XRP Dip Buyers Are Active — So Why Is the Price Still Falling?

The XRP price has corrected despite short-term buying rising this month. Long-term holders are selling far more aggressively, and money flow has turned negative, leaving the token stuck under key resistance levels. Until buyers reclaim $2.38, XRP remains vulnerable to further downside.

XRP price is down almost 8% in the past week, and even though the last 24 hours have been flat, the absence of red cannot be mistaken for strength.

The chart and on-chain data indicate that XRP is under real pressure, despite one group of investors continuing to buy the dip.

Short-Term Holders Keep Buying — But One Group Doesn’t Agree

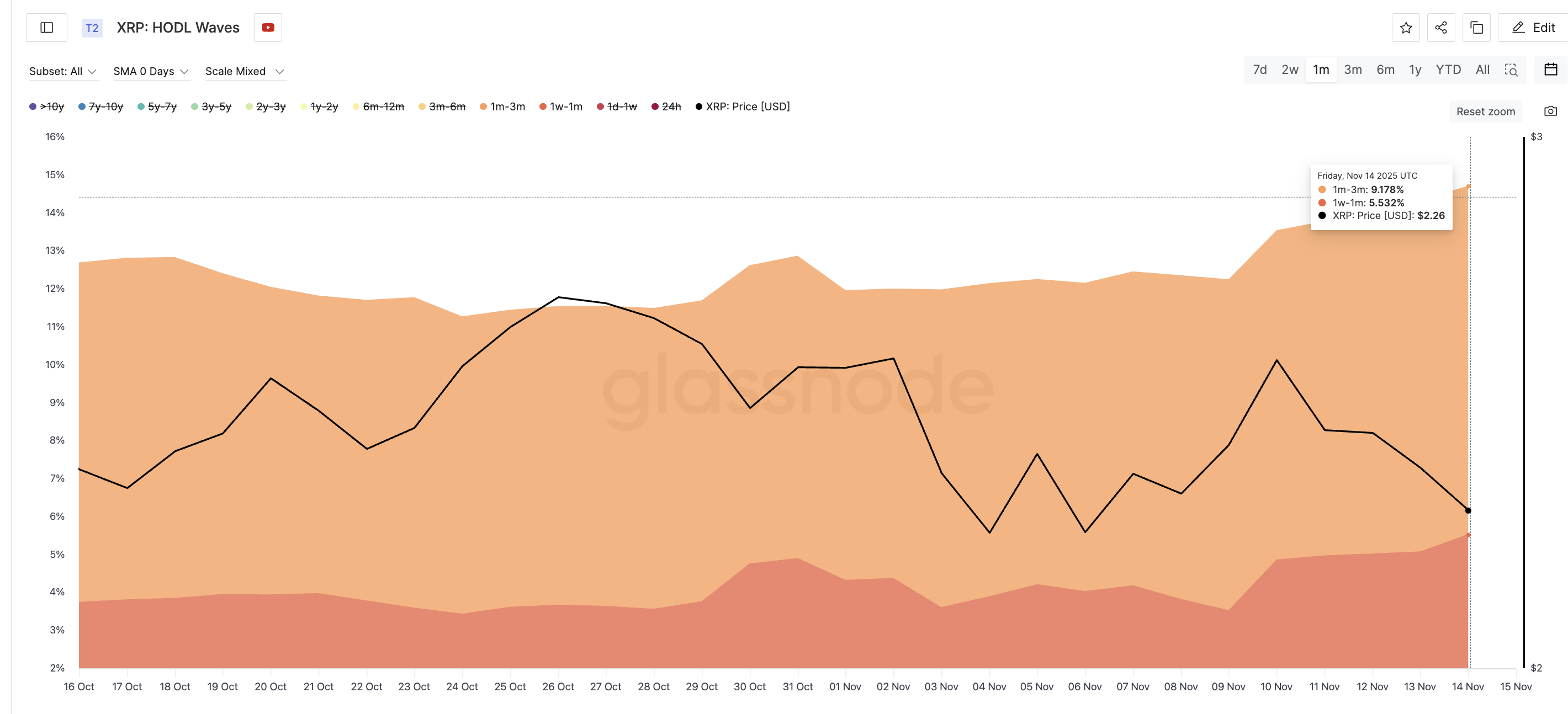

HODL Waves — a metric that shows how much supply each holding-duration group controls — reveals that two short-term cohorts have been steadily accumulating XRP through the month.

