility and sniping while enabling equitable distribution. - The protocol automatically seeds liquidity post-auction and supports privacy via Aztec's ZK Passport, marking a DeFi innovation in fair token distribution. - CCA aims to standardize on-chain price discovery, countering w