DOJ Cracks Down on North Korea's Cryptocurrency Network by Seizing $15M in Tether

- U.S. DOJ seized $15M in Tether linked to North Korean hackers, targeting sanctions-busting crypto operations via stolen identities and remote work schemes. - APT38 group and "domestic helpers" facilitated DPRK fund siphoning, masking IP addresses and routing payments to evade sanctions. - The crackdown highlights rising stablecoin risks, regulatory scrutiny, and cross-border efforts like the U.S.-Thailand $12M USDT seizure. - Investors face increased volatility and compliance costs, while Trump's crypto

The U.S. Department of Justice has confiscated $15 million worth of Tether's

The Justice Department’s intervention targets North Korea’s exploitation of stolen American identities and remote work arrangements to divert money from U.S. businesses. These so-called “domestic helpers” helped North Korean operatives secure jobs, disguise their online locations, and funnel salaries into financial channels linked to the Democratic People’s Republic of Korea (DPRK).

This enforcement wave draws attention to the increasing risks facing stablecoins like USDT, which are vital for trading and settlements on offshore platforms. Regulators are putting these assets under greater scrutiny for their potential role in illegal finance, and the DOJ’s actions show that on-chain assets are not immune to law enforcement. For the market, the trend of freezing and confiscating crypto assets brings three main challenges:

In addition, the Trump administration’s suggestion to create a federal “bitcoin strategic reserve”—holding seized digital currencies as long-term assets—adds further uncertainty. Although the proposal seeks to avoid selling off confiscated coins, there are still unresolved legal issues, such as the need for congressional approval.

International collaboration is also ramping up. A recent joint operation between the U.S. and Thailand resulted in the seizure of $12 million in USDT from a Southeast Asian scam syndicate, illustrating the growing cross-border fight against crypto-related crime.

For crypto investors, the DOJ’s recent actions point to a changing environment. While short-term volatility and compliance expenses may increase, ongoing crackdowns on state-sponsored theft could ultimately boost confidence in blockchain markets. The North Korea case, however,

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana News Update: Negative Tech Trends Meet Optimistic Investments as ZKP's $200 Million Daily Auction Influences the 2025 Crypto Scene

- Solana ETF inflows decline to $6.78M, with price dropping to $144 as key support level amid bearish technical indicators. - Analysts predict $500 by 2025 if Solana sustains growth in dApps and institutional adoption, despite regulatory risks. - ZKP project’s 200M/day auction model and transparency aims to drive 2025 crypto trends, competing with privacy-focused solutions. - REX-Osprey’s SSK ETF offers 7.3% staking yields, contrasting Bitcoin/Ethereum outflows and highlighting novel crypto ETF strategies.

ICP Network Expansion and What It Means for Blockchain Investors

- ICP's dual ecosystem combines blockchain infrastructure with medical TPU manufacturing, targeting digital-industrial convergence. - Caffeine AI and Chain Fusion upgrades drove 131% trading volume growth and 56% price increase in 2025. - Strategic cloud partnerships with Microsoft/Google Cloud enhance enterprise adoption but face SEC regulatory risks. - Network fees surged 100x in Q3 2025 despite 22.4% dApp usage decline, highlighting high-value transaction focus. - Investors balance bullish growth potent