On October 16, wallets holding XRP for 1–3 months controlled 8.94% of supply. As of November 14, they hold 9.17%.

Another short-term cohort, the 1-week to 1-month group, has increased from 3.74% to 5.53% of the supply in the same period.

Dip Buying Remains Active:

Glassnode

Dip Buying Remains Active:

Glassnode

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Despite the XRP price dropping 7.8% over the past 30 days, these groups are accumulating, likely positioning for short-term bounces.

But this buying doesn’t seem strong enough to lift the price for one key reason.

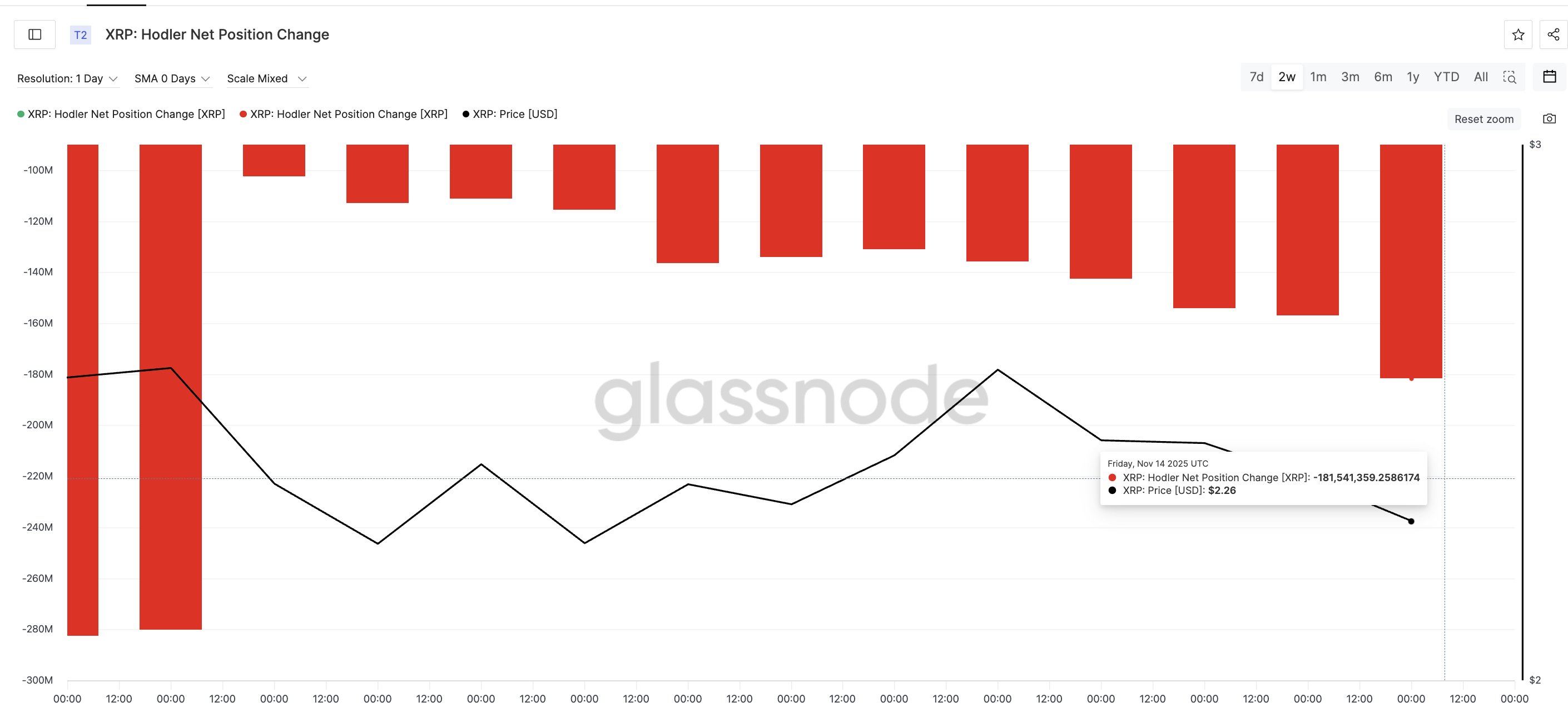

The Hodler Net Position Change — a metric that tracks the amount of long-term investor supply entering or leaving wallets — indicates that long-term holders are selling aggressively. It showed heavy negative flow on November 3, when long-term wallets removed 102.50 million XRP. Instead of easing, outflows continued to rise.

