Pi Coin’s Rare Green Streak Could Last If The Altcoin Clears One Key Level

The Pi Coin price is flashing a rare multi-timeframe green streak even while the broader market struggles. A breakout from a symmetrical triangle, a CMF surge, and improving OBV all point to growing strength. But the entire move depends on one level: $0.229. A close above it could unlock more upside.

Pi Coin just printed something unusual. Three major timeframes are green at the same time. The one-month chart is up 9.5%, the seven-day chart is up 2.1%, and the last 24 hours are up 3.5%.

This is rare because the Pi Coin price is still down almost 40% in the three-month window. The token is showing early strength while most of the market is still stuck in a slow bleed. The question now is simple: is this just a brief bounce, or the start of a larger move?

Symmetrical Triangle Breakout Surfaces As Money Flow Turns Positive

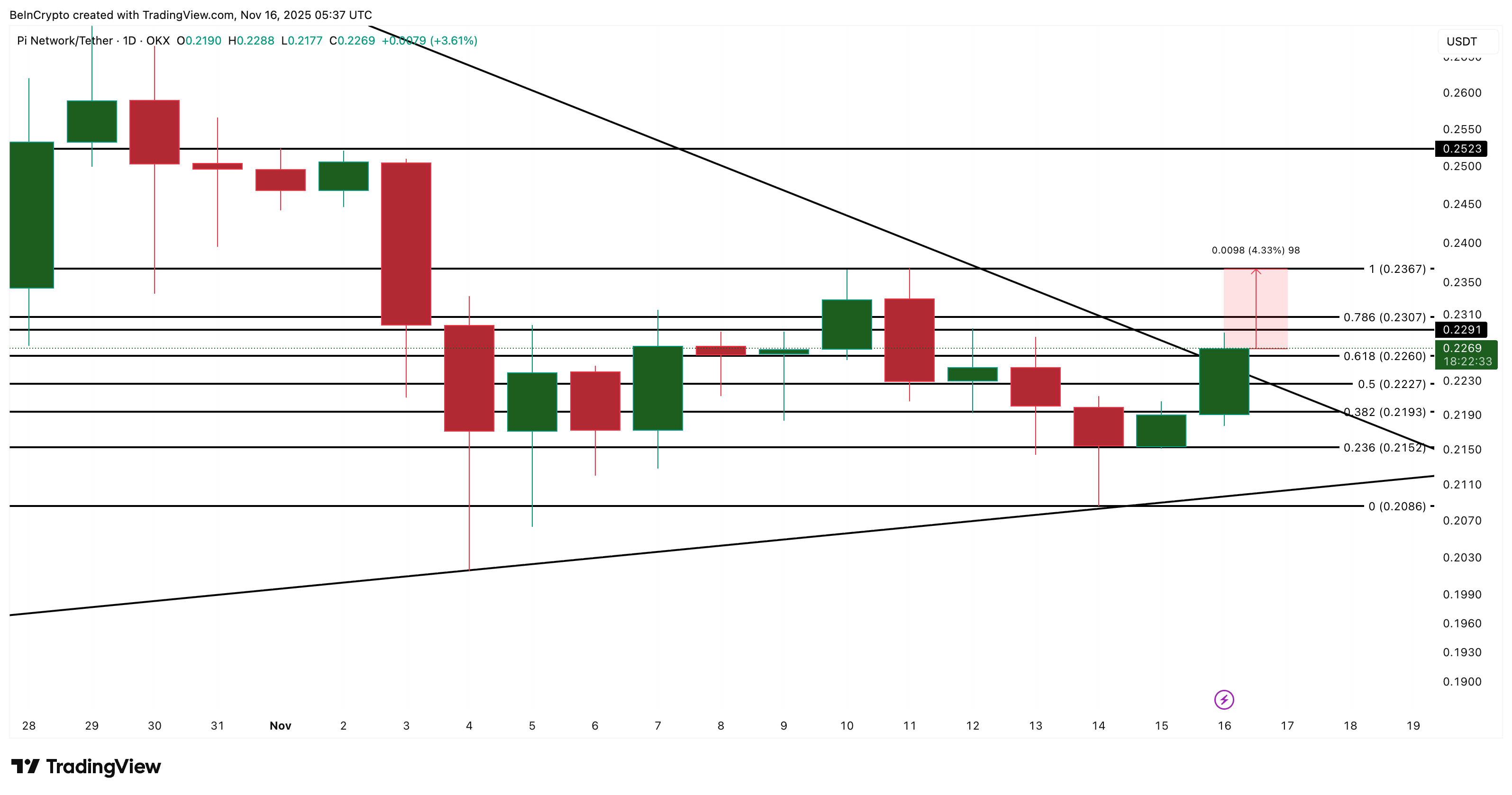

PI has been stuck inside a symmetrical triangle for weeks. This pattern typically indicates indecision, rather than a trend direction.