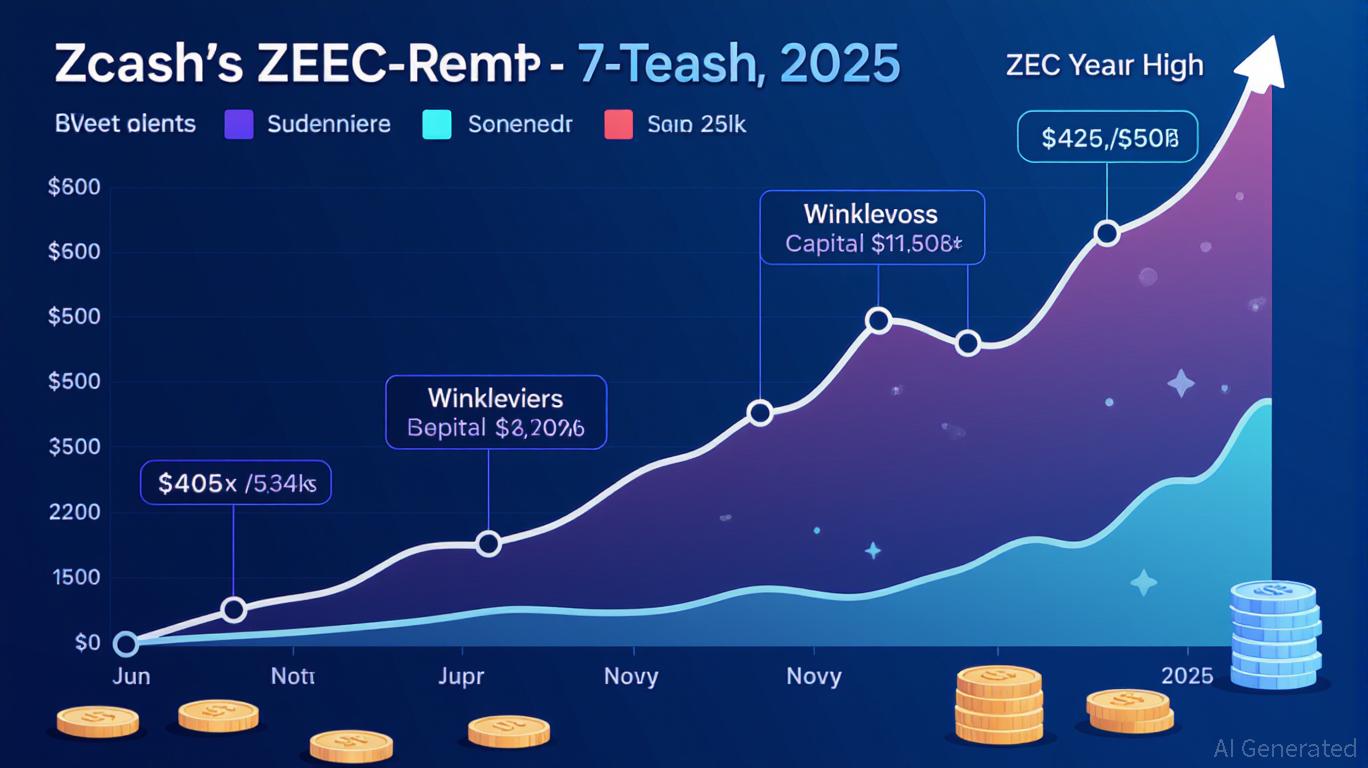

Zcash (ZEC) Price Soars: Blockchain Privacy Innovations and Growing Institutional Interest Usher in a New Chapter for Privacy-Focused Cryptocurrencies

- Zcash (ZEC) surged 472% to $420 in late 2025, driven by institutional adoption and blockchain privacy innovations. - Grayscale and Winklevoss Capital allocated $195.88M to ZEC, leveraging its hybrid privacy-transparency model for AML-compliant private transactions. - Zcash's optional transparency technology saw 30% of supply in shielded pools, with zenZEC token bridging privacy and DeFi liquidity. - 2025 U.S. Clarity/Genius Acts provided regulatory clarity, enabling privacy coins to operate within compli

Balancer Hacker Launders 2,000 ETH Through Tornado Cash

Quick Take Summary is AI generated, newsroom reviewed. The hacker converted most of the stolen assets, including LSTs, into pure ETH before beginning the laundering phase. $2,000 ETH was routed through Tornado Cash in quick succession using $100 ETH deposits to maximize untraceability. This move strongly suggests the attacker is not interested in claiming the offered bounty or returning the remaining funds. Despite the laundering, the primary exploiter wallet still holds over $1,700 ETH, indicating the pro