XRP HODLers Keep Selling:

Glassnode

XRP HODLers Keep Selling:

Glassnode

By November 14, the number had jumped to 181.50 million XRP: a 77% increase in long-term selling pressure in less than two weeks.

This is the core reason the XRP price was unable to bounce: short-term buying is being overwhelmed by long-term exits.

XRP Price Feels the Pressure as Big Money Steps Back

On the chart, XRP is still struggling to break above $2.26, a strong 0.618 Fibonacci resistance level. The push higher is weakening because money inflows are fading rapidly.

The Chaikin Money Flow (CMF) — which measures buying and selling pressure — has plunged since November 10. It now sits at –0.15, showing net outflows. CMF has also broken below a descending trendline, indicating that larger investors are withdrawing rather than adding. When CMF stays negative while breaking trend support, upside attempts usually fail.

XRP Price Analysis:

TradingView

XRP Price Analysis:

TradingView

If weakness continues, XRP risks losing $2.17, exposing a deeper move toward $2.06. A breakdown below $2.06 would invalidate any short-term bullish attempts.

The only way to regain momentum is a clean daily close above $2.38 — a level that has rejected the price multiple times this month. Clearing it could open a path toward $2.57 and flip the near-term structure bullish.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP News Today: Institutional Trust in XRP ETFs Fuels Hope Despite Widespread Crypto Slump

- XRP , Bitcoin , and Ethereum face sharp declines amid crypto market correction, with XRP dropping 15% to $2.17 as of November 14. - Analysts highlight XRP's $2.15 support level and potential $2.40–$2.70 rally if ETF inflows and institutional demand sustain momentum. - XRP ETFs attracted $243M net inflows despite whale selling 200M tokens post-launch, signaling mixed short-term pressure and long-term institutional confidence. - Franklin Templeton and Grayscale list XRP ETFs in DTC pipeline, while Bitget's

Bitcoin News Update: Impact of Leverage: $215 Million in Crypto Liquidations Reveal Market’s Underlying Vulnerabilities

- Crypto markets saw $215M+ Bitcoin futures liquidations as prices plummeted below $95,000, triggering panic across digital assets. - Analysts attributed the crash to profit-taking, macroeconomic uncertainty, and leveraged long positions wiping out 77.71% of Bitcoin's liquidations. - Despite turmoil, MicroStrategy's CEO Michael Saylor reaffirmed Bitcoin bullishness, denying claims of selling holdings amid $1.8M in company stock sales. - Tether's $1B robotics investment highlighted shifting capital flows, w

Hyperliquid News Today: Trump Clashes with Greene Regarding Epstein Documents Amid Crypto's Institutional Expansion and Market Fluctuations

- Trump withdraws support for Rep. Greene over Epstein files dispute, deepening GOP fractures amid IRS chief reversal and government reopening. - AMINA AG becomes first foreign crypto bank in Hong Kong with SFC license, expanding institutional access to Bitcoin and Ethereum . - Altcoins like Stellar (XLM) and Hyperliquid (HYPE) face sharp declines due to liquidation pressures and liquidity risks in decentralized markets. - Political tensions and crypto volatility highlight divergent challenges as instituti

Solana Latest Updates: Bitwise's Solana ETF Overtakes Grayscale by Offering Staking and Reduced Fees

- Bitwise's Solana ETF (BSOL) attracted $580M in three weeks, outpacing Grayscale's $24.4M inflows for its competing fund. - BSOL's 0.20% fee and staking integration differentiate it, enabling yield generation on Solana holdings for investors. - The fund's 14-day consecutive inflows highlight institutional confidence, supported by a $222.9M seed investment versus Grayscale's $102.7M. - Growing institutional adoption of crypto-native products signals shifting investor strategies toward blockchain exposure t