Aster Clarifies Tokenomics After Confusion Over Token Unlock Delays

Aster clarified its tokenomics after a CMC update caused confusion over unlocks, saying no changes were made and unused tokens remain out of circulation.

Aster moved to calm its community after a miscommunication on CoinMarketCap (CMC) led users to believe the project had quietly changed its token unlock schedule.

The team said the tokenomics remain unchanged and blamed an update on CMC for creating the confusion.

ASTER Token Unlock Confusion

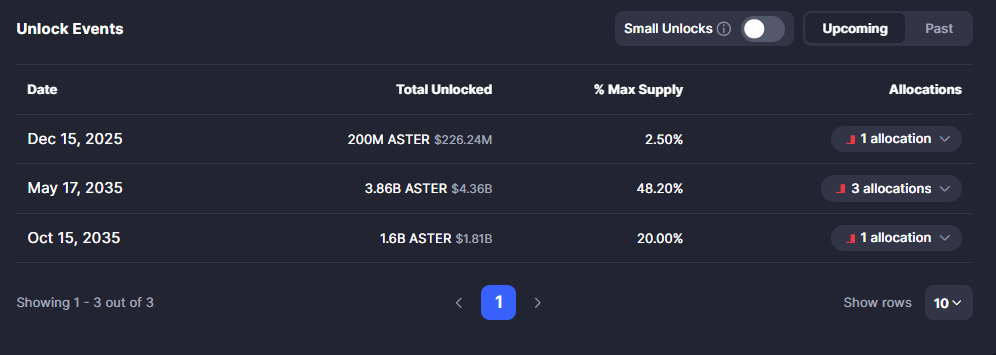

The clarification came hours after Aster community members noticed major upcoming unlocks listed on CMC — including one for December 2025 and two massive releases scheduled for 2035.

This contradicts earlier statements from the exchange about delaying 2025 unlocks to mid-2026.

A recent update to the tokenomics of ASTER on CoinMarketCap (CMC) has caused confusion within the community. This confusion stemmed from a miscommunication, and we sincerely apologize for the inconvenience caused. We want to clarify that the ASTER tokenomics remain unchanged.…

— Aster (@Aster_DEX) November 15, 2025

The uncertainty started when updated CMC data showed 200 million ASTER scheduled to unlock on December 15, 2025, followed by 3.86 billion ASTER and 1.6 billion ASTER unlocks in 2035.

Those figures implied that 75% of the token supply was still locked, with 24% currently circulating.

Aster said the CMC update was meant to correct circulating supply information and clarify how unused ecosystem tokens were being treated.

Original Post That Caused Confusion About Aster Tokenomics. Source:

Original Post That Caused Confusion About Aster Tokenomics. Source:

The team said the tokens that unlock monthly under the ecosystem allocation have never entered circulation and have remained untouched in a locked address since TGE.

To avoid further confusion, Aster will now transfer these unlocked-but-unused tokens to a public, dedicated unlock address to separate them from operational wallets.

The team said it has no plans to spend from this address.

Why This Matters for ASTER Holders

The episode highlights a recurring issue in crypto markets. Inconsistent or unclear circulating supply data can influence price action, investor expectations, and perceived dilution risk.

Upcoming ASTER Token Unlocks. Source:

Upcoming ASTER Token Unlocks. Source:

