Most institutional investors unaware of Bitcoin Core-Knots software debate

Institutional investors largely unaware of Bitcoin Core-Knots debate, Galaxy Digital survey finds

- 46% of surveyed institutional investors had no knowledge of the Bitcoin Core versus Bitcoin Knots debate

- Only 18% of respondents held strong opinions, all supporting Bitcoin Core’s approach

- Major mining operations show minimal concern about the protocol dispute, according to Galaxy Digital research

Most institutional investors in the Bitcoin ( BTC ) sector remain either uninformed or indifferent to the ongoing debate between Bitcoin Core and Bitcoin Knots, according to a survey conducted by Galaxy Digital .

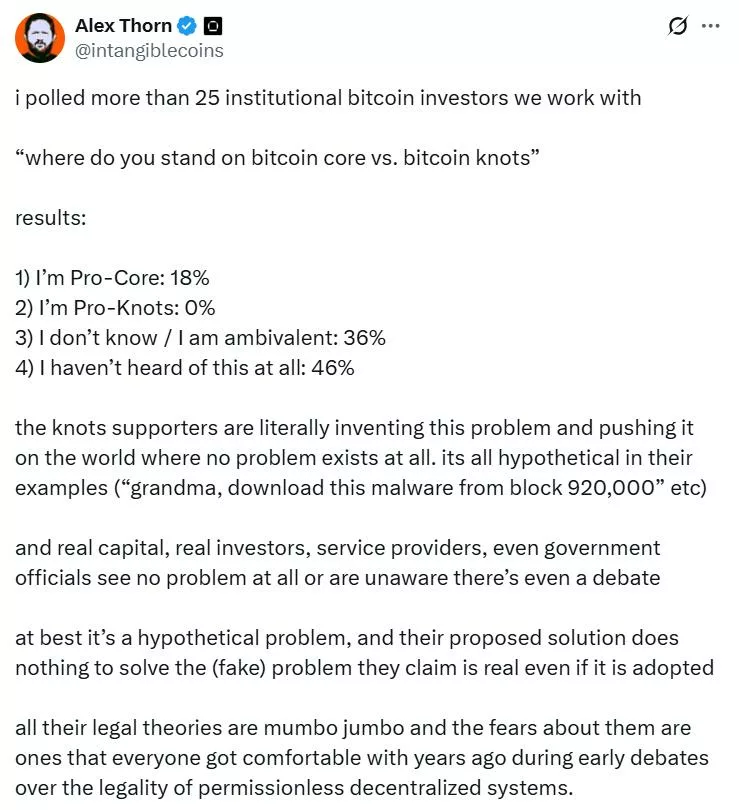

Alex Thorn, head of research at Galaxy Digital, released findings showing that 46% of 25 institutional investors surveyed were not aware of the debate, while 36% reported having no clear opinion or remaining indifferent to the issue. Of the remaining 18%, all respondents expressed support for the Bitcoin Core position.

The debate centers on how the Bitcoin network should be utilized and whether non-financial transactions should be excluded from the blockchain. The discussion intensified following the release of the Bitcoin Core v30 update, which some users claim opened the door to operations considered spam on the blockchain.

Supporters of Bitcoin Knots argue that unwanted content should be filtered, citing concerns that malicious actors could insert illegal or immoral material into the blockchain. Bitcoin Core supporters maintain that any limitation could fragment the network, create user confusion, and contradict core principles of the protocol.

In a post published on social media platform X, Thorn stated that real capital, real investors, service providers, and government officials either see no problem or remain unaware of the debate. He characterized the issue as a hypothetical problem at best, according to the post.

Thorn also indicated that while miners were not included in the survey, his knowledge of major mining operations suggests minimal awareness or concern regarding the debate, according to his statement on X.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Zcash Halving and Its Effects on the Dynamics of the Cryptocurrency Market

- Zcash's halving mechanism reduces block rewards every four years, enhancing scarcity and mimicking Bitcoin's deflationary model while offering optional privacy features. - Historical halvings (2020, 2024) triggered sharp price swings, with Zcash surging 1,172% post-2024's NU5 upgrade and institutional adoption via Grayscale Zcash Trust. - Next halving projected for late 2028 faces risks from regulatory scrutiny of shielded transactions and competition from privacy coins like Monero. - Long-term investors

Zcash (ZEC) Rallies as Interest in Privacy Coins Grows: Can the Momentum Last?

- Zcash (ZEC) surged 900% in Q4 2025, peaking at $702.04, driven by institutional adoption and regulatory clarity via the CLARITY/GENIUS Acts. - The November 2025 halving reduced block rewards by 50%, historically correlating with price surges, while shielded transactions now account for 20-25% of supply. - Zcash diverged from broader crypto weakness, gaining 35% weekly in November despite Bitcoin's decline, fueled by privacy-focused retail demand and $2B+ trading volume. - Upgrades like Zashi wallet and P

Why Dash (DASH) is Soaring in 2025: An In-Depth Strategic Review for Investors

- Dash (DASH) surged 150% in Nov 2025 amid regulatory tightening, leveraging ChainLocks/InstantSend upgrades to maintain 10% market share. - Its DAO governance model and real-world adoption in Latin America boosted institutional confidence despite privacy coin crackdowns. - While DASH futures open interest doubled, challenges remain in DeFi integration and liquidity due to exchange delistings. - Upcoming confidential transactions and retail partnerships position Dash as a compliance-focused privacy asset w