Mutuum Finance introduces a hybrid lending approach that transforms the effectiveness of DeFi.

- Mutuum Finance (MUTM) emerges as a top DeFi breakout candidate, raising $18.8M in presale ahead of its Sepolia testnet V1 launch. - Its hybrid lending model combines Peer-to-Contract pools with Peer-to-Peer markets, attracting 18,000+ holders and 250% token price growth since 2025. - Gamified presale incentives and institutional-grade efficiency strategies align with DeFi trends, though crypto markets remain fragmented and volatile. - Upcoming V1 launch and potential partnerships could drive further MUTM

The cryptocurrency sector, recognized for its frequent price swings, is currently experiencing another period of instability, creating both challenges and possibilities for investors. Amidst the turbulence, a number of projects are gaining traction as potential leaders, with Mutuum Finance (MUTM) emerging as a strong contender. This decentralized finance (DeFi) initiative has

Although Mutuum Finance is currently in the spotlight, the wider crypto market remains divided. Traditional financial sectors are also sending mixed signals. For example,

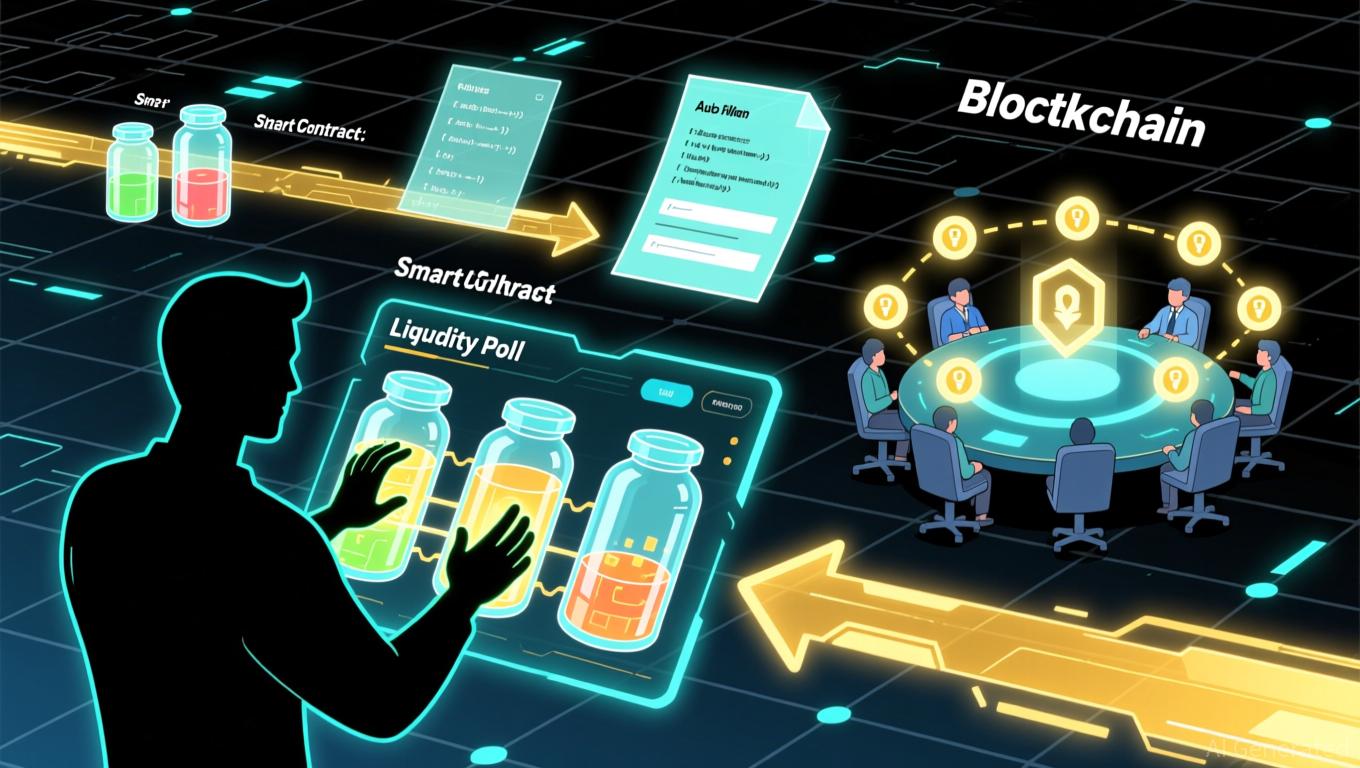

Despite this, the DeFi sector continues to draw both speculative and institutional funds. Mutuum’s emphasis on hybrid lending—combining automated smart contracts with targeted asset markets—positions it to address shortcomings in current platforms. By appealing to both individual and institutional participants, the project seeks to emulate the achievements of established protocols while introducing innovations in areas like collateral management and risk control.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Nasdaq futures extended gains to 1%.

95% of the total Bitcoin supply has been mined.