However, yesterday, the Pi Coin price broke through the upper boundary and is now testing the confirmation level near $0.229, a key level. A clean candle close above that line is the first sign that buyers are finally taking control.

Pi Coin Breaks Out:

TradingView

Pi Coin Breaks Out:

TradingView

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

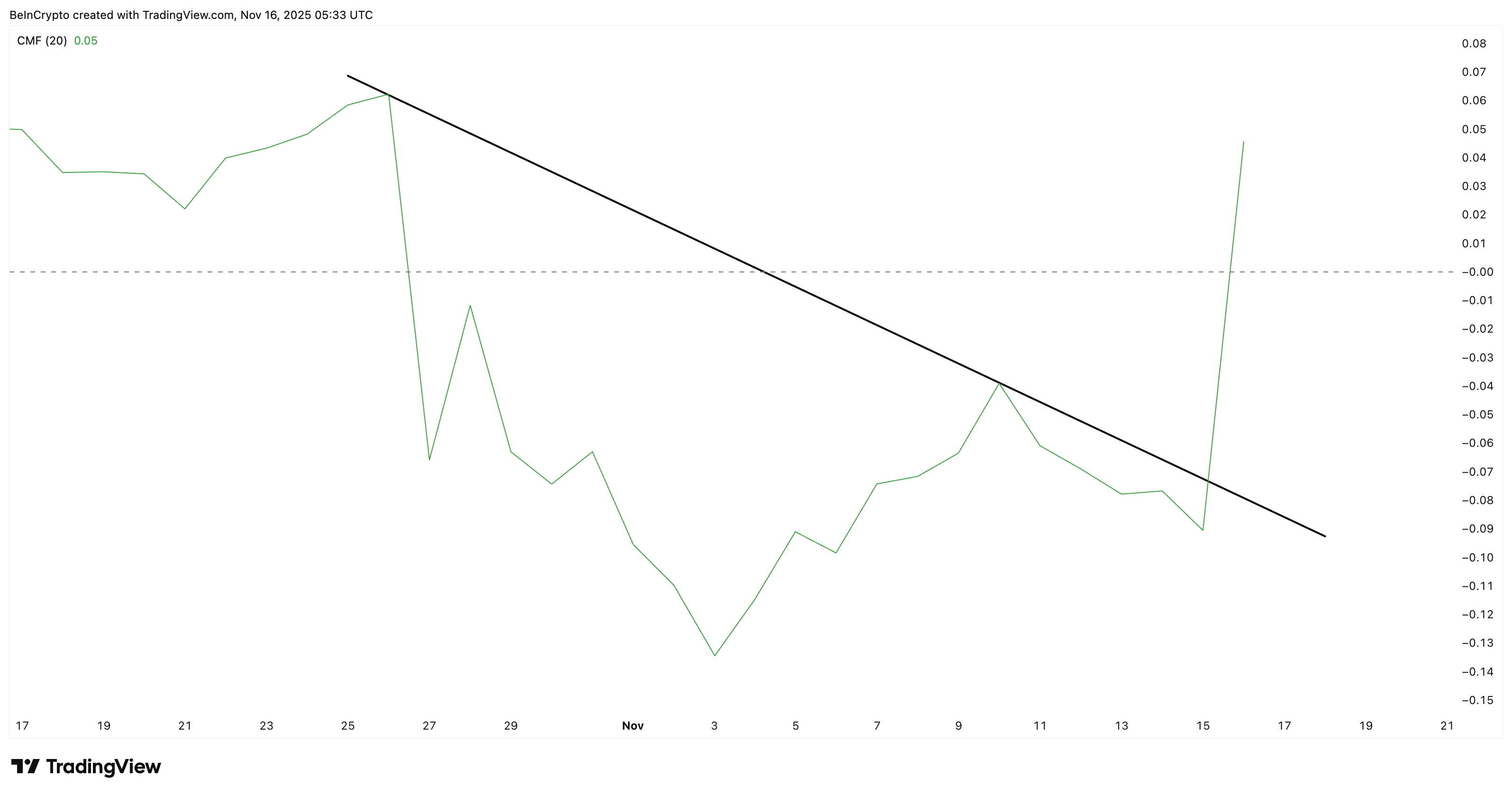

The next clue comes from the Chaikin Money Flow (CMF). CMF measures whether money is moving into or out of an asset. Two days ago, CMF broke out of its descending trend line, rising sharply from –0.09 to +0.05.

This jump shows that the breakout is not random. Bigger Pi Coin wallets may be stepping in as the pattern flips bullish.

Big Money Flows In:

TradingView

Big Money Flows In:

