Ethereum Updates Today: BitMine's Acquisition of Ethereum Reflects the 1990s Telecom and Internet Boom

- BitMine acquires 3.5M ETH ($11.2B), becoming largest publicly traded Ethereum holder, surpassing Bitcoin-focused treasuries. - Institutional buying drives Ethereum's exchange balances to multi-year lows, with BitMine's purchase marking a major institutional acquisition. - JPMorgan and ARK Invest boost BitMine holdings amid regulatory progress enabling Ethereum staking ETPs with 3-5% yields. - CEO Chi Tsang compares Ethereum's potential to 1990s telecom/internet revolutions, targeting 5% supply ownership

BitMine Immersion Technologies (BMNR) has ramped up its accumulation of

Institutional faith in Ethereum’s future is further highlighted by new investments and collaborations.

BitMine’s recent leadership changes have also attracted notice.

Despite ongoing market swings, BitMine is steadfast in its aim to secure 5% of Ethereum’s total supply. The company’s treasury approach stands out from recent sector sell-offs, as

The company’s assertive buying strategy could have a notable impact on Ethereum’s price trends. With 3.5 million ETH in its reserves, BitMine controls a substantial share of the available supply,

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

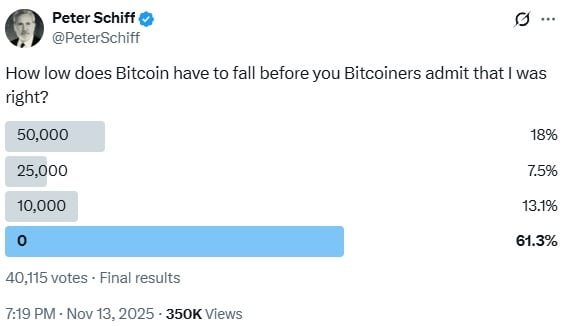

Peter Schiff Warns Bitcoin May Keep Sinking as Sentiment Tests Major Thresholds

Bitcoin Updates: As Crypto Markets Waver, Founder’s BTC Acquisition Reflects Enduring Confidence

- Cryptocurrency markets fell for a third day, with Bitcoin dropping below $100,000, erasing $130B in value as panic spread. - Equation founder's BTC purchase signaled long-term confidence despite bearish sentiment and a "consolidation limbo" trapping Bitcoin. - Macroeconomic uncertainty from the U.S. government shutdown and $1B in liquidations worsened the selloff, while the Crypto Fear and Greed Index hit "Extreme Fear." - Institutional interest in crypto products like Canary XRPC ETF and decentralized p

DCR is currently trading at $37.04, up 10.6% in the last 24 hours.

STRK broke through $0.23, with a 24-hour increase of 29.3%.