Bitcoin Updates: Tether Rises While Bitcoin Drops, Indicating Investors Seek Safe Havens

- Tether CEO labels November 2025 "Bitcoin Black Friday," signaling heightened crypto volatility and Tether's record $184B market dominance amid Bitcoin's 11% monthly decline. - Stablecoin market expands to $300B as traders shift to safer assets, mirroring historical patterns where Tether's share rises during Bitcoin bearish phases. - Bitcoin's BVIV index breaks key resistance, indicating prolonged turbulence driven by thinning liquidity and macroeconomic risks like U.S. credit rating downgrades. - Institu

Tether CEO Refers to November 2025 as 'Bitcoin Black Friday'

The leader of

Tether's share of the market has climbed to its highest point since April 2025, with its $184 billion valuation reflecting a move toward safer assets as Bitcoin dropped 11% in a month to $97,630

The "Bitcoin Black Friday" label stands in stark contrast to how traditional retailers approach Black Friday. For example, On Holding AG, a Swiss sneaker company supported by Roger Federer, chose not to offer discounts during the holiday season, while Tether's strategy points to a different type of market adjustment. On's CEO Martin Hoffmann highlighted the company's focus on maintaining premium pricing and innovation, noting that

At the same time, Bitcoin's price fluctuations have reached a crucial technical stage. The BVIV index, which measures expected volatility based on options,

The intersection of Tether's growing influence and Bitcoin's increased volatility is raising concerns about the crypto market's overall strength. While

As November progresses, the "Bitcoin Black Friday" theme may influence strategies across the market, from individual traders to large investment portfolios. For now, the relationship between Tether's market share, Bitcoin's volatility, and changes in the retail sector highlights a pivotal moment for the industry—one where both stability and innovation could be just as vital as price movements.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

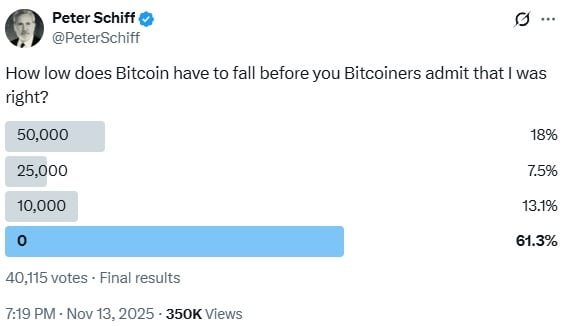

Peter Schiff Warns Bitcoin May Keep Sinking as Sentiment Tests Major Thresholds

Bitcoin Updates: As Crypto Markets Waver, Founder’s BTC Acquisition Reflects Enduring Confidence

- Cryptocurrency markets fell for a third day, with Bitcoin dropping below $100,000, erasing $130B in value as panic spread. - Equation founder's BTC purchase signaled long-term confidence despite bearish sentiment and a "consolidation limbo" trapping Bitcoin. - Macroeconomic uncertainty from the U.S. government shutdown and $1B in liquidations worsened the selloff, while the Crypto Fear and Greed Index hit "Extreme Fear." - Institutional interest in crypto products like Canary XRPC ETF and decentralized p

DCR is currently trading at $37.04, up 10.6% in the last 24 hours.

STRK broke through $0.23, with a 24-hour increase of 29.3%.