TradingView

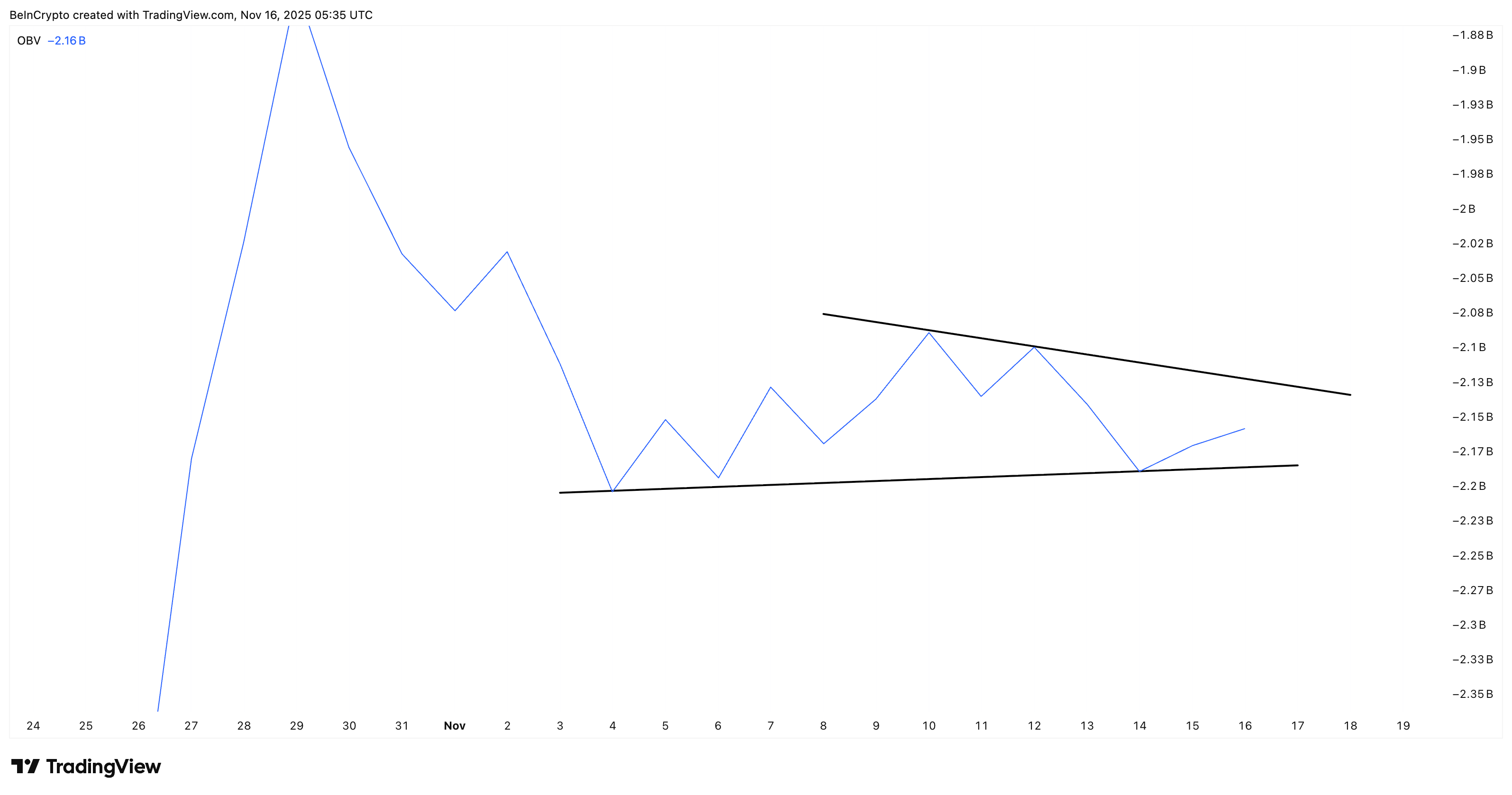

The On-Balance Volume (OBV) tells the other half of the story. OBV tracks buying and selling volume to show whether traders support the move. OBV touched lower, back to its rising trend line on November 12–13, hinting that retail volume wasn’t ready.

However, since November 14, OBV has begun to curl upward again. If OBV breaks its upper trend line, it confirms that retail Pi Coin buyers are now joining the move sparked by the CMF breakout.

Retail Volume Coming Back:

TradingView

Retail Volume Coming Back:

TradingView

The combination of a technical breakout, rising money flow, and recovering OBV gives Pi Coin its strongest setup in weeks.

Pi Coin Price Levels To Watch As Momentum Builds

If the Pi Coin price closes above $0.229, the move could extend to $0.236, representing a gain of approximately 4.2% from current levels. If momentum holds, the next target is near $0.252, which has previously acted as strong resistance.

However, the bullish setup can fail if the OBV rolls over again or the CMF slips back into negative territory. A drop below $0.215 weakens the structure and exposes a slide toward $0.208.

Pi Coin Price Analysis:

TradingView

Pi Coin Price Analysis:

TradingView

Currently, the Pi Coin price is exhibiting rare strength across multiple timeframes. Whether that strength lasts comes down to one line: $0.229. If the bulls defend it, PI’s green streak may have more room to run.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates: Bitcoin's Sharp Drop Contrasts with Japan's Economic Stimulus Amid Global Liquidity Puzzle

- Bitcoin fell to a seven-month low below $85,500, triggering $3.79B in ETF outflows as bearish technical signals and Fed rate-cut uncertainty deepened selling. - Japan's $135.4B stimulus package, its largest since 2020, sparked debate over whether liquidity injections or global deleveraging would dominate market sentiment. - BlackRock's IBIT led redemptions with $2.47B losses, while Bitcoin's "death cross" pattern and broken support levels intensified investor caution. - Market analysts split between altc