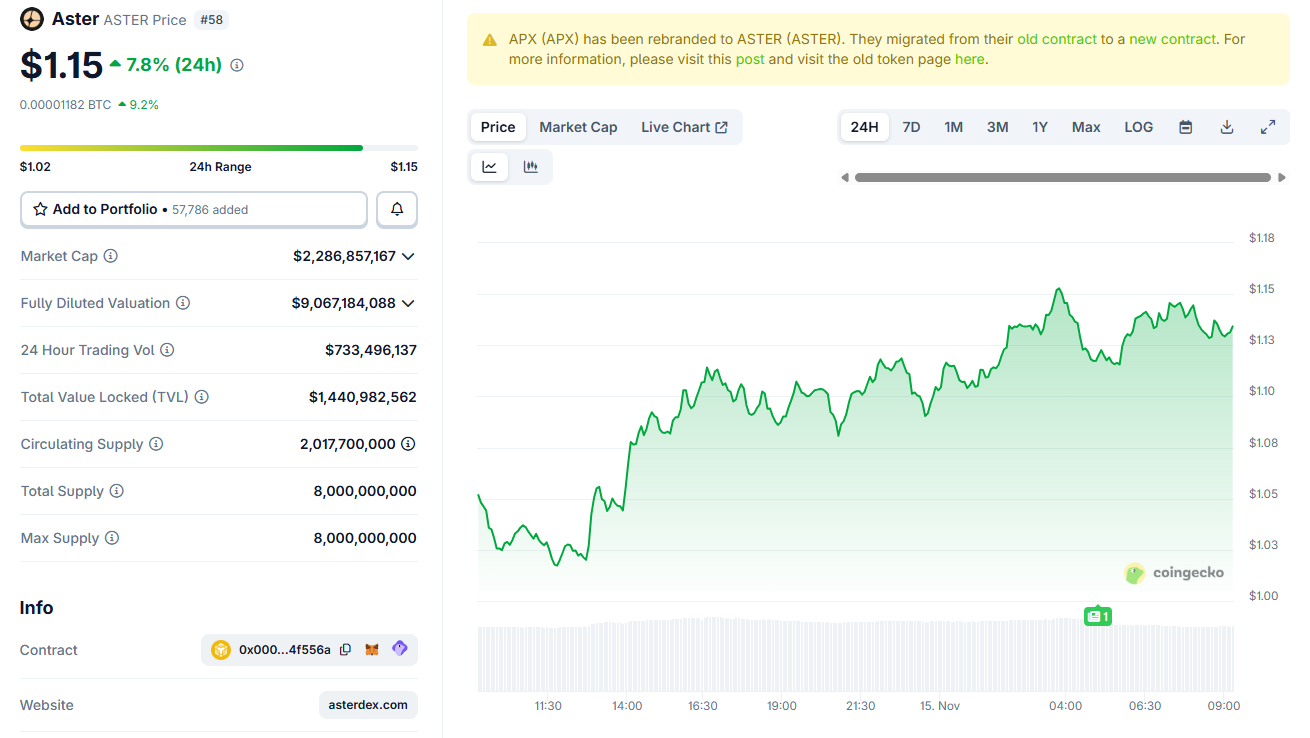

Aster’s circulating supply sits around 2.017 billion ASTER, with 6.06 billion still locked. Market cap is roughly $2.28 billion, while the fully diluted value exceeds $9 billion.

A sudden interpretation that large unlocks were imminent may have fueled speculation about dilution, especially as the project recently saw heavy trading volume and rising volatility.

ASTER Daily Price Chart. Source:

ASTER Daily Price Chart. Source:

Despite the confusion, ASTER traded higher on the day, moving around $1.14, up about 8% in 24 hours. The price has fluctuated between $1.02–$1.15, stabilizing after an early-morning sell-off.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Anthropic Claims Cyberattack Involved AI, Experts Express Doubts

- Anthropic claims Chinese state hackers used AI to automate 80-90% of a cyberattack targeting 30 global entities via a "jailbroken" Claude AI model. - The AI-generated exploit code, bypassed safeguards by fragmenting requests, and executed reconnaissance at unprecedented speed, raising concerns about AI's dual-use potential in cyber warfare. - Experts question the validity of Anthropic's claims while acknowledging automated attacks could democratize cyber warfare, prompting calls for stronger AI-driven de

AAVE Drops 13.95% Over 7 Days Amid Strategic Changes Triggered by Euro Stablecoin Regulatory Approval

- Aave becomes first DeFi protocol to secure EU MiCA regulatory approval for euro stablecoin operations across 27 EEA states. - The Irish subsidiary Push Virtual Assets Ireland now issues compliant euro stablecoins, addressing ECB concerns about USD-dominance in crypto markets. - Aave's zero-fee Push service generated $542M in 24-hour trading volume, contrasting with typical 1-3% fees on centralized exchanges. - With $22.8B in borrowed assets, the platform's regulatory milestone is expected to accelerate a

SEI Faces a Turning Point: Will It Be a Death Cross or a Golden Cross?

- SEI , Sei's native token, shows early recovery signs amid crypto market slump, with technical indicators suggesting potential breakout from prolonged consolidation. - Despite 2.83% 24-hour decline to $0.17, increased $114.1M trading volume and TD Sequential buy signals highlight critical inflection point potential. - Market analysis identifies $0.1756 support and $0.1776 resistance levels, with death cross risks below $0.1745 and golden cross potential above $0.1787. - Fear/greed index at 25 reflects ext

Bitcoin News Update: CFTC's Broader Role in Crypto Regulation Ignites Discussion on Clearer Rules

- U.S. lawmakers propose expanding CFTC's crypto oversight via a bill reclassifying spot trading, diverging from SEC's enforcement approach. - Harvard University invests $443M in BlackRock's IBIT ETF, reflecting institutional confidence in crypto as a legitimate asset class. - DeFi projects like Mutuum Finance raise $18.7M in presales, leveraging regulatory momentum and transparent on-chain credit systems. - RockToken's infrastructure-backed crypto contracts attract long-term investors with structured yiel