Momentum (MMT) Jumps After Key Acquisition – Could This Spark Sustained Expansion?

- Momentum (MMT) faces speculation linking it to GTCR's $34B Fiduciary Trust acquisition, though it has no direct involvement. - Swedish firm Momentum Group AB's 2025 acquisitions highlight middle-market trends, indirectly influencing MMT's fixed-income strategies. - Institutional investors increased MMT holdings in Q4 2024, but its stock fell below key averages amid a 9.05% dividend yield. - Analysts remain cautious, citing dividend cuts and mixed institutional ownership as risks despite macroeconomic tai

Dogecoin News Today: Dogecoin 2x ETF: A Tool for Stability or a Catalyst for Speculation?

- Dogecoin faces bearish pressure as price drops to $0.143, with technical indicators signaling overvaluation and structural support breakdowns. - 21Shares' 2x Long Dogecoin ETF (TXXD) aims to institutionalize the asset, offering leveraged exposure through a 1.89% fee structure on NASDAQ. - Whale accumulation of 4.72 billion DOGE ($770M) and positive exchange inflows hint at potential stabilization ahead of Grayscale's pending GDOG ETF launch. - Leverage risks persist as similar products like UDOW show dec

Hedera's Fundamental Flaws Challenge Its Long-Term DeFi Prospects Amid Intensifying Sell-Off

- HBAR's 2.5% drop below $0.1480 triggered heavy selling, with 168.9M tokens traded as institutional distribution accelerated. - Liquidity concerns emerged after a 14-minute trading halt and 138% volume spike failed to stabilize the $0.1486 resistance level. - Hedera's Wrapped Bitcoin integration aims to boost DeFi adoption but hasn't offset immediate bearish momentum or liquidity fractures. - Technical indicators show breakdown risk with key support at $0.1382, as sellers dominate with a risk-reward profi